Ethereum’s worth has been in a droop lately, slipping greater than 15% previously week amid bearish momentum within the general crypto area. Ethereum’s present struggles are primarily pushed by a return to inflationary provide ranges. Since April 2024, the community’s provide has been growing, which is the alternative of the deflationary atmosphere it skilled after the Merger.

The overall provide has risen by 0.37% previously 9 months, reaching 120.4 million ETH. This elevated provide, coupled with decrease demand, has fueled issues in regards to the asset’s worth trajectory.

On the 4-hour chart, Ethereum has dropped under the $3,087 help stage in a transparent downtrend. The vital query for buyers now’s whether or not Ethereum can keep this help stage, with failure to carry above the help may result in additional declines.

ETH Every day Value Chart, Supply: TradingView

Moreover, the value is under the 50 and shifting averages. Nevertheless, ETH’s Relative Energy Index (RSI) is on the oversold territory of twenty-two, that means there’s a risk of worth reversing earlier than an additional downward momentum might be seen.

Ether’s worth had remained in a consolidation, buying and selling between a low of $3,189 and a excessive of $3,330 earlier than the value dipped to the present stage. On the day by day chart, RSI is near the oversold zone at 32, with the value at the moment above the 50-moving common.

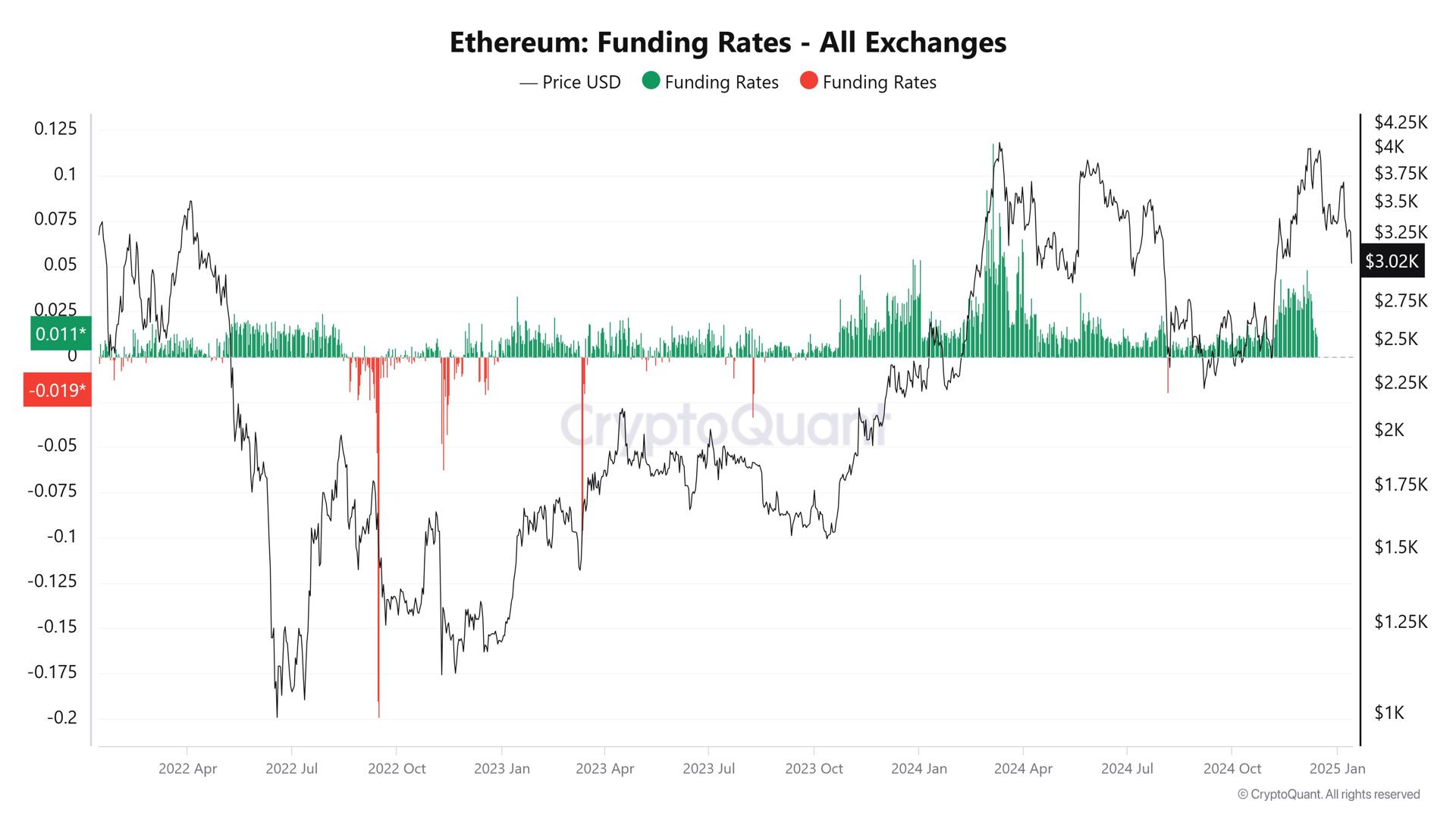

On the longer time chart, worth had been on a downward pattern on the weekly chart since touching a excessive of $4,010 in December 2. A notable growth is the current drop in funding charges, which suggests growing bearish sentiment amongst merchants.

Ethereum Funding Charges, Supply: CryptoQuant

On-Chain Metrics

Nevertheless, as Ethereum nears the $3,000 help zone, funding charges have begun to point out indicators of restoration, indicating that some merchants are opening lengthy positions in anticipation of a rebound, information from CryptoQuant exhibits.

If these funding charges proceed to recuperate, it may sign the beginning of a bullish part for Ethereum. Nevertheless, if the restoration falters and the bearish sentiment intensifies, additional draw back dangers stay. Ethereum’s worth is at a crossroads, with its destiny possible tied as to whether it will possibly regain momentum.