It is a section from the Ahead Steerage e-newsletter. To learn full editions, subscribe.

On the TokenizeThis convention in New York this week, I had the pleasure of moderating a dialog with executives from Dinari and STOKR on the potential for tokenized shares.

I additionally caught a panel on the retail adoption of tokenized real-world belongings (RWAs) extra broadly. The headwinds, tailwinds, what have you ever.

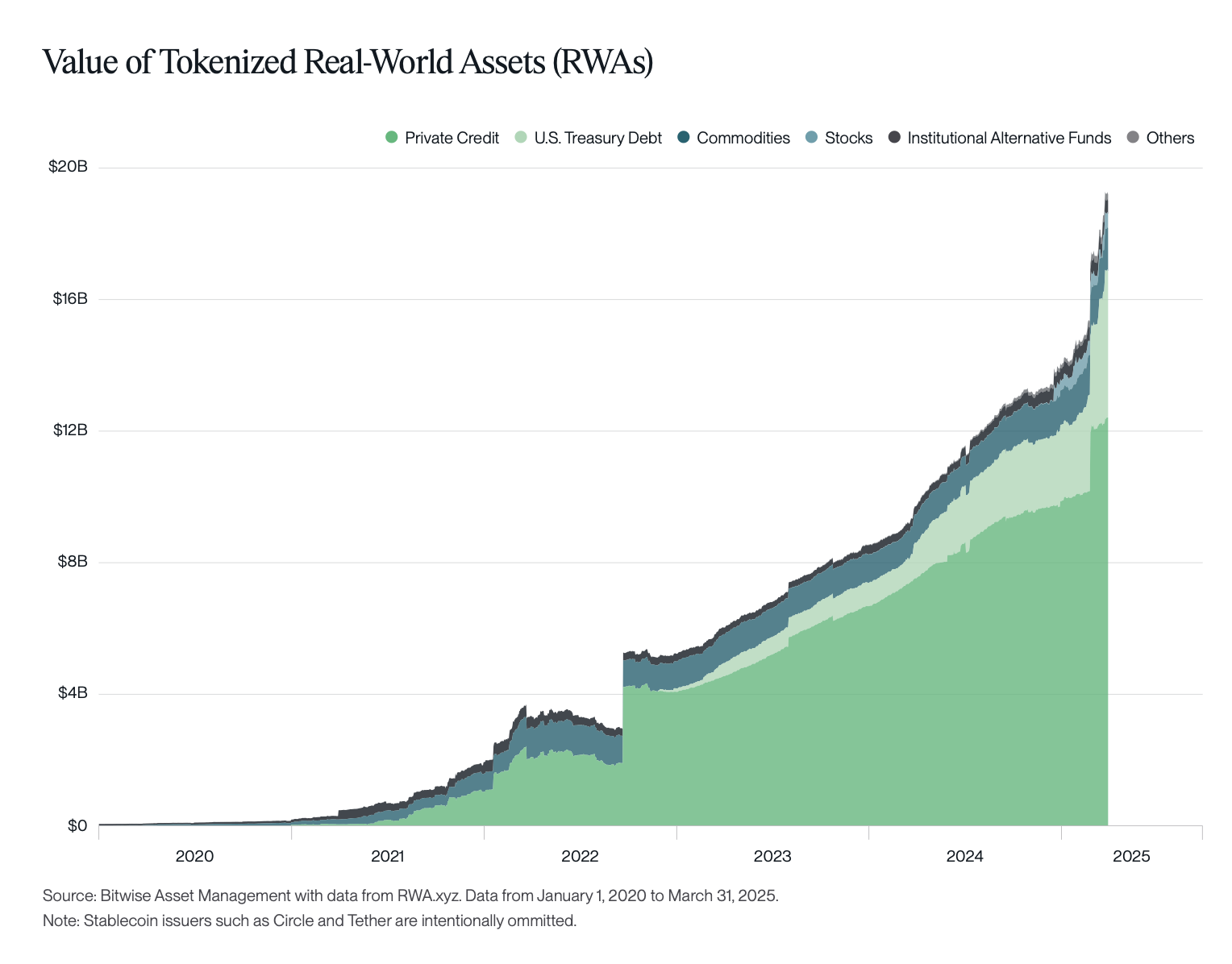

First issues first: Stablecoins (primarily tokenized {dollars}, so to talk) are a virtually $230 billion market. Exterior of that, onchain RWAs at present quantity to $18.5 billion, RWA.xyz information reveals.

A current report from Bitwise referred to as Q1 “the very best worst quarter in crypto’s historical past.” Whereas asset costs fell, stablecoin market cap hit a brand new excessive and tokenized RWAs grew 37% quarter over quarter. To not point out regulatory progress.

Supply: Bitwise

You’ll be able to see that large chunk in personal credit score, and the opposite substantial piece within the US Treasury debt class. Included in that’s BlackRock’s tokenized cash market fund, BUIDL, which lately hit the $2 billion Belongings Beneath Administration (AUM) mark.

Anticipated laws within the US that “permits on-ramps and off-ramps to proliferate” might be essential, Neoclassic Capital managing accomplice Mike Bucella mentioned on the TokenizeThis stage Wednesday. Stablecoins and tokenized Treasury merchandise will thus be “the muse” for extra inventive onchain choices within the coming years.

“The boring stuff is an absolute necessity, as a result of it exists within the offchain world,” he defined. “Should you can’t do this within the onchain world, then you definately’re not going to take a seat there and look forward to some attention-grabbing onchain yield product; you’re going to go offchain into the standard markets.”

As for the place we go from right here, Dinari Chief Enterprise Officer Anna Wroblewska argued that after stablecoins and cash market funds, publicly listed US shares supply one other easy accessibility level for buyers trying to transfer onchain.

Galaxy Digital tokenization head Thomas Cowan, nevertheless, famous the already-solid person expertise to put money into shares on venues like Robinhood. Subsequently, he asserted, the following wave of development may are available “locations the place there’s a transparent lack of transparency [and] settlement danger” — i.e. personal credit score.

Sitting beside Cowan, 21Shares US gross sales head Anton Kozlov added that he additionally sees demand for tokenized personal fairness — pointing to SpaceX and OpenAI. Blockworks Analysis analyst Carlos Gonzalez Campo expects shares of such personal corporations to be tokenized throughout the subsequent 4 years.

Crypto custody agency Taurus, in a current report, pegged the “market alternative” of fund tokenization at $1 trillion by 2030. Whereas cash market funds unlock use circumstances in collateral administration, the report notes, Taurus can be bullish on tokenization inside illiquid segments.