Tokenized institutional different funds (IAF) surged 47% within the final 30 days, reaching a complete worth of $1.74 billion, in response to knowledge from real-world asset (RWA) tokenization tracker RWA.xyz.

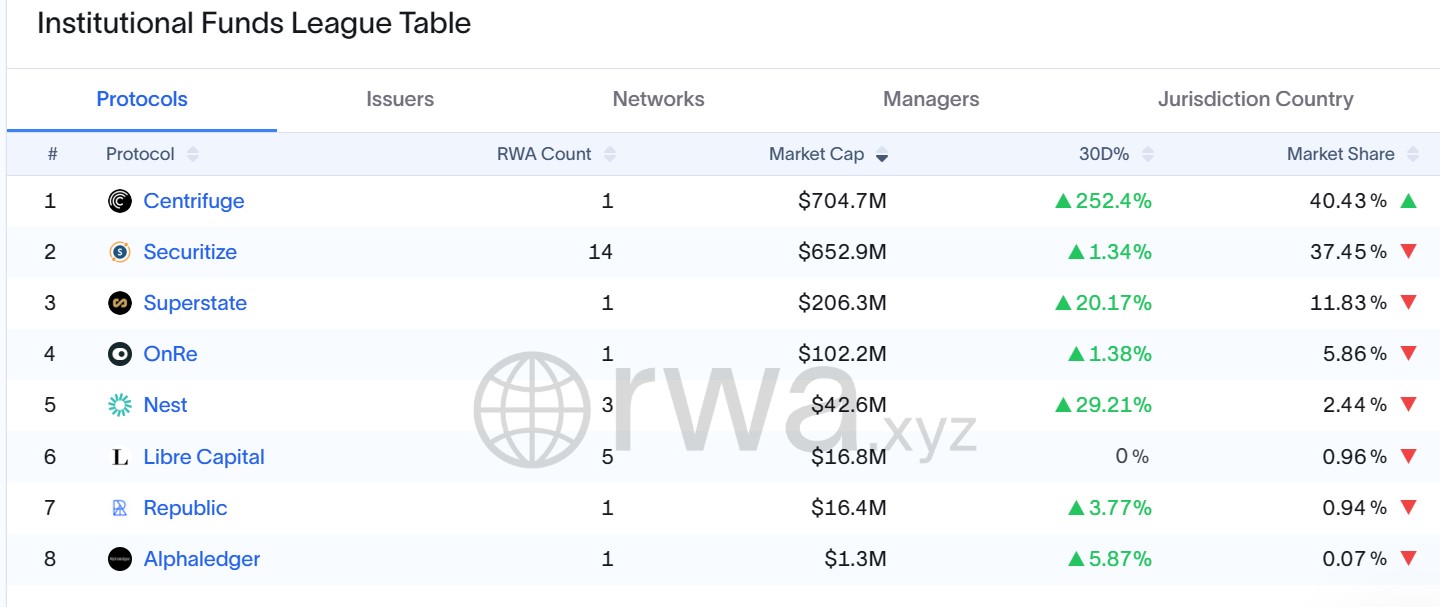

The info confirmed that each one protocols besides Libre Capital had share will increase within the final 30 days. Centrifuge led the expansion, increasing its market cap by 252% to $704 million. This gave the issuer a 40.4% market share for IAFs.

Aside from IAFs, Centrifuge additionally had virtually $400 million in tokenized US Treasury merchandise, bringing its whole worth locked (TVL) to over $1 billion. This allowed Centrifuge to affix BlackRock’s BUIDL fund and Ondo Finance to surpass the $1 billion RWA milestone.

Securitize adopted with $652 million throughout 14 tokenized IAFs, accounting for 37.5% of the market. Different notable protocols included Superstate with $206 million and OnRe with $102 million in fund worth.

Institutional funds league desk. Supply: RWA.xyz

What are institutional different funds?

Institutional different funds, or IAFs, are professionally managed funding automobiles that allocate capital into asset courses exterior of conventional shares and bonds. These embody hedge funds, non-public fairness, non-public credit score, enterprise capital and belongings like actual property or infrastructure.

