Binance broke above 240M registered customers after the most recent file crypto increase. Towards the top of 2024, Binance remained the highest change each by way of visits and liquidity.

Binance carried the increase of 2024, increasing each its volumes and person base. Richard Teng, CEO of Binance, introduced the milestone, underscoring the scale of the crypto market.

https://x.com/_RichardTeng/standing/1857395323016032644

Binance stays a full KYC change, although previously it has been accused of internet hosting bot accounts or spoofed identities. Nevertheless, the current person development is corroborated by on-line tendencies, the place Binance’s app and web site additionally develop in reputation.

Binance additionally confirmed the market nonetheless wanted a central settlement hub, because it carried a giant a part of the visitors throughout Bitcoin’s run as much as $93,000. Binance was additionally instrumental to a number of meme token rallies, together with PEPE, NEIRO, ACT, and PNUT. Curiosity in Binance additionally rose for its current coverage so as to add broadly distributed meme property with no indicators of insider holdings.

Within the brief time period, Binance is a means for tokens to undergo a increase. As of November 15, among the most actively buying and selling pairs concerned DOGE and PEPE, with excessive exercise for ACT and PNUT as effectively.

Binance is the market share chief with inflows from Asia and Europe

Binance nonetheless carries greater than 25.5% of all change volumes, based mostly on knowledge from Messari. The change handles extra volumes than different prime opponents, together with Coinbase and Crypto.com. The change carries one of many greatest Bitcoin (BTC) wallets, holding greater than $36B in deposits. The change carries greater than $102B in its balances, unfold throughout main L1 and L2 chains. The change is seen as extra clear attributable to common on-chain studies of present reseres.

Binance is a worldwide market, with a particular division for US merchants. The change has moved its registration to the Kayman Islands for a world presence, cautious of earlier issues with laws.

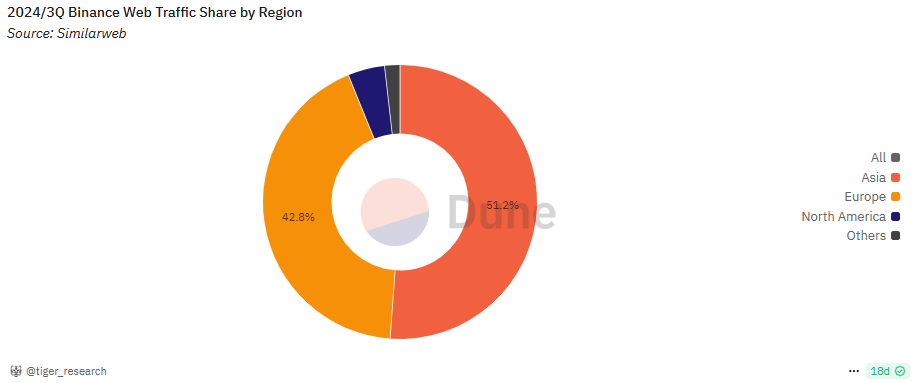

Binance additionally derives a giant a part of its volumes from Asia and Europe, based mostly on website go to knowledge. BinanceUS works as a separate entity, unrelated to the worldwide change and dealing with some limitations for US-based merchants. Near 35% of Binance internet visitors comes from Asian international locations, with 42.8% from Europe, the place the change sees no limitations within the SEPA space.

Binance derives most of its visitors from the booming Asian and European crypto markets. | Supply: Dune Analytics

For the European markets, Binance can be adapting to native laws, swapping out merchandise utilizing Tether (USDT) for USDC, a extra clear stablecoin with bank-based fiat reserves. Binance can even adjust to the second stage of EU necessities from 2025 onward, and isn’t threatened for its presence on the European market. Binance is each a retail hub and a settlement platform for bigger offers, just lately seeing whale inflows for profit-taking.

The highest centralized DEX additionally reinvented its affect after swapping its management. Former CEO and co-founder Changpeng ‘CZ’ Zhao moved on to the technical facet, just lately discussing crypto tech with Vitalik Buterin.

Binance ecosystem stays much less lively

Binance has confirmed its worth as a CEX, however its decentralized ecosystem lags behind different networks. Binance Sensible Chain and its DEX, PancakeSwap, retain fewer customers and lag behind Uniswap and Raydium.

Moreover, BNB, the native asset, hovers simply over $600, with no important breakouts to a better tier. The Binance ecosystem additionally phased out Binance USD (BUSD), changing it with the centralized FDUSD.

BNB Sensible Chain is among the busiest by way of initiatives. Nevertheless, these startups have been added in the course of the Web3 gaming increase and the NFT craze. A few of the initiatives misplaced their customers and their worth, hardly contributing to the Binance model.

To this point, the main crypto model appears to derive its greatest worth from centralized exercise. On the identical time, Binance retains its incubator applications, academic hub and varied fashions of DeFi, staking and passive earnings applications.

Prior to now years, among the property listed on Binance didn’t fare higher, particularly when it got here to VC-backed tokens. Within the current case of Binance listings, meme tokens truly benefitted, coming into a stage of worth discovery.