Bitcoin’s robust July rally could also be giving bulls a cause to smile, however the subsequent web page on the calendar brings a really completely different tone. From a statistical perspective, August is Bitcoin’s worst-performing month, and worth historical past means that hassle could also be on the horizon.

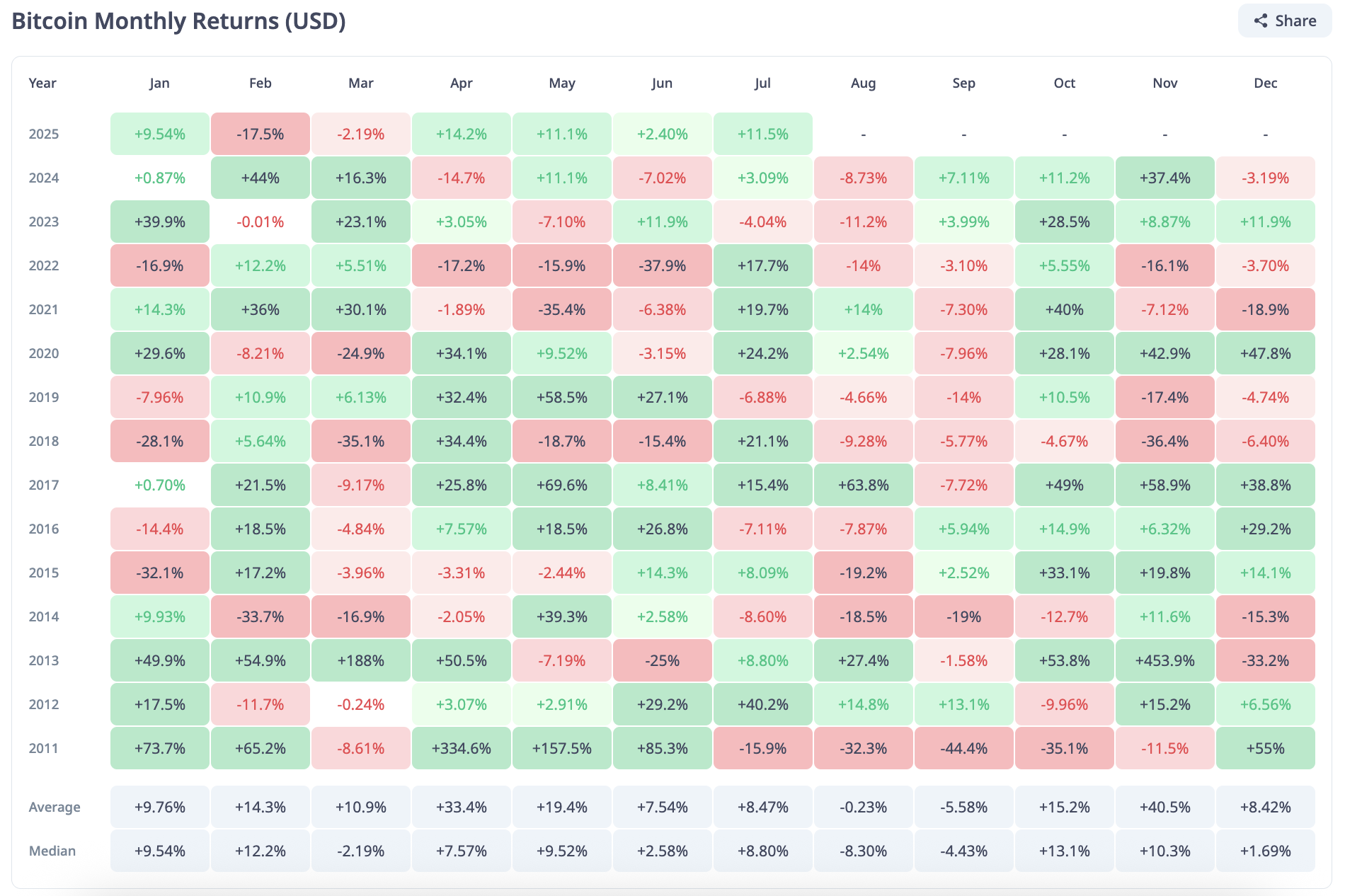

Of all of the months, August has the bottom median return, at -8.3%. The typical return isn’t significantly better at simply -0.23%, with repeated sell-offs throughout this era placing a damper on issues.

The numbers don’t lie. In 2024, BTC fell by 8.73% in August. In 2023, it fell by 11.2%. And in 2022? Down one other 14%. That’s three consecutive years of great losses, wiping out positive aspects and reversing uptrends.

Traditionally, the one hope for higher Augusts, such because the +14% in 2021 or the +2.54% in 2020, got here in the course of a bull cycle, identical to the present state of the market.

BTC is presently buying and selling at round $119,000, ending July with an 11.3% month-to-month improve. However, the chart is already flattening proper beneath the $120,000 resistance zone. And not using a new catalyst or quantity spike, the outlook is unsure heading into the top of the month.

What makes August particularly harmful is that promoting normally begins rapidly. Traditionally, early August usually brings sharp pullbacks, notably in years with robust Julys. It’s a traditional mean-reversion setup.

So whereas July could shut within the inexperienced, August has an extended monitor document of adjusting the temper. Until Bitcoin breaks this sample, the following 30 days might see BTC enter its weakest seasonal interval — and presumably rewrite the document books for all of the flawed causes.

For now, the bulls have 9 days left earlier than the calendar turns towards them.