Google is backing $3.2B for TeraWulf’s HPC internet hosting cope with Fluidstack and will find yourself proudly owning ~14% of the corporate. Will extra hyperscalers flip to Bitcoin miners for his or her vitality and infrastructure wants?

TeraWulf’s New HPC Deal

The next visitor submit comes from Bitcoinminingstock.io, the one-stop hub for all issues bitcoin mining shares, academic instruments, and trade insights. Initially revealed on Aug. 22, 2025, it was penned by Bitcoinminingstock.io creator Cindy Feng.

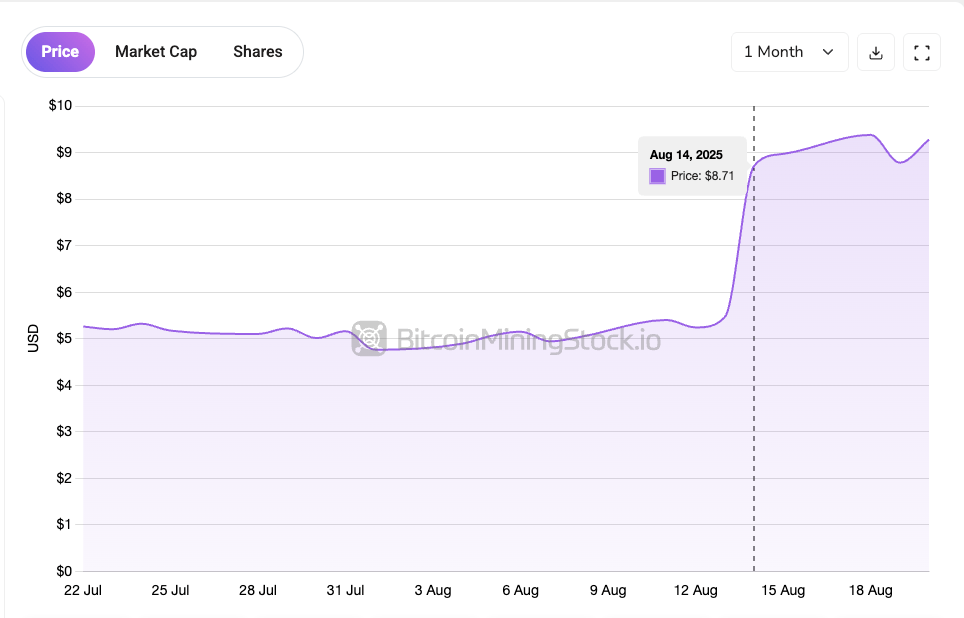

One other main HPC deal amongst Bitcoin miners is now confirmed. Like Core Scientific’s settlement with CoreWeave in 2024, TeraWulf’s current announcement has drawn important consideration from buyers that despatched its inventory value up ~60%. Clearly, the projected multi-billion-dollar income is the foremost spotlight, however the involvement of Google is just like the cherry on prime. On this case, Google has backstopped $3.2 billion for the deal and should maintain as much as 14% of TeraWulf by means of warrants. That is the primary time a significant hyperscaler has entered such an settlement with a Bitcoin miner. Although not as a direct buyer or lessee, it validates a long-held hypothesis: hyperscalers are eyeing Bitcoin miners, recognizing their energy entry and information middle infrastructure.

$WULF rose almost 60% following the announcement of its HPC internet hosting settlement.

What makes TeraWulf’s deal extra thrilling is that it outlines a repeatable blueprint for different public miners, since some friends have even bigger energy pipelines and infrastructure. On this submit, I’ll break down key features of the deal and share some ideas to assist consider future hyperscaler partnerships in Bitcoin mining.

