A surge in staking exercise from mega-ether holder BitMine Immersion (BMNR) is straining the Ethereum community, sending the wait time to turn out to be a validator to the longest since mid-2023.

There’s greater than 2.55 million in ether ETH$3,278.43 – price roughly $8.3 billion – at the moment ready to be activated, translating into an estimated wait time of over 44 days earlier than new validators can start incomes staking rewards.

That’s the most important backlog since late July 2023, only some months after Ethereum totally carried out its proof-of-stake mechanics and enabled withdrawals.

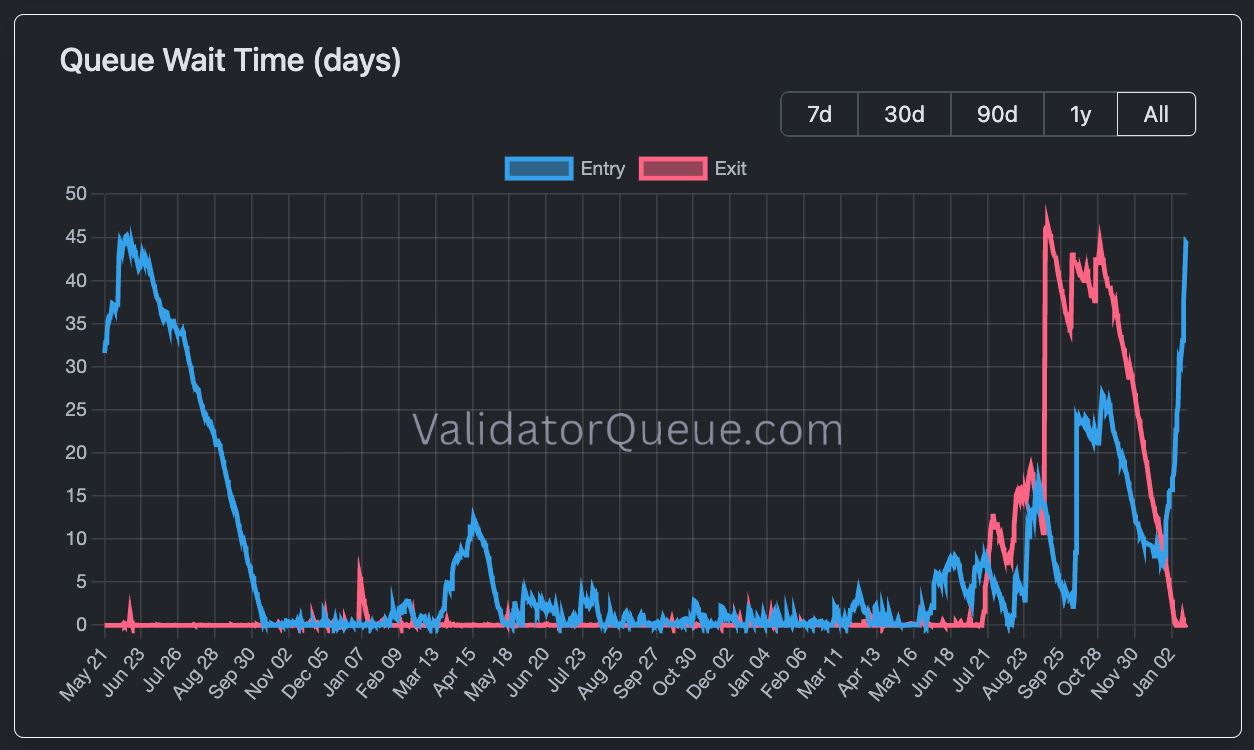

Validator exit and entry wait occasions (ValidatorQueue.com)

The Ethereum community makes use of validators to course of transactions and safe the blockchain. Nevertheless it limits the variety of new validators who can enter every day to keep away from sudden shocks to community stability. When too many individuals attempt to be a part of, the overflow is put right into a queue.

On the middle of the present spike is BitMine, the Ethereum treasury agency helmed by Fundstrat’s Thomas Lee. The agency, which is sitting on over $13 billion price of ETH, confirmed this week that it has already staked over 1.25 million tokens, greater than a 3rd of its holdings, clogging the entry for brand new validators.