Tokenizing these funds brings them to the blockchain, permitting them to entry advantages together with sooner settlement, wider investor entry and better transparency.

Protocols bringing such funds into blockchains spotlight a rising demand for RWA tokenization amongst conventional monetary establishments.

Whereas tokenized IAFs elevated in worth, RWA.xyz knowledge reveals that month-to-month lively addresses dropped by over 50% to 21,867 within the final 30 days, whereas the variety of holders elevated by 13.5% to 114,922.

This implies that establishments or skilled traders could also be consolidating their funds into fewer addresses. It additionally means that new traders could also be shopping for and holding, signaling long-term confidence within the funding car.

Associated: CoinShares stories 26% AUM improve to $3.46B in Q2

Ethereum stays probably the most dominant blockchain for tokenized IAFs

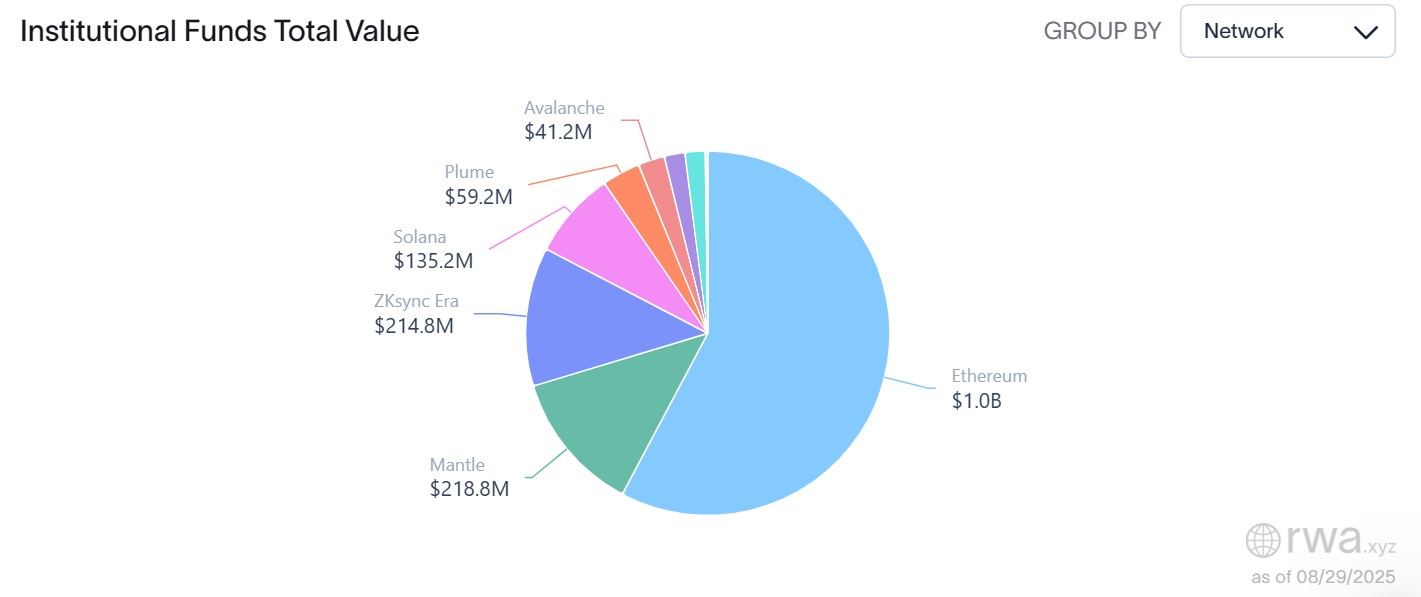

RWA.xyz knowledge confirmed that Ethereum remained probably the most dominant community for tokenized IAFs. The blockchain hosts $1 billion in whole worth, which is greater than half of all the market.

Mantle and ZKsync Period adopted with $218.8 million and $214.8 million, respectively, whereas Solana accounted for $135.2 million. Networks like Plume and Avalanche had smaller quantities, $59.2 million and $41.2 million.

Institutional funds whole worth by community. Supply: RWA.xyz

Journal: Stablecoins in Japan and China, India mulls crypto tax adjustments: Asia Categorical