TeraWulf x Fluidstack: $6.7B in Contracted Income with Upside to $16B

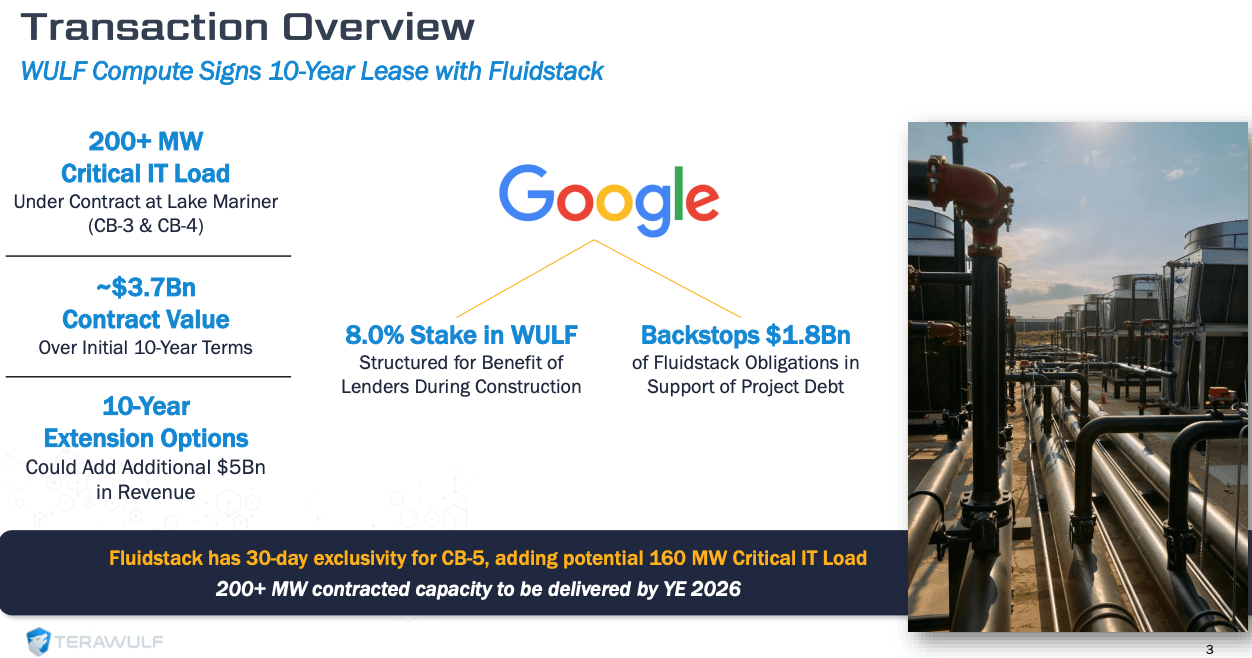

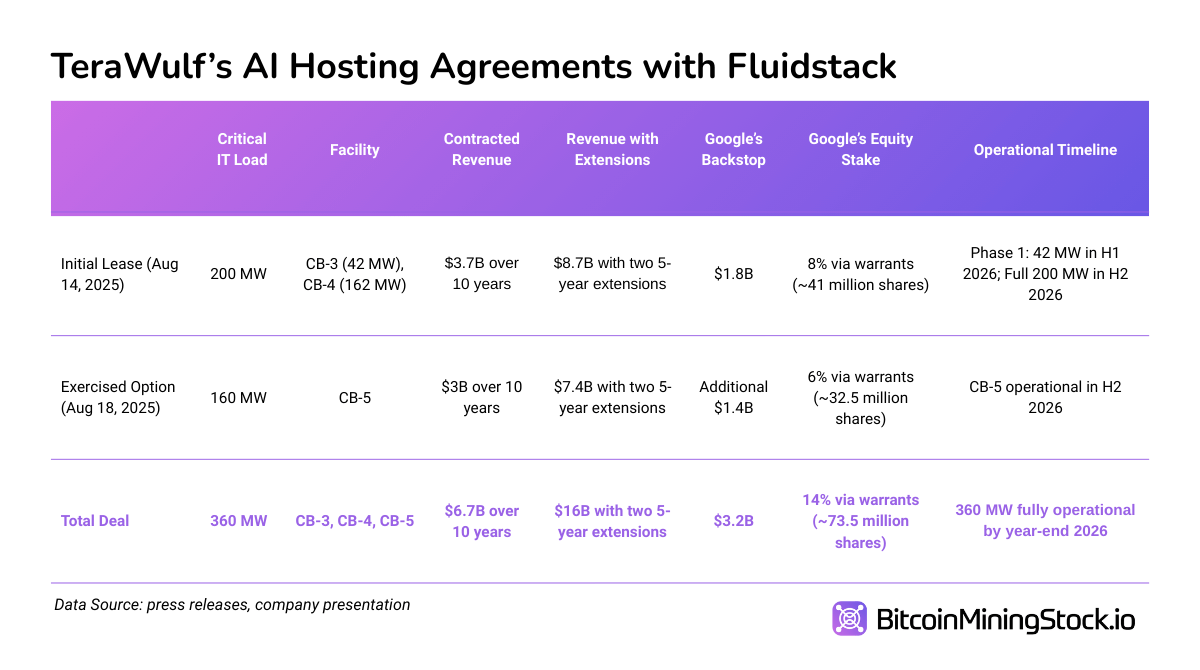

TeraWulf first introduced a 10-year HPC internet hosting settlement with Fluidstack on August 14, 2025. The settlement covers over 200 MW of infrastructure capability on the firm’s Lake Mariner facility in New York. It’s anticipated to generate $3.7 billion in contracted income over the preliminary time period, with a possible to achieve $8.7 billion ought to contract extensions be exercised.

Abstract of the preliminary 10-year lease (screenshot from the presentation of TeraWulf).

The settlement is structured as a colocation mannequin the place the purchasers carry their very own {hardware} and TeraWulf supplies scalable energy and purpose-built information middle house (CB-3 and CB-4). The crucial IT load to Fluidstack is predicted to come back on-line by mid-2026.

On August 18, 2025, Fluidstack exercised its choice to broaden additional by leasing a 3rd constructing (CB-5), including one other 160 MW. This brings the complete contracted capability to roughly 360 MW at Lake Mariner, which represents $6.7 billion in contracted income and a possible upside to $16 billion (if leases are prolonged).

For many who will not be conscious, this isn’t TeraWulf’s first HPC deal. In 2024, the corporate introduced partnership with Core42, a subsidiary of G42, for 72.5 MW on the similar web site. Agreements with these two companions mixed quantity to over 420 MW of dedicated HPC infrastructure, which is larger than TeraWulf’s present 250 MW mining operation. This marks a gradual shift from Bitcoin-focused operations to infrastructure supplier of each mining and HPC internet hosting within the close to time period.

Google’s Involvement: Monetary and Strategic Help

The rationale why TeraWulf’s new HPC deal brings further pleasure is Google’s participation. The large’s function is each strategic and monetary in nature. By way of its partnership with Fluidstack, Google is guaranteeing $1.8 billion of the preliminary 10-year lease obligations to help project-related debt financing. With the train of a further 160MW possibility, Google will present a complete $3.2 billion backstop. Curiously, Google can be backing Fluidstack’s lease obligations that embody early termination protections for the primary 6 years. All such help from Google helps de-risk the income stream and allows TeraWulf to safe financing extra simply.

In trade, Google will purchase roughly a complete 73.5 million shares of TeraWulf through warrants. If totally exercised, this may give Google a 14% stake, making it one of many largest shareholders of WULF. Whereas these warrants will not be fast dilution, they sign Google’s long-term alignment with TeraWulf’s upside. If TeraWulf executes, Google stands to realize a large fairness stake.

Total, Google’s involvement affords far more than capital safety; it sends a powerful sign to the broader market in regards to the firm’s credibility and infrastructure worth. It helps open the door to future direct relationships with hyperscalers, a improvement that might reshape the miner-HPC internet hosting panorama.

