Changpeng “CZ” Zhao introduced the “perp DEX period,” after a number of initiatives rushed to construct their very own variations of the permissionless markets. Zhao has spoken in assist of Aster DEX, however has additionally inspired different gamers to enter the area.

Binance’s co-founder Changpeng Zhao introduced the arrival of the “perp DEX” period in a latest message on X. Zhao has been identified to assist the perpetual futures buying and selling mannequin on Binance, which confronted competitors from Hyperliquid.

Zhao quoted an older message on X, the place he instructed perpetual futures DEX may obscure their bets to keep away from aggressive counter-trading.

Whoa, now everybody desires to be Perp Dex.

Extra gamers will develop the market dimension sooner. Rising tide lifts all boats.

Long run, the very best builders win. DYOR.

Perp Dex period! https://t.co/BLKSGBe4Ii

— CZ 🔶 BNB (@cz_binance) September 24, 2025

Whereas decentralized futures markets had been examined up to now, it was the rise of Hyperliquid that introduced the mannequin to the highlight. The combination of a venue for high-profile whales, a invaluable native token, and deep liquidity led different groups to repeat the Hyperliquid mannequin. Perpetual DEX apps are additionally assured to provide predictable charges.

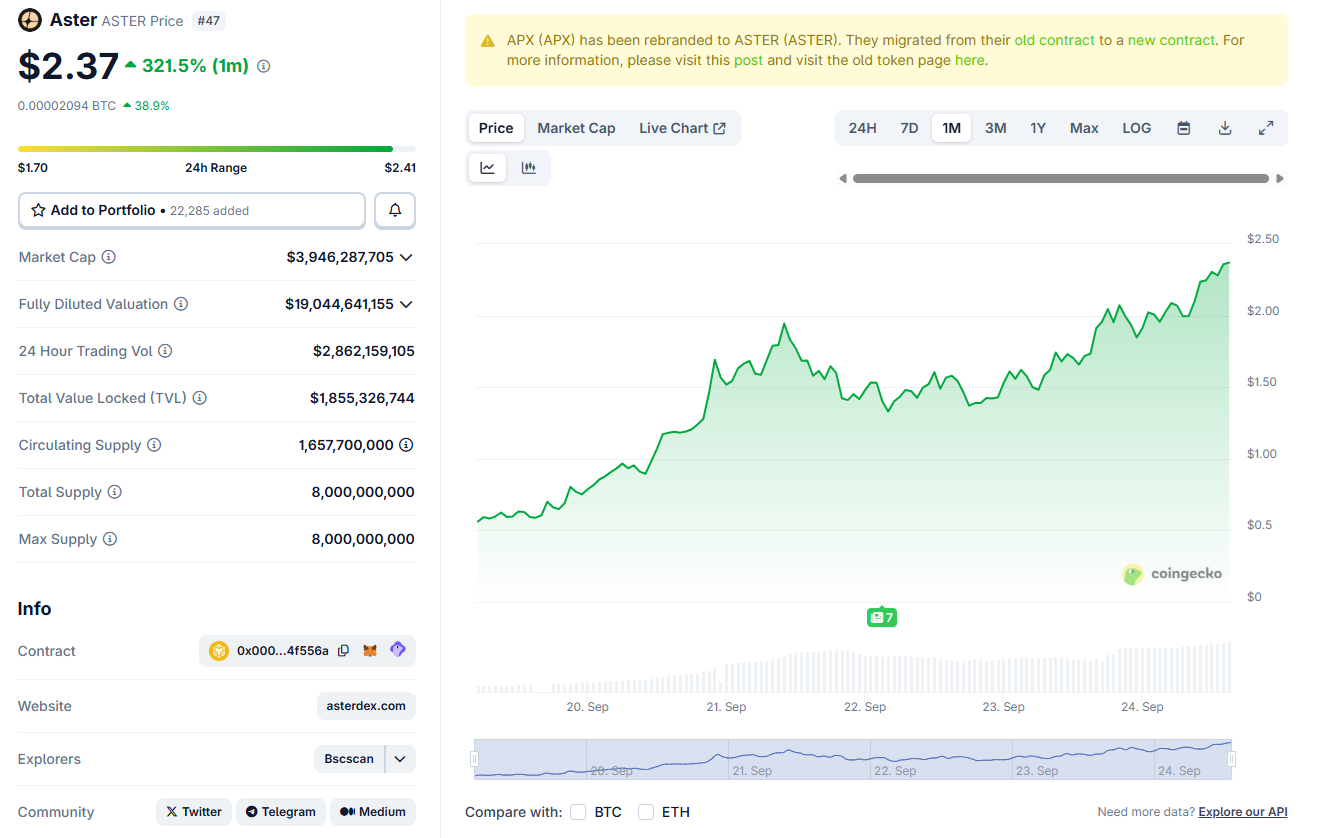

ASTER, BNB go into worth discovery

The each day consideration from Zhao has put each ASTER and BNB into worth discovery mode. ASTER rallied to a brand new all-time peak above $2.37. The token gained one other 22% for the previous day, buying and selling on report volumes above $2.9B.

ASTER rallied to a brand new all-time peak above $2.37, as consideration to perp DEX platforms accelerates every day. | Supply: Coingecko

On the similar time, BNB nonetheless traded above $1,000, down from its peak at $1,077. The tokens received a lift from the latest announcement of including perpetual DEX swaps instantly via Belief Pockets.

Perps are coming quickly to Belief Pockets.

100+ markets & as much as 100x leverage. Powered by @Aster_DEX

Superior buying and selling, designed for everybody. pic.twitter.com/aZOtF67ouT

— Belief Pockets (@TrustWallet) September 24, 2025

HYPE, the native token of Hyperliquid, took one other downturn, sliding to $45. The token unraveled on a mixture of shifting demand for Hyperliquid and the push to the warmer ASTER asset.

On the similar time, smaller or older perpetual DEX initiatives usually are not responding to the hype. Former leaders like GMX remained comparatively unchanged. Perpetual DEX from older DeFi market cycles had been additionally unmoved and within the purple. At present, perpetual DEX tokens are valued at $22B, as merchants solely flocked to the most popular property.

What brought about the perp DEX demand?

Perpetual futures DEX adopted the unfold of on-chain buying and selling tradition, as regional limitations and KYC had been stopping many merchants from utilizing centralized markets. DEXs already make greater than 18.5% of volumes, and readily provide liquidity for brand spanking new property, which can take months or years for a centralized itemizing.

Perp DEXs additionally established their credibility as payment producers, along with having a robust native token with virtually assured long-term development and income sharing.

The worth mannequin and clear tokenomics additionally stuffed demand for initiatives like Hyperliquid, which provided a transparent path to revenue-sharing and no insider VC gross sales. Perpetual DEXs are additionally non-custodial, calming the fears of a crash and misplaced property, just like the FTX chapter.

Perpetual DEX tokens additionally changed memes, bringing again the utility narrative and the creation of worth.

The brand new perpetual DEX are attracting whales, however they’re additionally consumer-oriented. Along with Hyperliquid and Aster, different lively markets embody Pacifica, EdgeX, Avantis, and Lighter. For now, Hyperliquid stays the venue for high-profile whales, difficult the brand new markets to additionally entice high-value merchants.