Ethereum (ETH) consolidated close to $3,400 on Tuesday, poised to shut the 12 months with an approximate 50% return. Ethereum has yielded underwhelming positive aspects in comparison with Bitcoin and most altcoins ranked within the prime 20 tokens by market capitalization

The narrative might change in 2025 with catalysts just like the upcoming Ethereum improve, accumulation by institutional traders, and different market movers.

Desk of Contents

Ethereum gears for Pectra improve in 2025

Ethereum might see a lift in scalability, safety, and consumer expertise with the upcoming Pectra improve, anticipated to go reside in 2025. The improve will introduce enhancements in account abstraction, validator operations, and community efficiency.

The objective is to enhance each the consumer and developer expertise on Ethereum and make future scalability upgrades simpler to implement.

Validator stake limits, staking withdrawals, and streamlined sensible contract improvement might enhance Ethereum’s community safety and effectivity. This might have a domino impact on Layer 2 chains that depend on Ethereum for his or her safety infrastructure.

Pectra would be the third most vital improve within the Ethereum ecosystem after the Merge, and its profitable execution might act as a catalyst for Ether’s restoration in 2025.

Ethereum analyst Anthony Sassano estimates that the Pectra improve will go reside subsequent March or April. Notably, Unichain, an Ethereum-based protocol, set to launch its mainnet in early 2025, goals to make use of blobs, and Pectra’s enhancements might assist Ethereum meet Unichain’s scalability necessities.

We’re getting a blob enhance to six/9 from 3/6 with Pectra in March/April (my estimate).

Unichain is slated to launch their mainnet in early 2025 and so they’ll be utilizing blobs.

The demand for blobs is up solely and Ethereum will scale to satisfy this demand!

— sassal.eth/acc 🦇🔊 (@sassal0x) December 31, 2024

Institutional traders accumulate Ether throughout dips

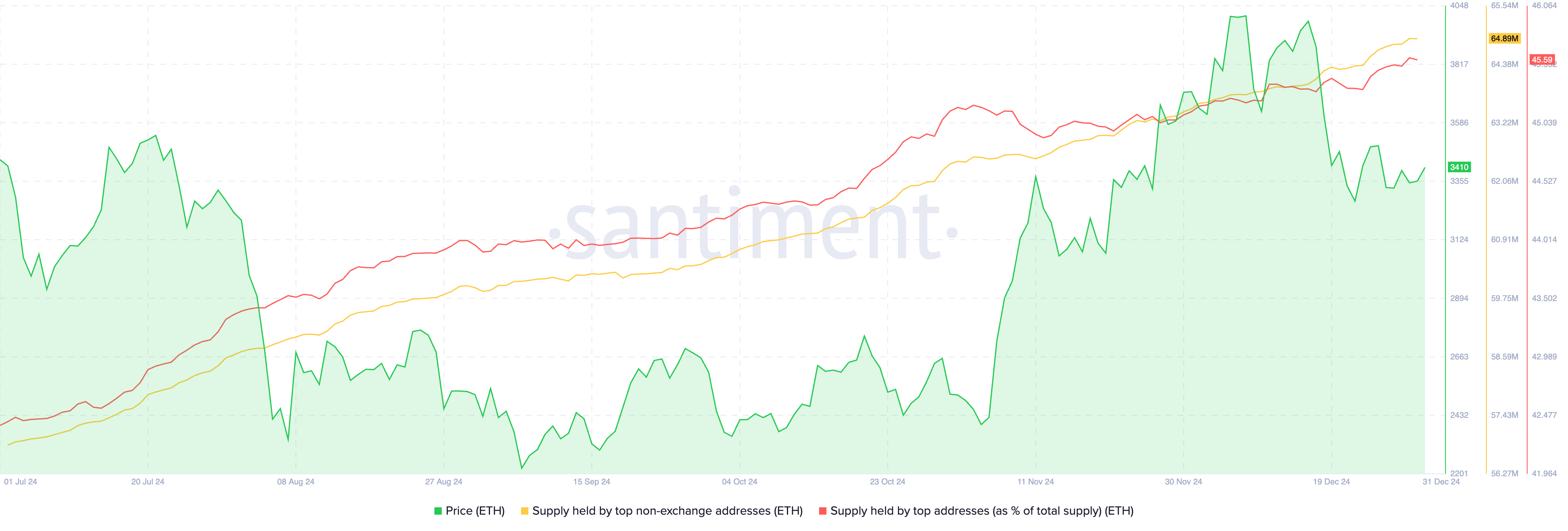

On-chain knowledge intelligence platform Santiment exhibits a constant enhance in two key metrics: provide held by prime non-exchange pockets addresses and the token’s prime addresses as a share of whole provide.

A rise in these metrics throughout November and December signifies that enormous pockets traders are accumulating Ether.

Ethereum provide held by prime non-exchange addresses and provide held by prime addresses | Supply: Santiment

Information from Lookonchain exhibits entities like World Liberty Monetary, backed by Donald Trump, have purchased Ether tokens in the course of the dips in ETH value.

As the provision of Ether held by massive entities exterior trade platforms will increase, it indicators whale accumulation, a usually bullish indicator for ETH.

