The US Bitcoin Spot ETFs have been one in all key bullish drivers of the current market cycle, heralding an inflow of institutional buyers into the BTC ecosystem. In 18 buying and selling months, these ETFs have acquired 6.25% of the Bitcoin market cap cementing their standing as a serious power out there.

Curiously, outstanding market analyst Axel Adler Jr. has pointed to a current constructive development throughout the Bitcoin ETF house, suggesting additional upside potential and a bullish outlook for the months forward.

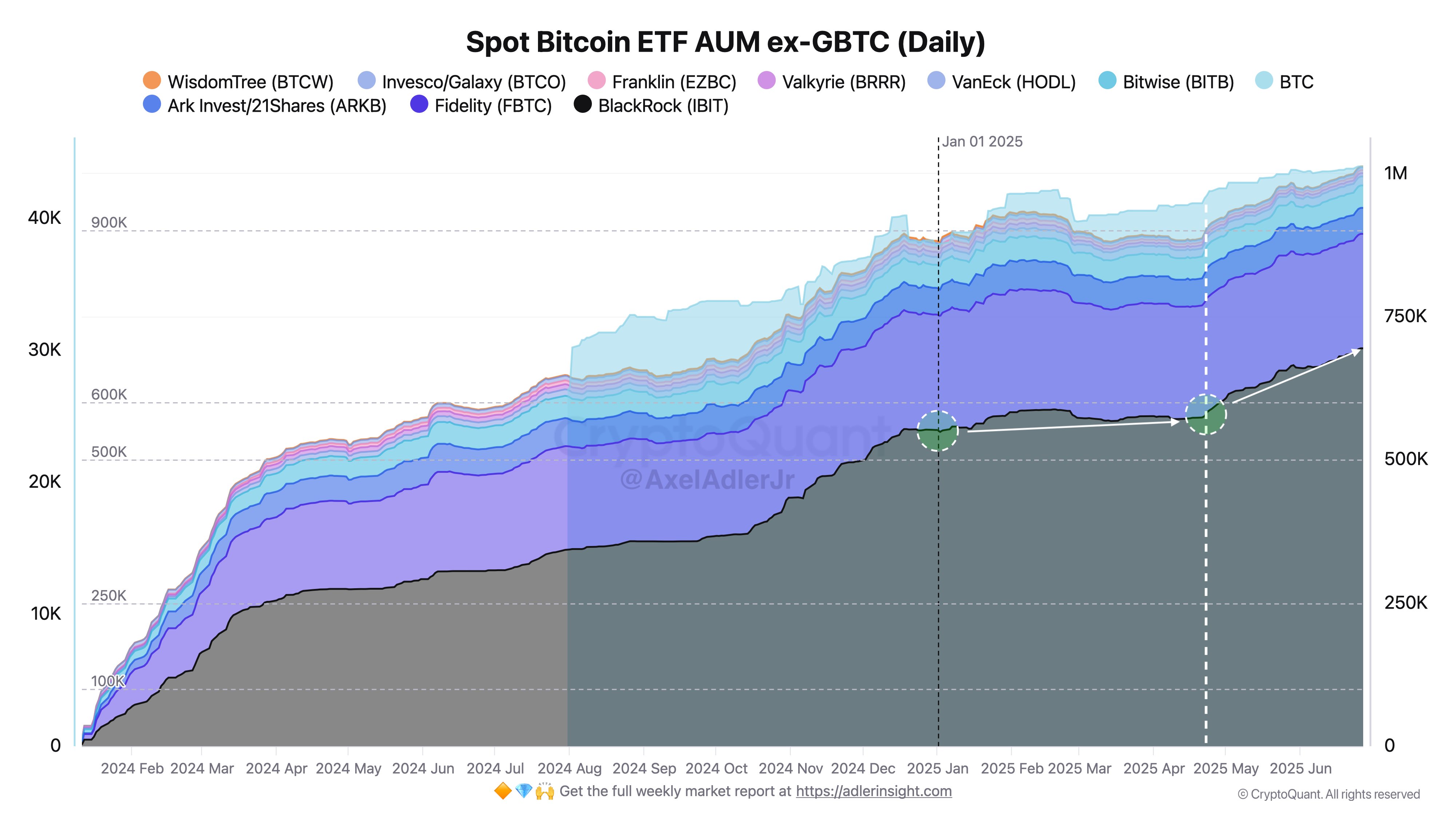

Bitcoin Spot ETFs To Maintain 1.2 Million BTC By September – Analyst

In an X publish on June 28, market analyst Axel Adler Jr. highlighted a compelling development within the accumulation sample of US Bitcoin Spot ETFs over the previous three months.

The famend analyst explains that belongings below administration (AUM) i.e. web belongings of those ETFs excluding the Grayscale GBTC have grown considerably from 932,000 BTC in April 2025 to 1,056,000 BTC in the present day. This improvement represents a web acquire of 124,000 BTC over 87 days, averaging a formidable influx of 1,430 BTC per day.

Because the undisputed market chief, the BlackRock IBIT accounts for almost all of this development attracting 118,000 BTC i.e. 1,360 BTC per day in deposits. In distinction, the remaining 11 ETFs contributed a mixed whole of 6,000 BTC, or 70 BTC per day, indicating a transparent focus of investor curiosity round BlackRock’s product.

In response to Adler Jr., if institutional buyers keep the present accumulation tempo of 1,430 BTC per day, these Bitcoin ETFs are on the right track to hit an AUM of 1,840,000 BTC by September, representing 9.25% of the circulating BTC tokens. Inside that whole, BlackRock IBIT is predicted to carry an estimated 817,000 BTC.

When mixed with GBTC’s present AUM of $19.79 billion, Adler Jr.’s predictions imply the US Bitcoin Spot ETFs would maintain web belongings valued considerably over $197.54 billion.

Bitcoin Value Overview

On the time of writing, Bitcoin trades at $107,339 reflecting a minor worth development of 0.28% prior to now 24 hours. In the meantime, the asset’s every day buying and selling quantity is down by 33.88% and valued at $30 billion.

On bigger time frames, the premier cryptocurrency additionally maintains a constructive efficiency with positive factors of 5.61% and 1.06% on the weekly and month-to-month chart respectively, indicating a possible bullish momentum shift following weeks of range-bound motion.

Since establishing a brand new all-time excessive of $111,970 in late Might, Bitcoin has struggled to discover new worth territory, as a substitute settling right into a descending channel between $100,000 and $110,000.

Featured picture from Libertex, chart from Tradingview

Editorial Course of for is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.