Ethereum (ETH) has been on a pointy downward trajectory after reaching highs above $4,000. The value has now dropped under $2,100, leaving merchants questioning whether or not the correction is nearing its finish or if extra ache is forward. With rising promoting stress and a weakening market construction, the massive query stays—might ETH fall to $1,000, or is a robust restoration imminent?

This evaluation will break down Ethereum’s key assist and resistance ranges, technical indicators, and potential value trajectory within the coming weeks.

Ethereum Worth Prediction: How Dangerous Is Ethereum’s Present Downtrend?

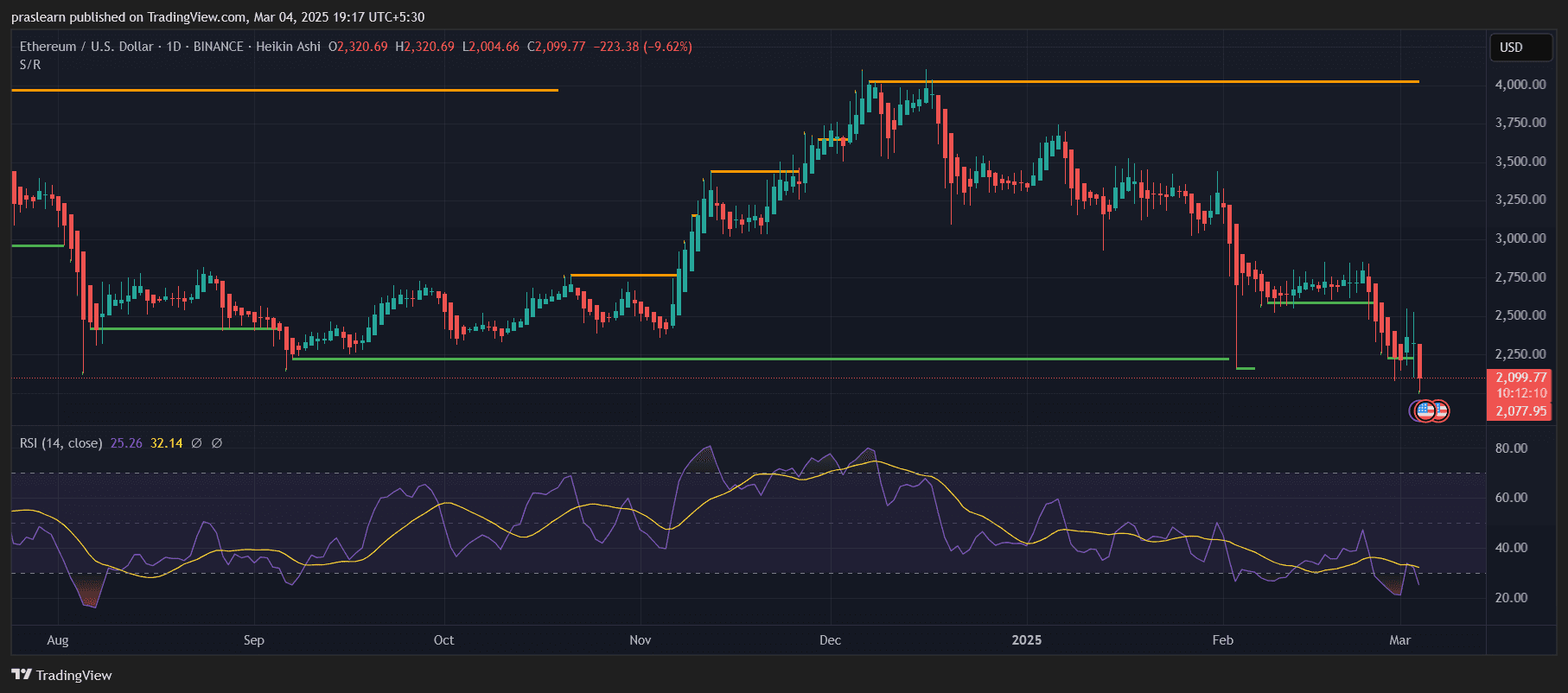

ETH/USD Day by day Chart- TradingView

Ethereum has been experiencing a steady decline, forming decrease highs and decrease lows. After failing to carry above $3,500, the worth sharply corrected, triggering elevated promoting stress. ETH is at present testing a main assist zone close to $2,000, which has traditionally acted as a robust demand stage.

The present market construction means that ETH continues to be in a bearish part, with the downward momentum displaying no clear indicators of exhaustion but. If Ethereum fails to carry above $2,000, a deeper correction towards $1,500-$1,600 could possibly be the subsequent step.

Is $2,000 a Sturdy Assist for Ethereum?

The $2,000 stage is a big assist zone for ETH, because it has offered sturdy rebounds previously. The final time Ethereum examined this space, patrons aggressively pushed the worth again above $2,500, resulting in a short-term aid rally.

Nevertheless, if ETH breaks under $2,000, the subsequent main assist is round $1,500-$1,600, which was final examined in the course of the 2023 bear market. A breakdown under this zone might enhance the probability of Ethereum revisiting $1,200-$1,000, which might be a worst-case state of affairs for bulls.

What Do the Indicators Say About Ethereum’s Subsequent Transfer?

The Relative Power Index (RSI) is at present at 25, which is deep in oversold territory. Traditionally, RSI ranges under 30 point out that the asset is closely offered and could possibly be due for a short-term bounce. Nevertheless, a sustained reversal would require ETH to regain key resistance ranges and ensure bullish momentum.

The Heikin Ashi candles are nonetheless forming sturdy crimson bars, signaling that bearish stress is dominant. For ETH to ascertain a development reversal, it should print a number of inexperienced Heikin Ashi candles with elevated quantity.

Ethereum Worth Prediction: Will Ethereum Worth Drop to $1,000?

Whereas ETH value is at present sitting at essential assist, a break under $2,000 might result in additional draw back. If Ethereum loses this key stage, the primary goal could be $1,600-$1,500, and if market situations deteriorate, a drop to $1,200-$1,000 might change into a actuality.

Nevertheless, a direct crash to $1,000 appears unlikely until the general market sees excessive bearish sentiment, similar to a big Bitcoin correction or regulatory setbacks within the crypto house. For now, ETH nonetheless has possibilities to get well if bulls defend the $2,000 assist zone.

Can Ethereum Worth Get better and Rally Again Above $3,000?

For ETH value to regain bullish momentum, it should break key resistance ranges, beginning with $2,500-$2,600. A profitable shut above this vary would point out renewed shopping for curiosity and will push Ethereum towards $3,000 within the medium time period.

Nevertheless, so long as ETH stays under $2,500, the market construction stays bearish. A full-fledged restoration would require Ethereum to reclaim $3,200-$3,500, which was beforehand a crucial support-turned-resistance stage.

Closing Ideas: Ought to You Purchase Ethereum Now?

Ethereum is at present buying and selling at a make-or-break stage, with $2,000 appearing because the final sturdy assist earlier than a possible deeper correction. Quick-term merchants would possibly search for a bounce from this stage, whereas long-term buyers might think about accumulating ETH if it drops nearer to $1,500-$1,600.

For now, ETH’s destiny depends upon whether or not it could possibly maintain $2,000 or if bears proceed pushing it decrease. Merchants ought to look ahead to a confirmed breakout above $2,500 to sign a reversal, whereas a break under $1,800 might open doorways for additional declines.