Ethereum co-founder Vitalik Buterin is selling a brand new mechanism to mitigate sudden spikes in transaction prices on the community.

His newest proposal outlines a trustless, on-chain prediction market designed to assist customers safe future fuel costs and handle volatility reasonably than react to it.

Buterin Backs Ethereum Gasoline Pricing Market

On December 6, Buterin argued that Ethereum wants a market-based sign for future demand for block area.

The construction would commerce publicity to the community’s Base Charge by letting individuals purchase or promote fuel commitments tied to a future window.

In accordance with him, the goal is to offer builders and heavy customers a approach to lock in prices and plan even when the spot value of fuel stays low.

The proposal comes at an uncommon time, as fuel costs are close to multi-year lows.

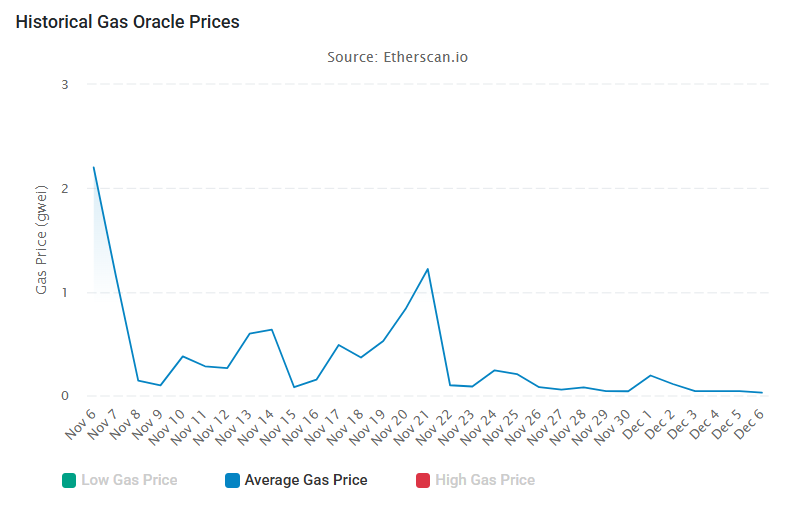

Etherscan information reveals that Ethereum’s common fuel value is about 0.468 Gwei, or roughly three cents. It’s because a lot of the community’s retail exercise has shifted to cheaper Layer 2 networks like Base and Arbitrum.

Ethereum’s Common Gasoline Charges in The Final 30 Days. Supply: Etherscan

But, Buterin argues that present tranquility breeds complacency.

He stresses that an on-chain futures curve would offer a transparent sign of long-term market expectations. It might allow customers to prepay for block area and lock in prices no matter future spikes.

“Folks would get a transparent sign of individuals’s expectations of future fuel charges, and would even have the ability to hedge towards future fuel costs, successfully prepaying for any particular amount of fuel in a selected time interval,” he acknowledged.

Trade Specialists Throw in Views

Supporters see the proposal as an underappreciated pillar of Ethereum’s long-term design. They argue {that a} trustless fuel futures market would fill a structural hole reasonably than introduce one other DeFi novelty.

Of their view, a BASEFEE market would align expectations with clear pricing and supply the ecosystem with a shared reference level for future community circumstances.

So, a liquid marketplace for fuel publicity may change this dynamic by permitting builders to purchase fuel insurance coverage to cap working prices forward of vital occasions. Heavy customers may additionally offset future charge spikes by taking the other market place.

“If Ethereum is changing into the settlement layer for every part, then fuel itself turns into a monetary asset. So yeah a trustless fuel futures market isn’t a “good to have.” It appears like a pure evolution for a sequence aiming for global-scale coordination,” the analyst acknowledged.

In the meantime, one trade advisor at Titan Builder famous that operating this as a basic spinoff market could be tough as a result of validators may manipulate outcomes by producing empty blocks.

He added {that a} delivered futures marketplace for block area with a liquid secondary venue stays possible. Such a construction could also be sufficient to help public value discovery and hedging.

The submit Vitalik Buterin Pushes Gasoline Futures Concept for Ethereum appeared first on BeInCrypto.