Ethereum is buying and selling beneath the $2,700 mark after days of struggling to reclaim this degree and push above $2,800. The market has been coping with sturdy promoting strain, and Friday’s stunning information of Bybit’s $1.4 billion ETH hack added extra uncertainty. This assault was a significant occasion, marking the biggest crypto hack in historical past, triggering a wave of worry that despatched Ethereum into decrease demand ranges. Buyers stay cautious because the market assesses the long-term affect of the breach on sentiment and liquidity.

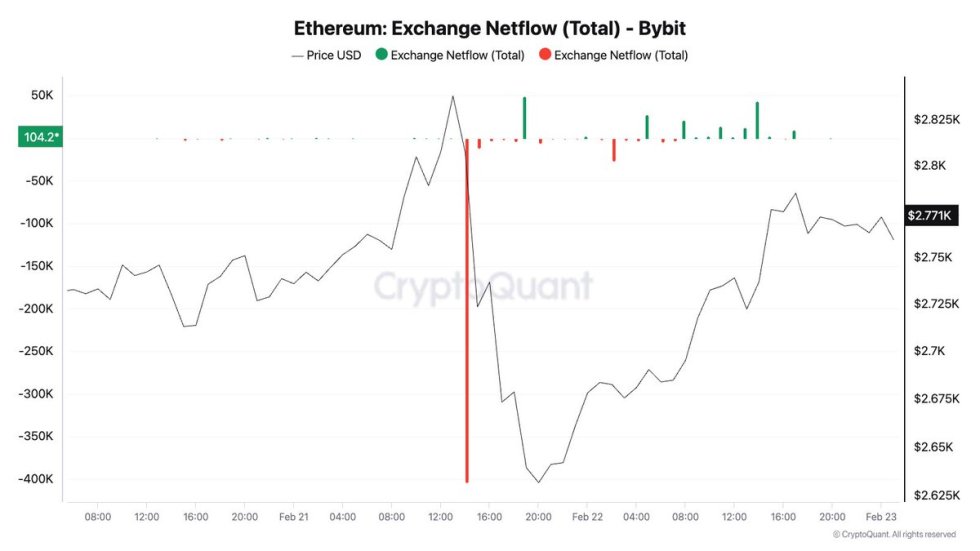

Regardless of the preliminary panic, there are indicators of restoration. Key metrics from CryptoQuant reveal that Bybit’s ETH reserves are slowly recovering. The alternate has skilled constructive internet flows of 139,000 ETH because the hack, suggesting that confidence is progressively returning. This means that Bybit has managed to stabilize its platform, assuaging fears of a chronic disaster.

With Ethereum nonetheless buying and selling at important ranges, the market is carefully watching whether or not it could actually reclaim key resistance zones or face additional draw back. The following few days will likely be essential in figuring out ETH’s short-term route as patrons try to regain management amid lingering uncertainty from the hack.

Ethereum Value Holding Amid Bybit Hack

Ethereum has been struggling as buyers develop bored with the huge promoting strain and ongoing negativity surrounding the second-largest cryptocurrency. Since late December, ETH’s value has been on a downward trajectory, with no clear indicators of a sustained restoration. Sentiment stays bearish as Ethereum continues to commerce beneath key resistance ranges, failing to realize momentum for a bullish breakout.

Including to this uncertainty, the Bybit ETH hack on Friday additional rattled the market. The assault resulted in over $1.4 billion in ETH being stolen from the alternate, making it the biggest crypto hack in historical past. This occasion fueled further promoting strain as panic briefly unfold throughout the market. Nonetheless, Bybit’s speedy response helped include the state of affairs and stop a broader selloff.

Key information shared by CryptoQuant’s Head of Analysis, Julio Moreno, reveals that Bybit’s ETH reserves are slowly recovering. The alternate has seen constructive internet flows of 139,000 ETH because the hack, an indication that confidence is progressively returning. This can be a constructive indicator, suggesting that regardless of sudden setbacks, the trade stays resilient.

Whereas Ethereum nonetheless faces key resistance ranges, the restoration of Bybit’s reserves alerts that buyers are regaining belief. The following few days will likely be essential in figuring out whether or not ETH can escape of its bearish pattern or proceed its wrestle.

Technical Evaluation: Key Liquidity Ranges

Ethereum is buying and selling at $2,750 after days of struggling beneath the $2,800 resistance degree whereas sustaining help above $2,600. Indecision has dominated value motion for over two weeks, leaving buyers unsure in regards to the subsequent transfer. The extended consolidation means that ETH is constructing momentum for a major breakout in both route.

If bulls can reclaim the $2,800 degree within the coming days, Ethereum may push towards the $3,000 mark, which serves as each a psychological and technical resistance. A breakout above this degree would affirm a bullish reversal and set the stage for an enormous rally into larger provide zones. Then again, failing to reclaim $2,800 and dropping the $2,600 help may set off one other spherical of promoting strain, doubtlessly sending ETH into decrease demand ranges.

Market sentiment stays divided, with some analysts anticipating Ethereum to comply with Bitcoin’s lead into new highs, whereas others anticipate additional draw back if the general crypto market weakens. As volatility continues to lower, merchants are watching carefully for any indicators of an imminent breakout. The following main transfer will possible decide the short-term route of Ethereum and set the tone for its efficiency within the coming weeks.

Featured picture from Dall-E, chart from TradingView