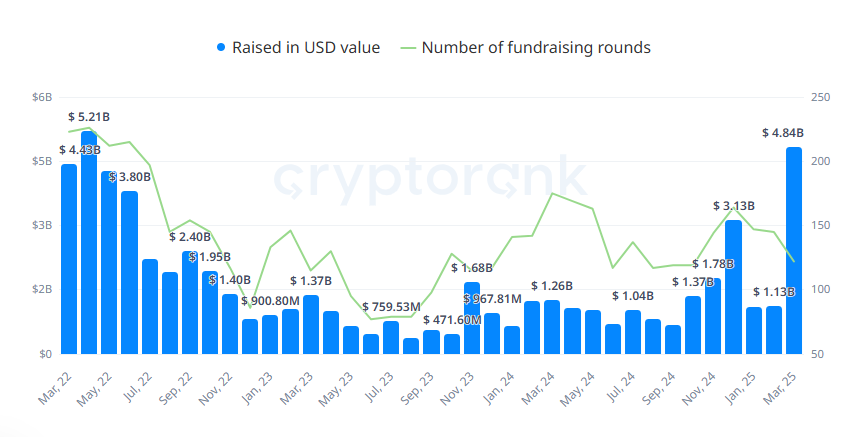

Crypto funding is on monitor to complete a extremely energetic Q1, with as much as $7.3 billion in funding rounds. Based on Messari, 550 offers have been wrapped up previously quarter.

Crypto funding accelerated in March, increasing funding to $7.3B for Q1, 2025. Crypto funding normally follows the growth phases of a bull market. This time, main belongings remained subdued, however VC offers continued.

Based on Messari’s knowledge, crypto funding closed $154M in funding for simply the previous week, whereas the whole quarter was on monitor to surpass the earlier gradual months.

Regardless of the shift in deal with meme tokens, new initiatives and platforms are nonetheless constructing below all market situations. Funding exercise switched to ‘excessive’ after exhibiting a ‘low’ indicator in January and February. Based mostly on Cryptorank knowledge, exercise is up by 13% previously month.

VC offers peaked in March, with a predominance of undisclosed rounds and seed funding. | Supply: Cryptorank

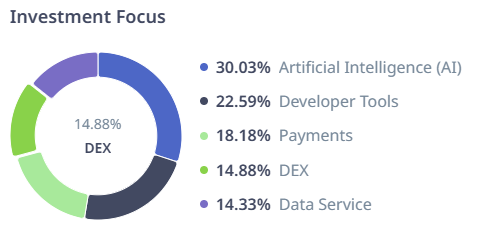

The highest 12 funds have various funding portfolios, however all have a deal with AI funding. The initiatives embody each AI agent platforms and AI infrastructure. AI takes up 14% to 22% of the Tier 1 high VC funds.

The growth of AI affected crypto funding as properly. Over 30% of offers flowed into AI initiatives, turning into the most important funding sector. Over 22% of offers flowed into developer instruments. A brand new development emerged for fee providers, taking on 18% of funding previously month.

VC funds targeted on AI initiatives, whereas a brand new fee tech sector emerged. | Supply: Cryptorank

March was a very robust month for VC offers, as revealed by Cryptorank knowledge. By the tip of the month, a complete of 122 offers have been closed, elevating a complete of $4.84B. After two comparatively gradual months, March stood out as a interval for fast deal-making, suggesting older narratives might reawaken.

The latest progress comes from undisclosed rounds, whereas seed rounds nonetheless make up round 30% of all funding. The most typical rounds are for $3M to $10M, adopted by smaller fundraising of $1M to $3M. These forms of rounds make up round 60% of all funding exercise. Round 6.28% of all offers are for over $50M.

Animoca Manufacturers leads with probably the most funding rounds

For the primary quarter of 2025, Animoca Manufacturers and OKX Ventures have been tied with 14 funding rounds every. Coinbase Ventures accomplished 13 funding rounds, and Amber Group closed 10 VC offers.

Animoca Manufacturers stood out for being the one fund nonetheless attempting to revive on-chain gaming. GameFi now makes the majority of fundraising for Animoca Manufacturers, with 177 offers so far.

In March 2025, a complete of 30 GameFi offers have been accomplished, with one other 30 for blockchain providers.

Animoca Manufacturers accomplished its greatest spherical in March for Slingshot, a brand new GameFi mission. The fund led an undisclosed spherical for $16M. Animoca Manufacturers additionally helps NFT initiatives, remaining one of many final backers for one of these exercise.

Regardless of the latest revival, VC funding remains to be down from the degrees of 2021. Quarterly funding simply surpassed $10B in the course of the 2021 bull market. The present restoration helped the market attain 50% of that stage.

Token-based fundraising slows down

The primary three months of 2025 triggered token fatigue after the launch of 1000’s of meme tokens. For that purpose, token launchpads noticed a big outflow of exercise and vital losses from most launches. Solely Bybit retained its optimistic ROI, with 700% in positive factors for the primary three months of 2025, whereas different platforms posted vital losses from their token launches.

Total, non-public token gross sales made up simply 2.8% of VC rounds, as extra initiatives determined to go tokenless. Providing tokens to early VC backers continues to be a pink flag for initiatives, as a result of promoting stress over time.

Token creation is extra curated, with a number of the new TGE occurring on the Binance ecosystem. Every launchpad is turning into specialised in several types of tokens. Gate.IO is the chief in launching GameFi belongings, whereas others deal with DeFi tokens.