U.S. authorities debt is rattling traders, contributing to a pointy decline within the markets—at the same time as Bitcoin reached a brand new all-time excessive.

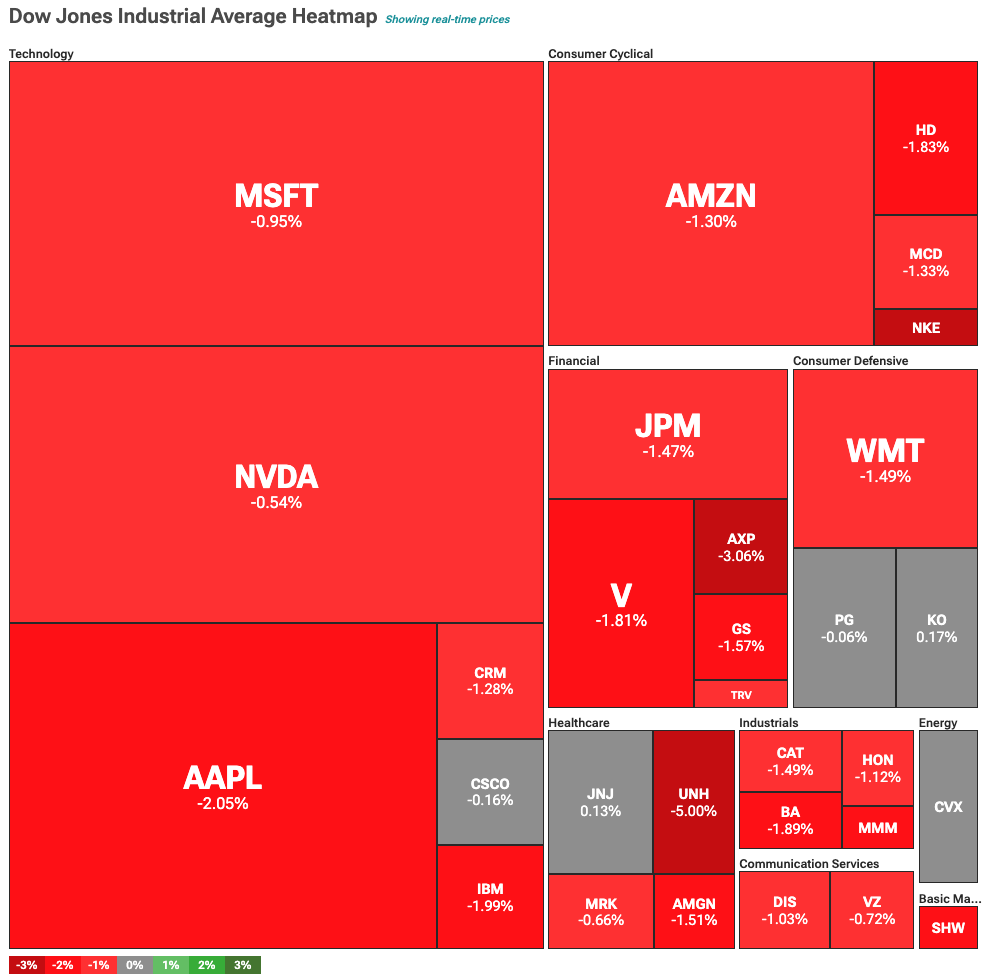

U.S. public debt has ignited investor considerations, at the same time as Bitcoin (BTC) reached its all-time excessive. On Could 21, the S&P 500 traded at 5,882.35 factors, down 0.98%, whereas the tech-heavy Nasdaq was at 21,232.05, down 0.63%. On the similar time, the Dow Jones was deep within the pink at 42,059.08, dropping 620.63 factors, or 1.46%.

DOW Jones Industrial Common warmth map | Supply: TipRanks

Investor focus is totally on U.S. debt, as rising bond yields threaten to push the federal government deficit even increased. The newest $16 billion public sale of 20-year Treasury bonds attracted little demand from traders, sending bond yields increased. This got here after the U.S. suffered a credit standing downgrade from Moody’s, dropping its excellent rating.

You may additionally like: Dow Jones posts modest features as U.S. debt downgrade shakes Wall Avenue

On the similar time, the U.S. Congress is pushing a brand new invoice to increase Trump-era tax cuts. These cuts would enhance disposable earnings, particularly for high-income earners, but in addition increase considerations about additional widening the federal deficit.

Nonetheless, this unsure macroeconomic setting seems to be working in Bitcoin’s favor. The most important crypto asset reached a brand new all-time excessive, whereas gold additionally confirmed sturdy efficiency—rising 0.94% to $3,313.5 per ounce.

You may additionally like: BREAKING: Bitcoin hits new all-time excessive at $109,400.68

Tech shares, healthcare down, Google replenish 4%

Virtually all the highest 30 firms listed on the DOW Jones have been in decline, together with tech, main retailers, and healthcare. Nevertheless, the Nasdaq-listed Alphabet inventory rose 4% on Google’s new AI announcement. The tech big is engaged on redefining search, making it work equally to the large AI fashions.

UnitedHealth continues its decline, with scandal on high of scandal. Most lately, reviews revealed that the corporate tried to chop insurance coverage payouts by paying nursing properties to scale back transfers of sufferers to hospitals. This exposes the insurance coverage big to potential litigation, and its inventory dropped 6% on the information.

Learn extra: Shopping for Bitcoin at all-time excessive nonetheless is sensible: Saylor