In TeraWulf’s Q2 earnings name, its CEO Paul B. Prager emphasised the significance of this deal over the lengthy haul:

“With this new buyer and the $1.8 billion Google backstop, our credit score profile is considerably enhanced, enabling us to pursue low-cost, scalable capital options that align with our development trajectory.”

Financing Technique for the HPC Construct-Out: Lean and Leveraged

To construct out the infrastructure required for the Fluidstack deal, TeraWulf is pursuing an asset-light mannequin. Shoppers are answerable for offering their very own GPUs and compute clusters, which considerably reduces TeraWulf’s upfront capital necessities for costly and quickly-depreciating {hardware}.

One other funding supply comes from pay as you go internet hosting charges, which affords fast money circulate help throughout buildout. This strategy aligns with a typical information middle financing technique: safe long-term contracts first, then use them to underwrite capital growth.

So as to speed up development and fund short-term wants, TeraWulf additionally introduced convertible observe providing shortly after the Fluidstack deal. The preliminary $400 million convertible notes providing was upsized to $850 million on August 18. Based on the announcement, $743.2 million of proceeds will primarily fund the CB-5 buildout and different HPC infrastructure at Lake Mariner.

Whereas I can’t inform you the precise motive for administration’s choice to go together with convertibles, I feel this strategy supplies low-cost capital (1.00% rate of interest) in comparison with conventional debt, and preserves money circulate whereas funding speedy HPC growth to satisfy Fluidstack’s timeline (H2 2026). The capped name transactions additionally mitigate dilution danger that shield shareholders as TeraWulf’s inventory value has surged (55% YTD, 101% over 12 months as of August 19, 2025).

How Does It Evaluate to Core Scientific’s Deal?

