Whereas the bullish development stays intact, Ethereum is coming into a key consolidation vary. A profitable retest of $2.8K might ignite the subsequent wave towards $3.3K and past.

Technical Evaluation

By ShayanMarkets

The Day by day Chart

ETH has lately seen a notable inflow of shopping for stress, breaking above the important thing $2.8K resistance, which had acted as a persistent barrier in current months. This breakout has led to the formation of a better excessive, signaling a shift towards a bullish market construction on the each day timeframe.

Nonetheless, Ethereum now finds itself buying and selling inside a important vary between $2.8K and $3.3K, the place a short-term consolidation part is probably going. The higher boundary of this vary additionally aligns with a bearish order block, suggesting potential provide and promoting stress at this stage.

If Ethereum manages to interrupt above the $3.3K resistance, the subsequent bullish goal would seemingly be the $4K psychological threshold, a serious technical and psychological stage.

The 4-Hour Chart

On the decrease timeframe, ETH’s impulsive rally has been halted close to the $3K stage, as momentum cools. The $2.8K zone, beforehand sturdy resistance, is now being retested as assist. A correct pullback to this area would serve to validate the breakout and set up a stronger base for the subsequent leg up.

The 0.5-0.618 Fibonacci retracement ranges additionally function potential targets for this ongoing correction, offering confluence with short-term demand zones.

Within the coming days, Ethereum is anticipated to consolidate and proper, doubtlessly setting the stage for an additional bullish rally towards the $3.3K resistance.

Sentiment Evaluation

By ShayanMarkets

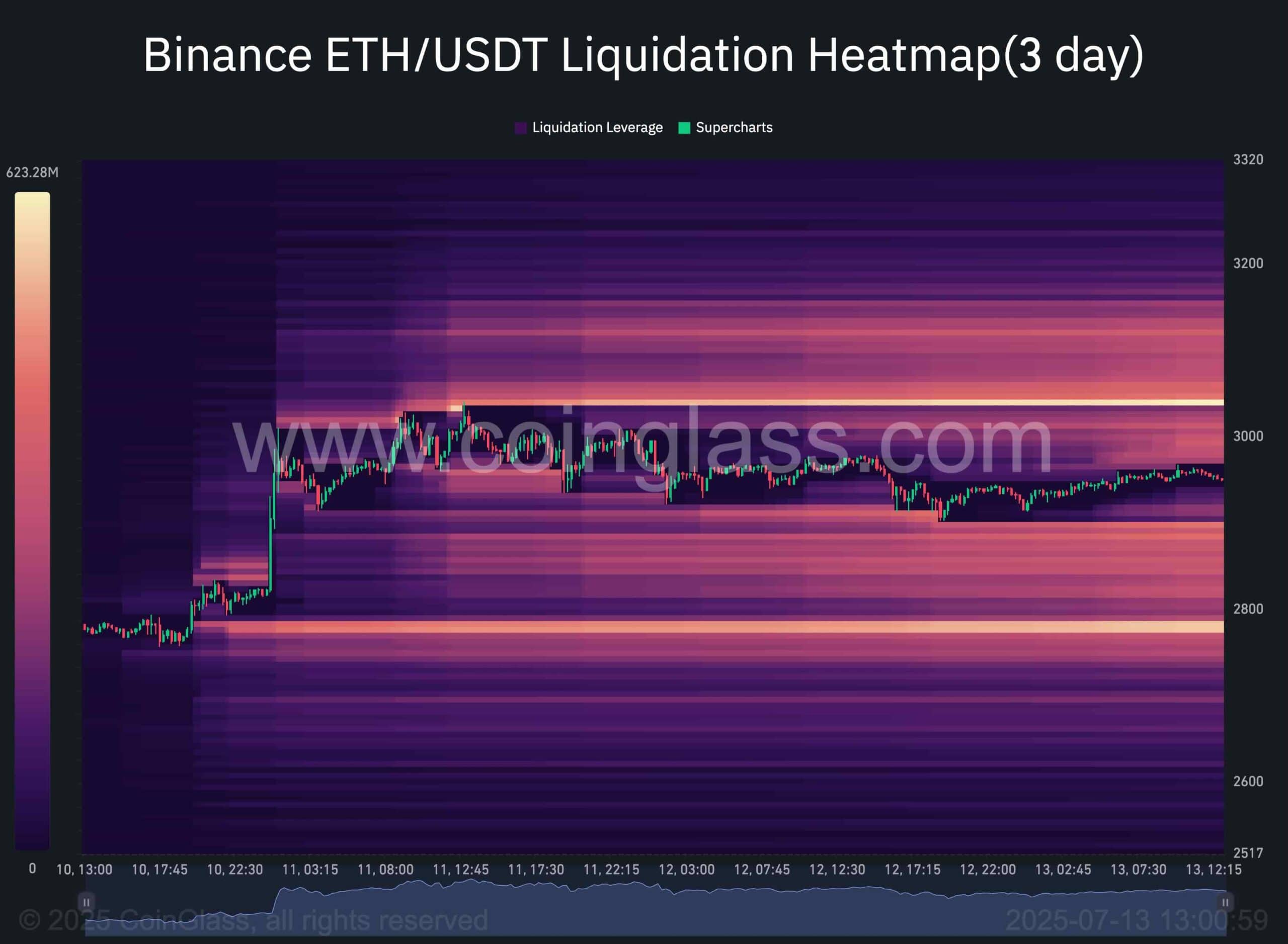

This chart visualizes the Binance Liquidation Heatmap, which pinpoints zones the place important liquidation occasions are more likely to unfold. These areas usually act as liquidity magnets, attracting value motion as a result of excessive focus of leveraged positions. In such eventualities, massive gamers or “whales” are inclined to capitalize on these zones to enter or exit trades effectively.

At current, a outstanding liquidation cluster is situated slightly below the $2.8K mark, implying a excessive likelihood that Ethereum’s value might gravitate towards this stage. Ought to this state of affairs play out, ETH would full its pullback to this key assist, doubtlessly reigniting bullish momentum and setting the stage for a rally towards the $3.3K resistance.

On the flip facet, one other sizeable liquidity pool sits above the $3K stage, indicating that following the pullback, Ethereum might additionally transfer greater within the brief time period to faucet this zone, doubtlessly triggering a short-squeeze and fueling additional upside.