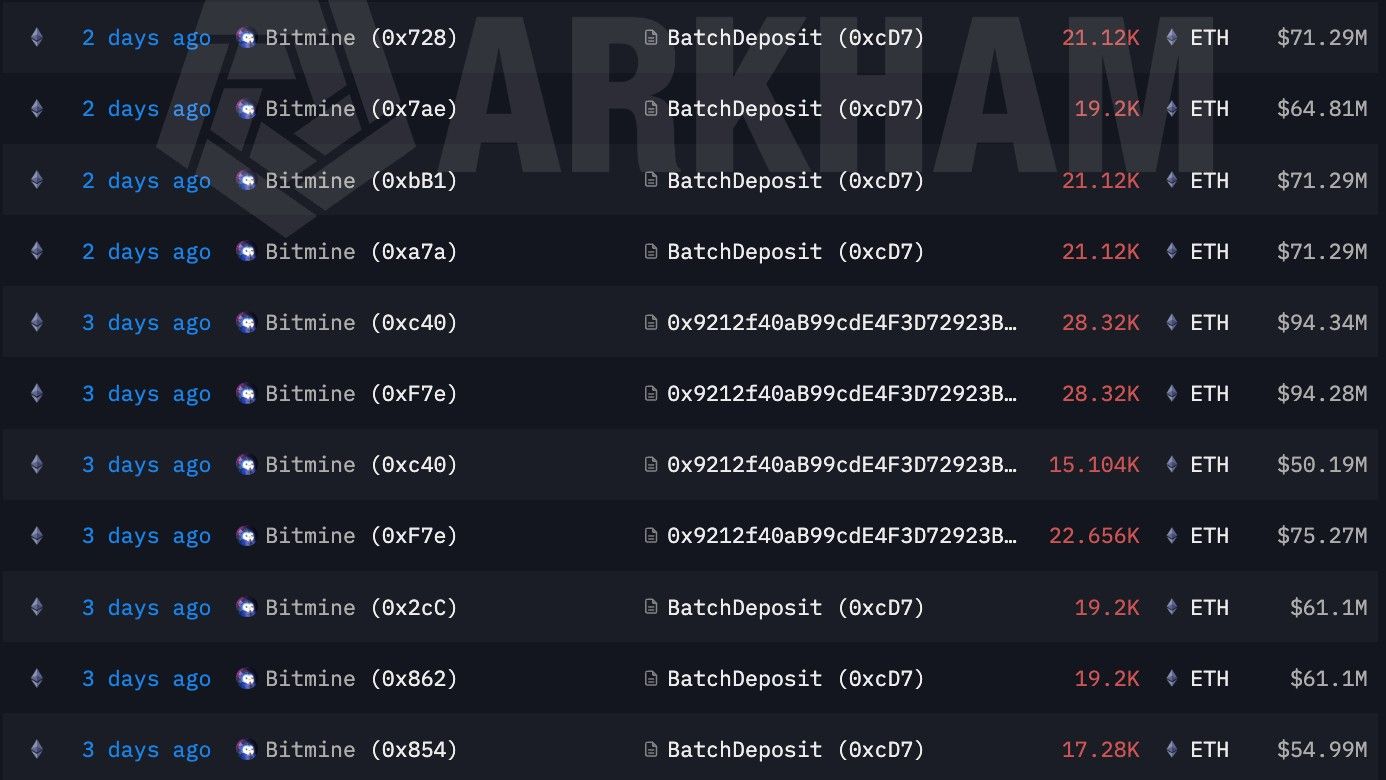

With practically 3 million extra ETH nonetheless on its steadiness sheet with out being put to make use of, the queue might develop even longer. Blockchain knowledge reveals that BitMine’s been busy transferring a whole bunch of thousands and thousands of {dollars} price of ETH previously couple of days, doubtless for staking functions.

Blockchain knowledge of BitMine’s ETH transactions (Arkham Intelligence)

The present state of affairs is a hanging shift from just some months in the past. In September and October, the Ethereum community was clogged in the other way, with 1000’s of validators making an attempt to exit – largely due to an infrastructure problem that pressured institutional staking supplier Kiln to reshuffle its validator community – pushing wait occasions to 46 days on the way in which out.

The entry backlog comes at a time when a contemporary wave of institutional staking demand could possibly be on the way in which.

ETF issuers and different giant gamers are watching intently as regulators outline authorized boundaries for staking within the U.S. In December, asset administration large BlackRock filed for a staked ether ETF, following Grayscale’s transfer so as to add staking to its ether-focused ETFs.

“The activation stress is more likely to persist,” mentioned Josh Deems, head of income at Figment, an institutional crypto staking supplier. “Many authorized ETPs [exchange-traded products] and treasuries are but to totally activate staking, and these autos collectively maintain roughly 10% of Ethereum’s circulating provide,”

The gridlock might additionally complicate asset administration for these giant gamers, resulting in lacking out on greater than a month’s price of revenue from staking yields whereas ready in line.

Learn extra: Staking goes mainstream: what 2026 might appear like for ether buyers