The latest Ethereum (ETH) rally become a withdrawal rush for Lido DAO and a worth slide for wrapped stETH. The protocol noticed a peak stage of unprocessed withdrawals, whereas wstETH fell from its latest highs.

The latest Ethereum (ETH) rally was favorable for some DeFi protocols. Within the case of Lido DAO, the ETH rally brought about a drive to withdraw the tokens from liquid staking. The spike in withdrawals arrived after ETH rallied above $3,800 for the primary time in months. Later, ETH sank to $3,692.72 as the general market rally paused for consolidation.

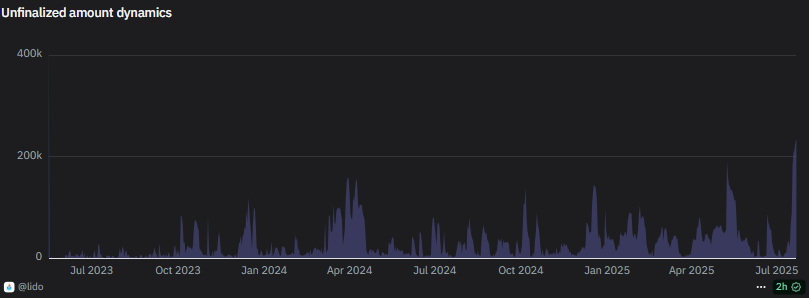

A complete of 228,992 ETH is ready to be unstaked, with a median ready time of 71 hours. Each whale and retail batches of ETH have been making an attempt to depart Lido on the highest fee for the previous two years. One purpose will be the presence of ETH locked at a lower cost, making an attempt to liberate belongings and understand earnings.

Lido DAO noticed peak requests for unstaking, with the very best unprocessed queue for the previous two years. | Supply: Dune Analytics

Lately, the worth locked in Lido expanded above $34B, based mostly on the notional ETH valuation. The protocol affords 2.8% in annualized passive earnings, along with issuing the stETH and Wrapped stETH tokens for extra DeFi actions.

Wrapped stETH slides from the latest peak

Because the use circumstances for normal ETH shift, Wrapped stETH has slid from its latest peak. The token habitually traded at a premium to ETH, lately peaking above $4,600.

Previously day, WSTETH retained its downward development, shedding 2.4% to $4,446.47. The latest slide additionally occurred on file buying and selling volumes.

WSTETH is generally swapped in opposition to stETH and common ETH, utilizing Uniswap decentralized pairs. Even by DEX, the token achieves over $148M in every day volumes, increasing exercise to a three-month peak.

The WSTETH premium means merchants can purchase extra ETH because of appreciation, or swap to stETH after which unstake it by the sensible contract. WSTETH makes up 1.28% of locked ETH reserves, and the exodus could not harm the ecosystem at scale. Nonetheless, the turning of the development could sign a shift basically Ethereum use circumstances.

Lido dominance in ETH staking slides decrease

Previously two years, Lido’s staking dominance has fallen from over 75% of staked ETH to round 62.8%.

The most important problem got here from Binance staking, which expanded its share from underneath 3% to over 20% since 2023.

On the similar time, Lido is assured its stETH could also be utilized by establishments for each ETF passive earnings and as a technique to put ETH treasuries to work.

Lido has slowed down previously 12 months, although the protocol nonetheless generates sturdy revenues per consumer and stays part of the essential DeFi infrastructure. Lately, Lido added BitGo as its first US-based custodian to supply staking infrastructure.

Comparable unstaking occasions have occurred earlier than, although the protocol retained its affect whereas persevering with to construct its roadmap. Within the coming months, Lido V3 is seen as a possible staking mechanism for the influx of establishments into ETH. Total, 30% of ETH stays locked within the Beacon Chain contract, and unstaking stays uncommon even for older whales.