Intesa Sanpaolo, Italy’s largest financial institution, has reportedly entered the Bitcoin market by buying €1 million price of the main digital asset.

This interprets to roughly 11 BTC, in response to an inner e-mail allegedly signed by Niccolo Bardoscia, the pinnacle of the financial institution’s digital asset buying and selling and funding division.

Though Intesa has but to verify the acquisition, a number of credible media shops, together with Reuters, have reported on it.

In the meantime, Intesa’s reported Bitcoin acquisition follows a sequence of strategic strikes within the digital asset house.

Final 12 months, the financial institution’s crypto division reportedly secured approval for spot crypto buying and selling, including to its current choices of crypto choices, futures, and exchange-traded funds (ETFs).

Nonetheless, it’s unclear if this Bitcoin buy alerts its broader growth into the digital property ecosystem.

However, Pierre Rochard, Vice President of Bitcoin Miner Riot Platforms, highlighted the importance of this shift, noting that monetary establishments more and more acknowledge Bitcoin’s potential.

He said:

“All the banks want to start out accumulating BTC to recapitalize their steadiness sheets.”

Intesa is well known as a frontrunner in digital asset adoption inside Italy’s conventional finance sector. It additionally holds the highest spot amongst Eurozone banks by market capitalization, valued at €69 billion—outpacing opponents like Santander (€67 billion) and BNP Paribas (€66 billion).

Institutional Bitcoin curiosity

Market observers famous that Intesa’s buy displays a broader development of elevated Bitcoin adoption amongst monetary establishments.

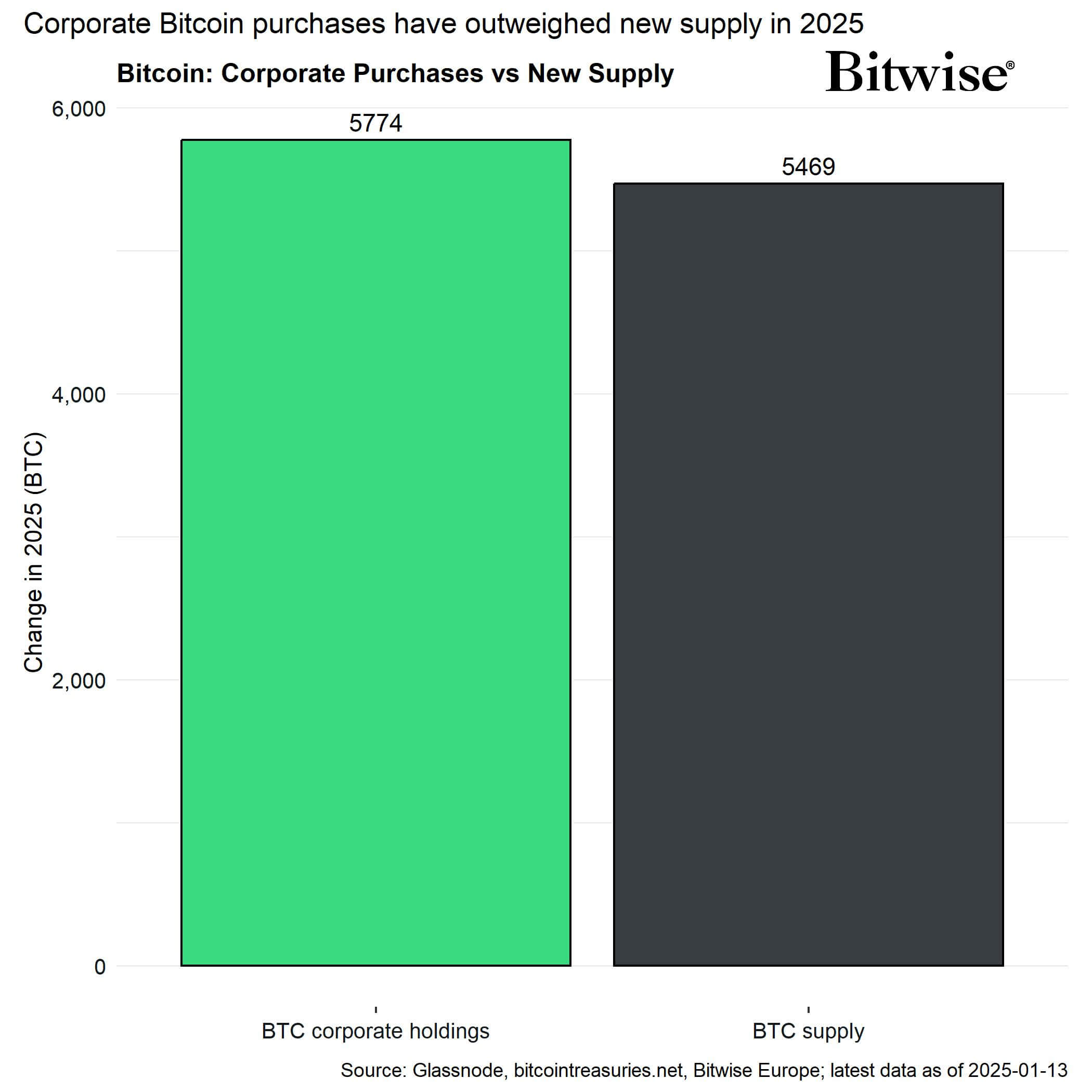

Knowledge from Bitwise highlights that company demand for Bitcoin in 2025 has exceeded the availability of newly mined cash. Firms have collectively bought 5,774 BTC because the starting of the 12 months, whereas solely 5,469 BTC had been mined throughout the identical interval.

Among the many outstanding company patrons is MicroStrategy, which has added roughly 3,600 BTC to its reserves this 12 months. Different companies like Semler Scientific and Ming Shing Group have additionally turned to Bitcoin of their liquidity and reserve diversification methods.

Hunter Horsley, Bitwise CEO, expects this development to proceed this 12 months, saying:

“Companies shopping for Bitcoin goes to be a significant theme of 2025.”