Ethereum value in the present day is buying and selling round $4,298, consolidating inside a tightening symmetrical triangle on the 4-hour chart. Help is near $4,250, and resistance is at $4,370. Which means that ETH is at a key level the place it might both get away or go down much more.

Ethereum Value Compresses In Triangle Construction

ETH value forecast (Supply: TradingView)

Ethereum value motion exhibits repeated defenses of the $4,250 zone, the place the 200-EMA aligns with trendline assist. Overhead, the 20-EMA close to $4,312 and the 50-EMA round $4,351 proceed to cap rallies, making a slim buying and selling vary.

Associated: Dogecoin (DOGE) Value Prediction: Rising ETF Odds Spark Bullish Momentum

RSI is near 46, which signifies that momentum is low and there isn’t a transparent route. If consumers push the worth above $4,370, the following targets are $4,500 and $4,700. If the worth doesn’t keep above $4,250, it might drop to $4,100, and perhaps even $3,900 if promoting strain picks up.

Analysts Examine Cycle Patterns With Bitcoin

$ETH is doing precisely what $BTC did final cycle.

However Bitcoin had a 20% correction after hitting the earlier ATH.

This implies Ethereum might go down round $3.8K-$3.9K stage earlier than a brand new ATH. pic.twitter.com/jxEmwj09Qz

— Ted (@TedPillows) September 6, 2025

Market strategist Ted highlighted that Ethereum is mirroring Bitcoin’s previous cycle construction. He famous that Bitcoin corrected practically 20 % after hitting its prior all-time excessive earlier than resuming its uptrend. By that logic, Ethereum might retest the $3,800–$3,900 vary earlier than launching towards new highs.

This cycle-based evaluation provides warning for merchants betting on quick upside. The weekly chart additionally exhibits ETH approaching the higher boundary of a multi-year wedge, making the $4,300–$4,400 zone an important pivot for long-term positioning.

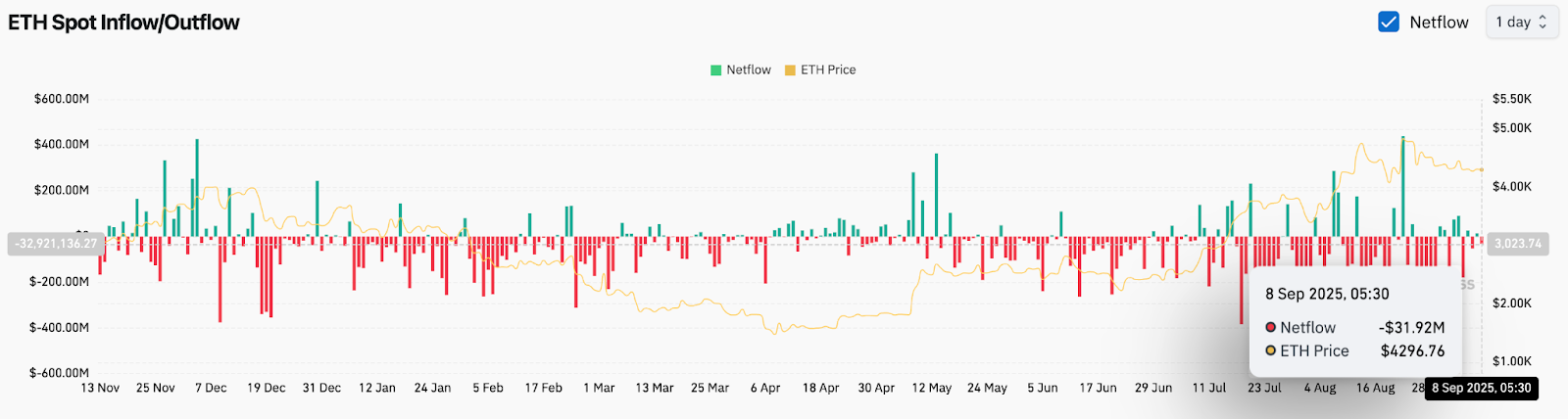

Outflows Sign Investor Warning

ETH Netflows (Supply: Coinglass)

On-chain information exhibits that $31.9 million left the community on September 8, which signifies that holders moved ETH away from exchanges. Persistent outflows can imply accumulation, however they will additionally imply that there isn’t a lot liquidity for short-term rallies.

Spot flows have been risky, with alternating bursts of inflows and outflows since late August. With out sustained inflows above $50–100 million, analysts warning that ETH might lack the gas for a decisive breakout within the quick run.

Associated: XRP (XRP) Value Prediction for September 9

Technical Outlook For Ethereum Value

Key resistance stands at $4,370, adopted by $4,500 and $4,700. Help ranges sit at $4,250 and $4,100, with deeper danger towards $3,800 if sellers regain management. RSI and EMA clusters underline the compression part, suggesting volatility enlargement is imminent.

A confirmed breakout above $4,370 would strengthen bullish conviction, whereas shedding $4,250 might lengthen consolidation or set off a correction.

Outlook: Will Ethereum Go Up?

Ethereum’s short-term trajectory hinges on whether or not consumers can defend $4,250 whereas overcoming resistance close to $4,370. Analysts stay divided, with cycle comparisons pointing to a attainable correction, however broader adoption traits supporting the long-term bull case.

So long as ETH holds above $3,800, the construction favors eventual upside. Merchants ought to watch intently for quantity affirmation on any breakout try, as September might determine whether or not Ethereum rallies towards $5,000 or retraces earlier than resuming its uptrend.

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version isn’t chargeable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.