Bitcoin mining shares prolonged their restoration in September, outpacing Bitcoin at the same time as trade economics stay underneath strain and {hardware} payback durations stretch longer.

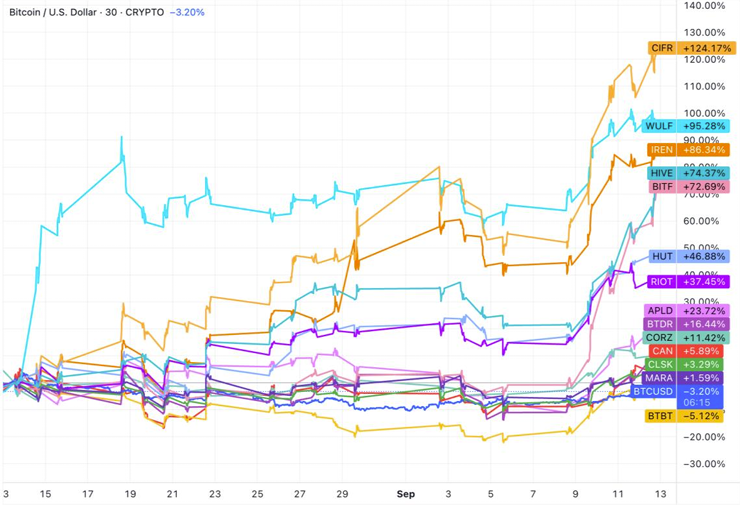

In accordance with The Miner Magazine’s newest trade replace, shares of Cipher Mining (CIFR), Terawulf (WULF), Iris Vitality (IREN), Hive Digital Applied sciences (HIVE) and Bitfarms (BITF) surged between 73% and 124% over the previous month. Against this, Bitcoin (BTC) slipped greater than 3% over the identical interval.

A number of Bitcoin mining shares are buying and selling at yearly or all-time highs. Supply: The Miner Magazine

The rally in mining shares comes regardless of continued strain on trade fundamentals. The Bitcoin community’s subsequent problem adjustment is projected to rise one other 4.1%, which might “mark the primary epoch with a median hashrate above the zetahash mark,” The Miner Magazine reported.

That 1 zetahash milestone was first reached in September, based mostly on Bitcoin’s 14-day transferring common hashrate. But the achievement has completed little to ease profitability strains.

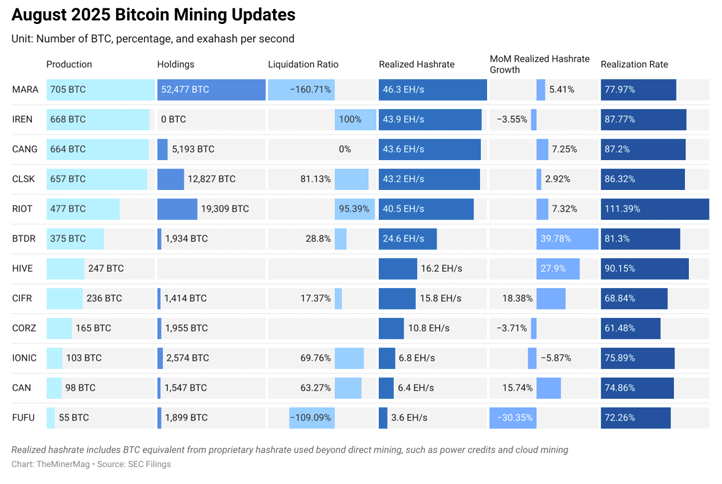

Hashprice stays caught beneath $55 petahash per second, pressured by rising community exercise, whereas transaction charges have slipped underneath 0.8% of month-to-month rewards — an indication of weaker onchain exercise.

Bitcoin mining replace for August 2025. Supply: The Miner Magazine

Even so, traders are rewarding miners pursuing GPU and AI pivots, The Miner Magazine stated. Hive Digital is accelerating its transition into AI knowledge middle infrastructure, Iris Vitality is ramping up with Blackwell GPUs, and Terawulf has drawn momentum from its high-performance computing partnership with Google.

Associated: Bitcoin community mining problem climbs to new all-time excessive

Bitcoin miner accumulation continues

Confronted with tighter revenue margins, rising prices and rising competitors, Bitcoin miners are more and more turning to diversification methods to remain afloat.

Past pivoting assets towards AI and high-performance computing, many miners have additionally embraced a treasury technique, holding onto extra mined Bitcoin in anticipation of a future value surge.

Cointelegraph reported on this pattern in January, highlighting a notable shift in miner accumulation that gained momentum by 2024 as corporations retained a bigger share of their manufacturing.

“In 2024, a notable shift emerged amongst Bitcoin miners, with many opting to retain a bigger portion of their mined Bitcoin or refraining from promoting altogether,” Digital Mining Options and BitcoinMiningStock.io wrote in a January report.

Miners seem like doubling down on this technique in September, with Glassnode knowledge exhibiting pockets balances rising for 3 consecutive weeks. On Sept. 9, internet inflows peaked at 573 BTC — the most important every day improve since October 2023.

Journal: Bitcoin’s long-term safety price range drawback: Impending disaster or FUD?