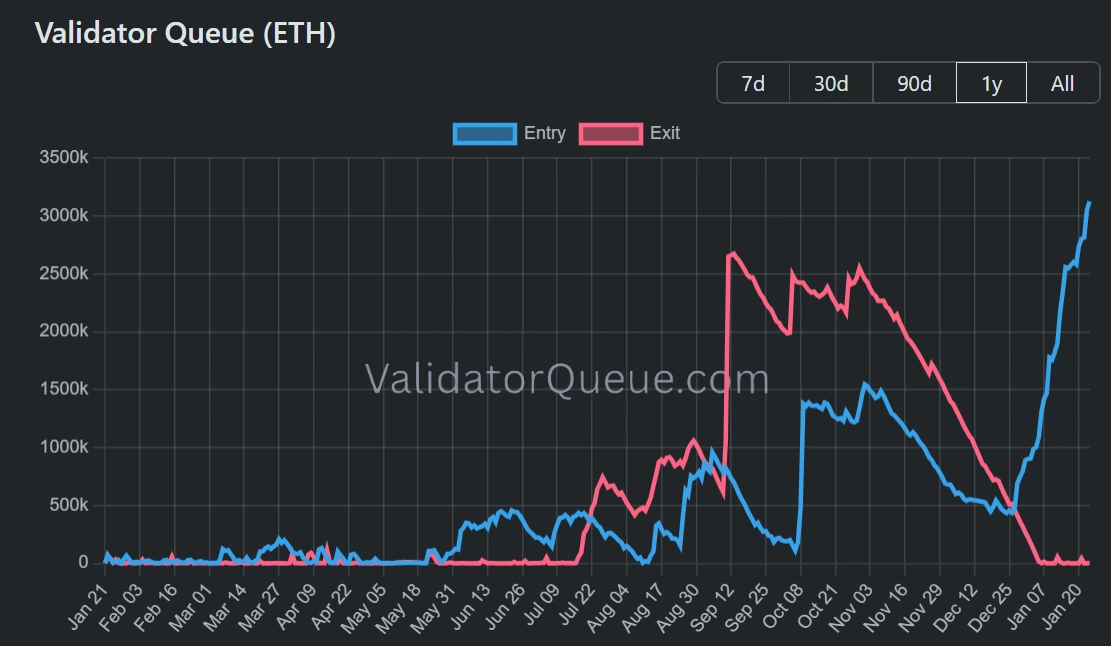

The entry queue to change into an Ethereum validator now stands at 3,114,842 ETH with a wait time of 54 days and a couple of hours, in response to knowledge from Validator Queue, creating the longest entry queue in over a 12 months as institutional buyers pour capital into the world’s second-largest cryptocurrency community.

The final time that exit queues dominated was in December 2025, after reaching a peak in September.

976,509 lively validators have staked over 36.3 million ETH, which is almost 30% of the entire provide, as of the time of writing.

Supply: Validator Queue

Why is Ethereum’s validator entry queue congested?

The rise of the entry queue has been fueled largely by institutional contributors taking main positions in Ethereum staking.

As of January 19, 2026, Tom Lee’s BitMine, the main Ethereum treasury agency, had staked 1,838,003 ETH, which was value $5.9 billion at $3,211 per ETH.

BitMine now holds over 4.2 million ETH, which is almost 3.5% of ETH’s whole circulating provide.

Lee, who’s the chairman of BitMine, said, “BitMine has staked extra ETH than different entities on the planet. At scale (when Bitmine’s ETH is totally staked by MAVAN and its staking companions), the ETH staking price is $374 million yearly (utilizing 2.81% CESR), or higher than $1 million per day.”

73.57% of Grayscale’s ETH holdings are staked as of the time of writing. The asset supervisor has since change into the primary US Ethereum exchange-traded product to distribute staking rewards to buyers in January 2026, with Goal Investments set to comply with go well with on January 30.

SharpLink Gaming, working below the ticker SBET, has emerged as the primary publicly listed firm to make use of ETH as its major treasury asset. The agency has generated over 11,600 ETH from staking actions since launching its Ethereum treasury in June 2025.

Technical upgrades lowered obstacles to entry

Ethereum’s Pectra improve in Might 2025 contributed to reducing the obstacles for large-scale staking operations. The replace elevated the utmost validator stake from 32 ETH to 2,048 ETH and likewise enabled computerized compounding of rewards. This has made it simpler for institutional gamers to handle massive positions with out working 1000’s of separate validators.

With 29.88% of ETH’s provide now locked in staking contracts and the present annual proportion charge at 2.83%, the community faces a tightening of liquid provide. Analysts recommend this might assist value appreciation, with some forecasting strikes towards $4,000 to $6,000 in 2026.

Critics declare that the focus of staking energy amongst institutional gamers threatens the very core of Ethereum, which is decentralization.

Nonetheless, folks like Lee disagree with that take, as he believes that somebody accounting for 10% of a system doesn’t equate to them being in command of it. The management of BitMine has said that they wish to purchase extra ETH and lift their proportion of holdings to five% of token provide.