Japan’s Monetary Providers Company (FSA) is reportedly making ready legal guidelines to assist stop the outflow of home property within the case of FTX-type bother with crypto exchanges based mostly abroad. The state regulator is seeking to set up a “holding order” within the nation’s Fee Providers Act.

Ostensibly in response to a narrowly dodged bullet with the collapse of the notorious crypto alternate FTX, Japan’s monetary regulator is now seeking to create a brand new “holding order” to forestall home property from flowing abroad within the case of foreign-based alternate failures.

FSA goals to keep away from asset hemorrhage in case of alternate failures abroad

In fact, no person actually is aware of the true impetus for the measures however these in energy — the precise political and control-based motives. Nonetheless, based on native media outlet Nikkei:

“The Monetary Providers Company is transferring in the direction of creating a brand new ‘holding order’ within the Fee Providers Act, which regulates cryptocurrency exchanges, that can get them organized to not take home property entrusted to them by clients abroad.”

“Abroad” on this case could be Japanese residents utilizing exchanges based mostly overseas, resembling FTX, who in sure instances may lose their funds resulting from chapter and different failures.

Thus far, such holding orders have solely utilized to companies registered with the Monetary Devices and Alternate Act, but when the proposed authorized change takes maintain, they’ll reportedly apply to all “digital forex alternate corporations registered beneath the Fee Providers Act.”

On the time of FTX’s spectacular implosion, Bankman-Fried’s rip-off outfit was registered as a monetary devices agency, so a holding order was capable of be issued.

Nonetheless, with the proposed modification, the safeguard could be put in place in a wider style.

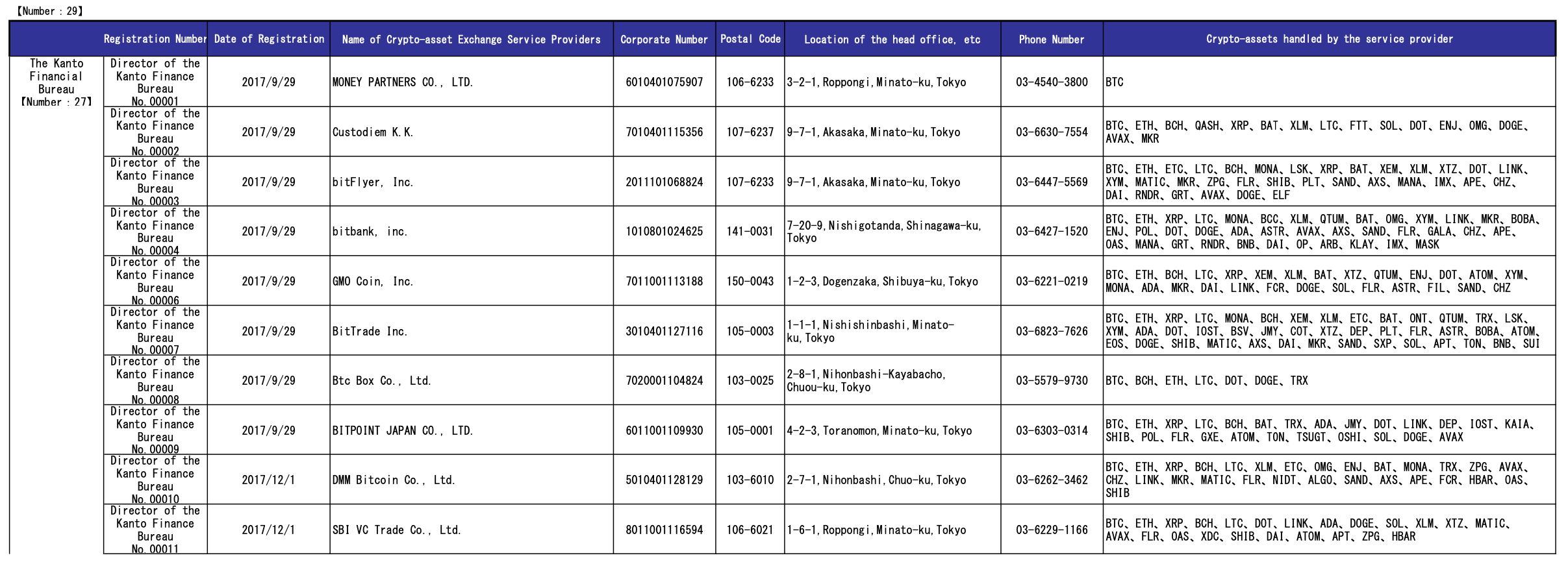

Registered home exchanges in Japan are already legally restrained from permitting asset leakage abroad, and 29 exchanges (each home and in any other case) are at the moment registered. The modification would lead to a system designed to carry home property in Japan, no matter an alternate’s headquarters.