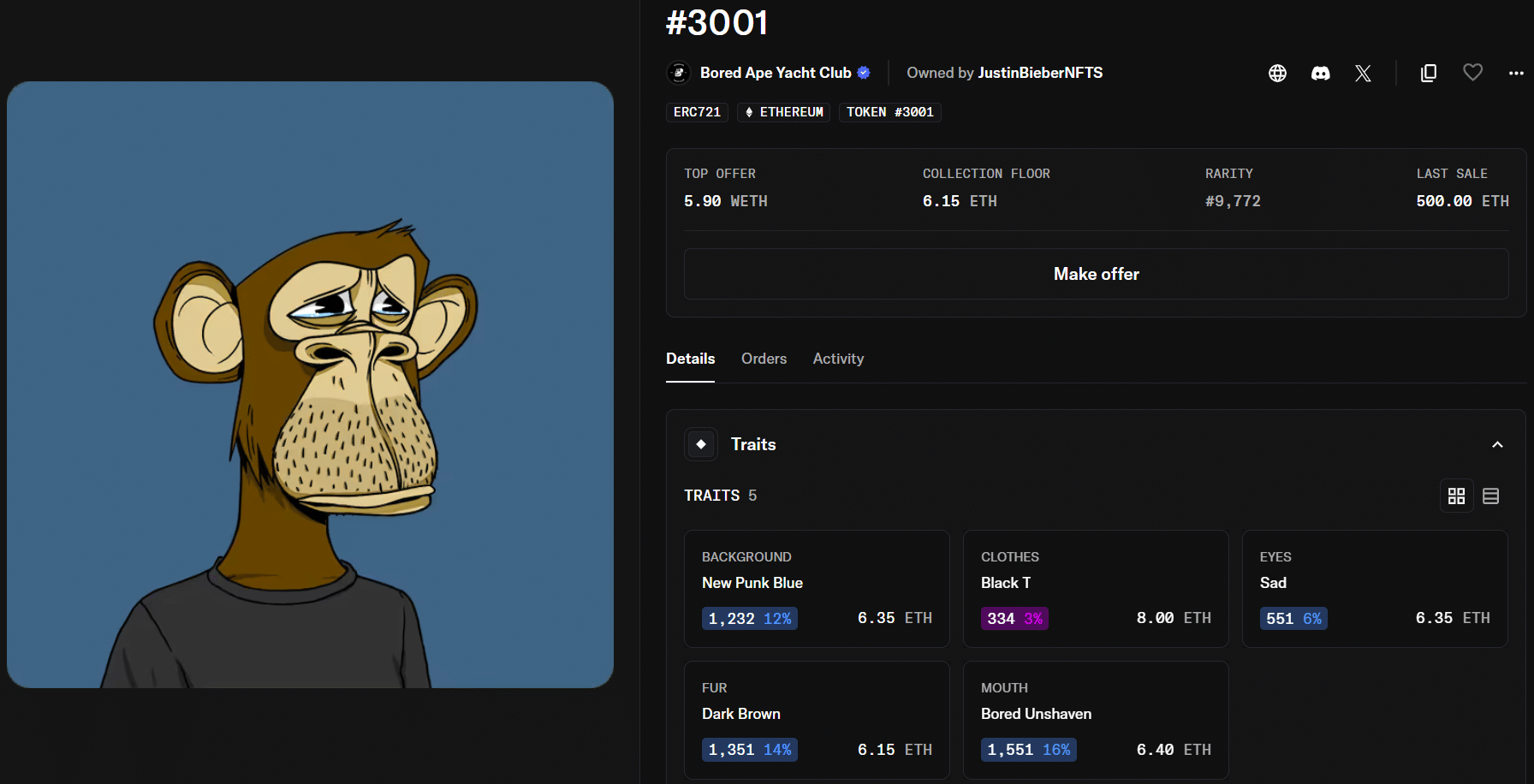

Justin Bieber’s Bored Ape #3001, acquired for a staggering 500 $ETH in early 2022, has seen its worth evaporate to roughly $12,000, reflecting a near-total wipeout of his preliminary $1.3 million funding.

The pop star, who has amassed probably the most seen superstar $NFT portfolios, acquired the digital collectible when enthusiasm for the sector reached its zenith. Analysts on the time famous Bieber paid nicely above prevailing charges, with comparable belongings within the assortment buying and selling between $200,000 and $300,000.

With the very best bid at 5.9 $ETH and the gathering’s ground hovering close to 6.15 $ETH, Ethereum buying and selling round $2,000 means buyers who entered in the course of the 2022 rally are going through even steeper dollar-denominated losses.

Bored Ape Yacht Membership (BAYC), a ten,000-piece generative artwork collection created by Yuga Labs, debuted in April 2021 at a mint price of 0.08 $ETH and bought out inside half a day. By Could 2022, ground costs reached as excessive as 128 to 145 $ETH, equal to roughly $350,000 to $420,000 at prevailing alternate charges.

Bieber holds not less than one further piece from the collection, ape #3850, which he acquired for roughly $470,000 shortly after his first buy.

After the speculative bubble burst, $NFT buying and selling volumes and ground costs dropped sharply from their 2022 highs, however the sector didn’t disappear. As a substitute, growth has shifted towards utility-focused purposes similar to in-game belongings, entry passes, identification instruments, and tokenized real-world gadgets.

Ethereum stays dominant for high-value NFTs, whereas Solana and Polygon have gained share by decrease charges and higher scalability.