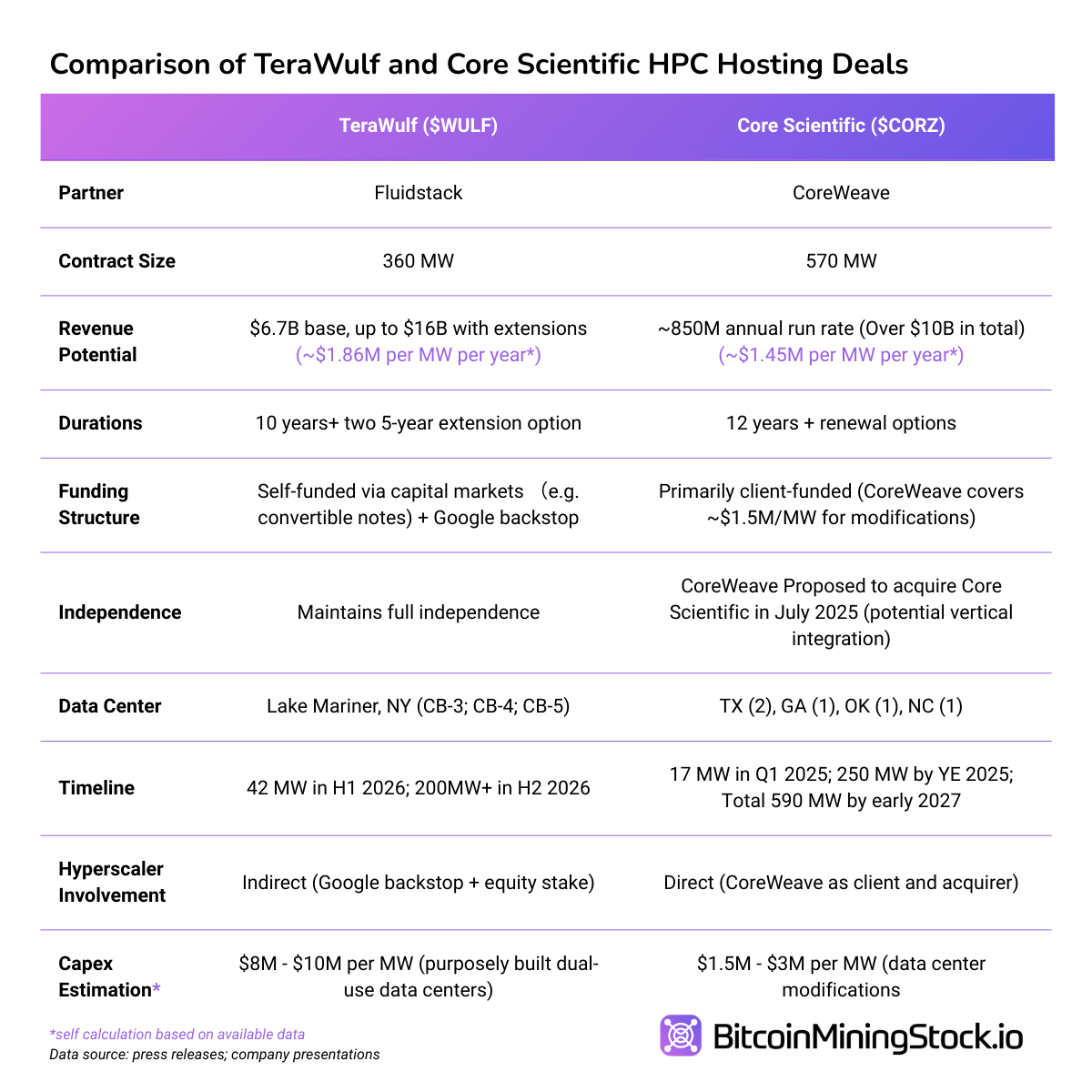

Whereas each TeraWulf and Core Scientific landed main HPC internet hosting offers, their fashions differ in a technique or one other.

Whereas Core Scientific‘s contract has the benefit of scale and capex, TeraWulf’s deal is bigger when it comes to complete income potential. Most significantly, it consists of direct monetary involvement from Google – a primary within the house. This might increase credibility amongst buyers and different potential purchasers.

Remaining Ideas

TeraWulf could have entered the HPC internet hosting sport later than a few of its friends, nevertheless it’s shortly proving that being early isn’t every part – execution is. From its preliminary partnership with Core42 in 2024, to the Fluidstack deal in 2025, the corporate has shifted from being “simply one other miner” to turning into a reputable infrastructure accomplice within the AI and HPC financial system.

In contrast to some corporations who aggressively market their AI pivot with out a lot to point out for it, TeraWulf has a comparatively low profile on X. But it secured one of many largest HPC internet hosting offers amongst all public miners thus far. Institutional buyers have taken discover: over 55% of the corporate’s shares are held by establishments, whereas retail accounts for simply ~15%. One seemingly motive is communication. TeraWulf has persistently spoken its enterprise in a language acquainted to conventional buyers. For instance, they deal with Bitcoin mining like a commodity enterprise, targeted on marginal unit economics that buyers can simply perceive.

This readability seemingly resonated not simply with buyers, but in addition with companions. Within the Fluidstack deal, Google’s involvement is particularly telling. By way of a $3.2 billion backstop dedication and related warrants, Google may change into a 14% stakeholder in TeraWulf (if totally exercised). That’s not simply capital help. That’s a credibility increase, each within the eyes of potential purchasers and the capital markets.

Extra importantly, this deal introduces a replicable playbook for different miners: safe the correct companions and ship outcomes; communicate in a language institutional gamers perceive; think twice about your financing- after which execute once more.

The demand for HPC is actual. Those that adapt their infrastructure and messaging to satisfy it, with out over-promising, could nicely land the subsequent massive hyperscaler partnership. Offers involving names like AWS, Microsoft, Meta, or Oracle could now not be “mission unattainable.”