You may also like: Grayscale Analysis up to date its ‘High 20’ cryptos for Q1 2025

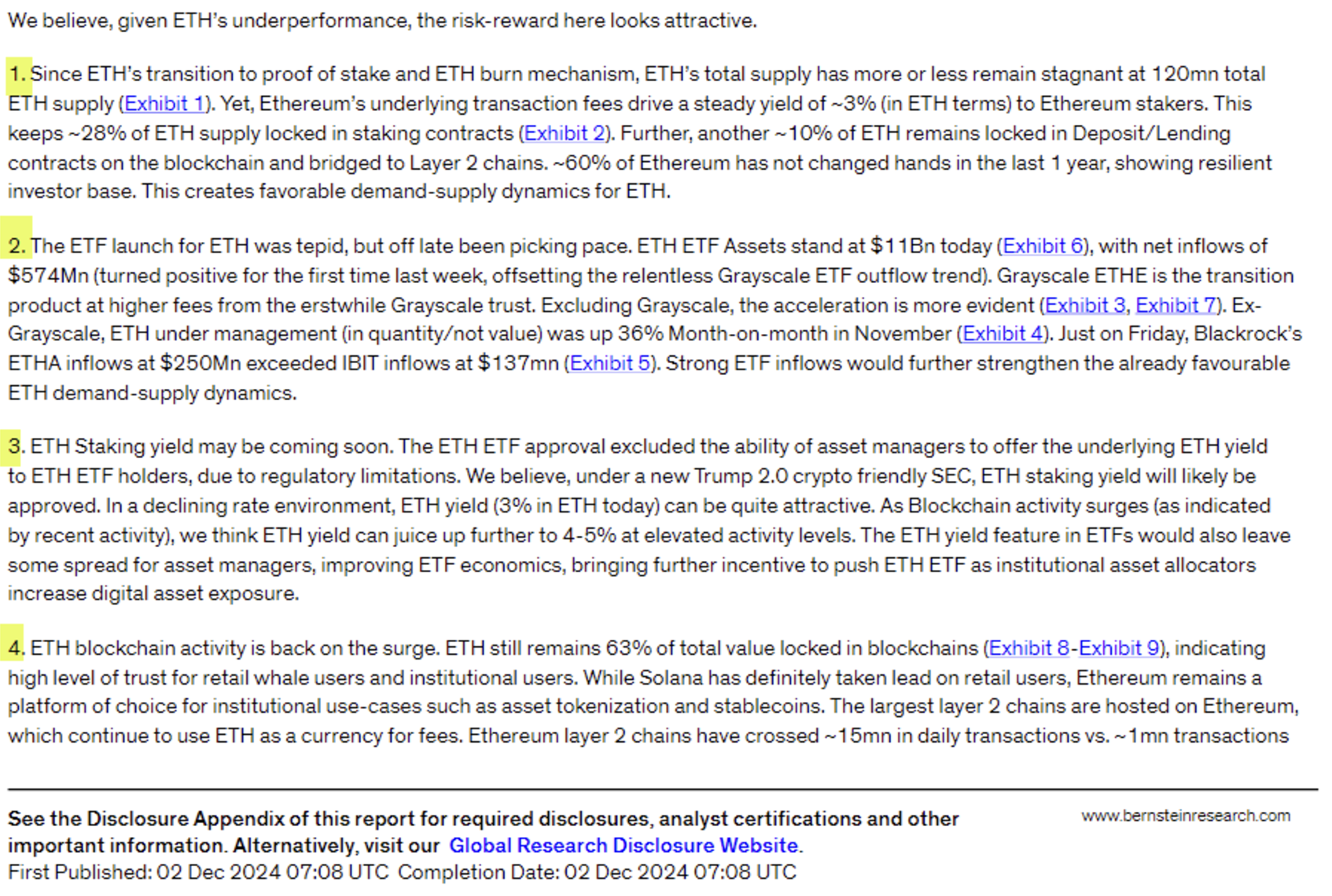

US based mostly Spot Ethereum ETFs might go on staking yield

Whereas a number of U.S.-based spot Ethereum ETFs have been accredited by the SEC, none at present embrace yield from staking. The regulator has pushed again on all ETF proposals together with staking, not like these in Switzerland and Canada.

Professional-crypto laws below President-elect Donald Trump might pave the best way for traders to extend returns by ETH staking rewards. ETF issuers may gain advantage from staking rewards through an elevated NAV, lowered administration charges, and dividends.

A report by Bernstein Analysis means that below a crypto-friendly Trump administration, the SEC is more likely to approve staking yield for Ethereum ETFs.

Bernstein Analysis feedback on Ethereum ETF | Supply: Bernsteinresearch

Increased adoption amongst establishments, exterior of token utility

Dario Lo Buglio, CTO at Brickken, instructed Crypto.information in an unique interview:

“There may be one factor folks ought to bear in mind about Ethereum, it not solely has monetary use circumstances like Bitcoin, it has sensible contracts. It may be used for programming purposes and there should be a stability between Ethereum worth and its utility as a type of cost and decentralized purposes.

I wouldn’t say there’s a lag in value. What I believe there’s a lag in, is lively improvement. And it’s as a result of it’s the largest decentralized blockchain so it takes time to make adjustments, not like Solana and different protocols that may be upgraded with no hassles.”

Lo Buglio stays optimistic about Ethereum’s adoption amongst establishments for its sensible contract performance and underlying know-how.

You may also like: 3 cryptos merchants ought to take a look at in 2025, in accordance with consultants

Technical evaluation and targets

Ethereum hovered round $3,400 on Dec. 31. The coin faces resistance at $3,497 and finds help within the honest worth hole between $3,159 and $3,257. On the ETH/USDT day by day value chart, technical indicators help a bullish outlook for Ether.

Relative power index reads 46 and slopes upward, indicating optimistic underlying momentum. The Shifting common convergence divergence exhibits consecutively shorter histogram bars, suggesting that unfavourable momentum is probably going waning.

Merchants ought to watch intently for a possible reversal in Ethereum’s value development.

ETH/USDT day by day value chart | Supply: Crypto.information

The goal for Ether is $4,500, with psychologically essential help at $3,000, as proven on the ETH/USDT day by day value chart.

Disclosure: This text doesn’t signify funding recommendation. The content material and supplies featured on this web page are for academic functions solely.