Conventional monetary establishments are more and more shaping the narratives within the crypto sector, and are poised to learn probably the most from the present tendencies, in keeping with Arthur Azizov, founding father of B2 Ventures, a non-public “alliance” of crypto providers and monetary tech firms.

Azizov instructed Cointelegraph that this market cycle has been dominated by institutional traders, funding autos like exchange-traded funds (ETFs), governments, and stablecoin issuers.

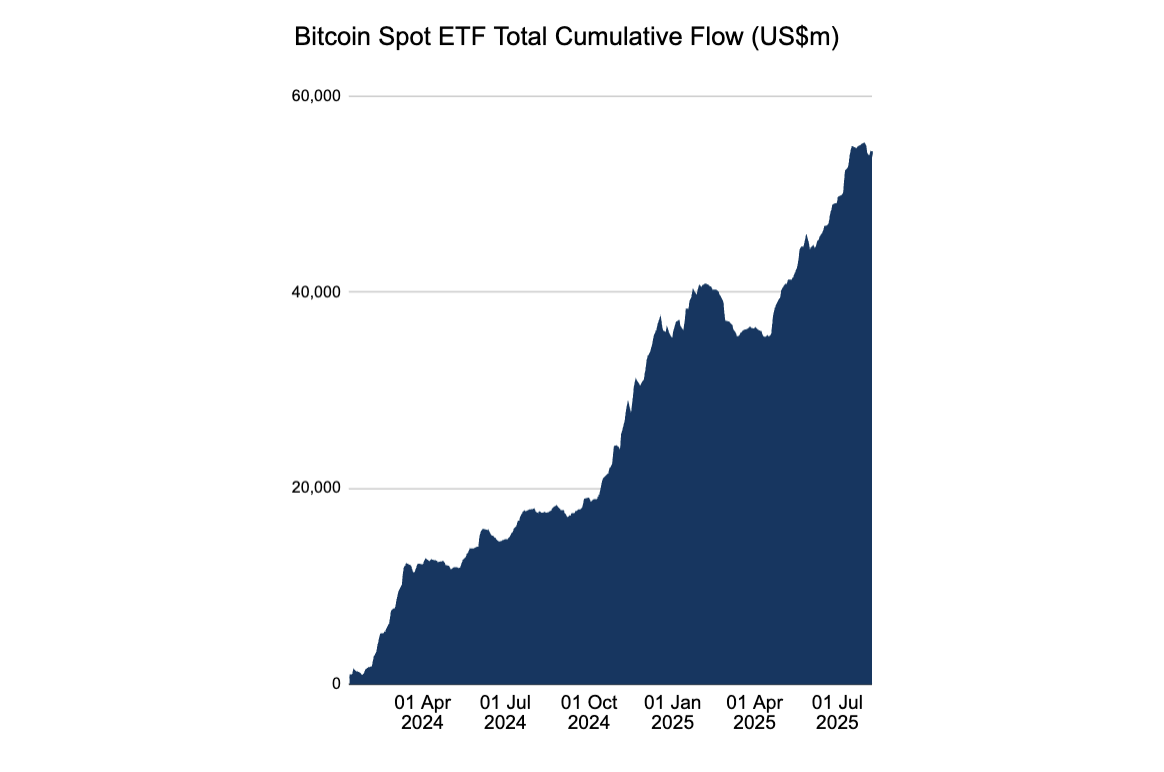

The entire cumulative circulate of Bitcoin ETFs reveals that billions of {dollars} in capital has been siphoned into Bitcoin funding autos. Supply: Farside Traders

He additionally mentioned that massive banks will speed up this pattern within the close to future, as soon as they’ve regulatory readability to work together with crypto, saying it would solely be a “matter of months” between the time these banks obtain regulatory readability and the time it takes them to launch a stablecoin. Azizov added:

“Banks have a considerable consumer base. They have already got their very own shoppers. These shoppers are loyal to these banks. And for them to implement crypto into their operations will likely be comparatively straightforward.”

These establishments have already modified the panorama. Sooner or later, it should change much more, and I might say it isn’t good for small startups,” he continued.

The growing presence of institutional traders, banks, and corporations in crypto has created pressure between these conventional monetary establishments and the cypherpunks that began the crypto motion, who advocate for the whole decentralization of the monetary system

Associated: Bitcoin funding banks coming to El Salvador — Gov regulator

The federal government can be driving the institutionalization of crypto

Governments even have financial incentives to control crypto and convey it beneath the purview of the standard monetary system.

“The narrative is to control crypto, not solely as a result of it’s mainstream, however in an effort to entice know-how firms, entice younger expertise, and fintech startups, Azizov instructed Cointelegraph.

This elevated regulation means a higher give attention to anti-money laundering (AML) rules and know-your-customer (KYC) necessities, he added.

AML and KYC are already required for retail crypto client functions all through a lot of the Asia-Pacific (APAC) area and Europe, and Azizov mentioned he expects this pattern to additionally take form within the US.

The emphasis on client surveillance and formally registered accounts runs opposite to the worth proposition of decentralized finance (DeFi), which guarantees permissionless entry to a censorship-resistant monetary system.

Journal: Crypto wished to overthrow banks, now it’s changing into them in stablecoin battle