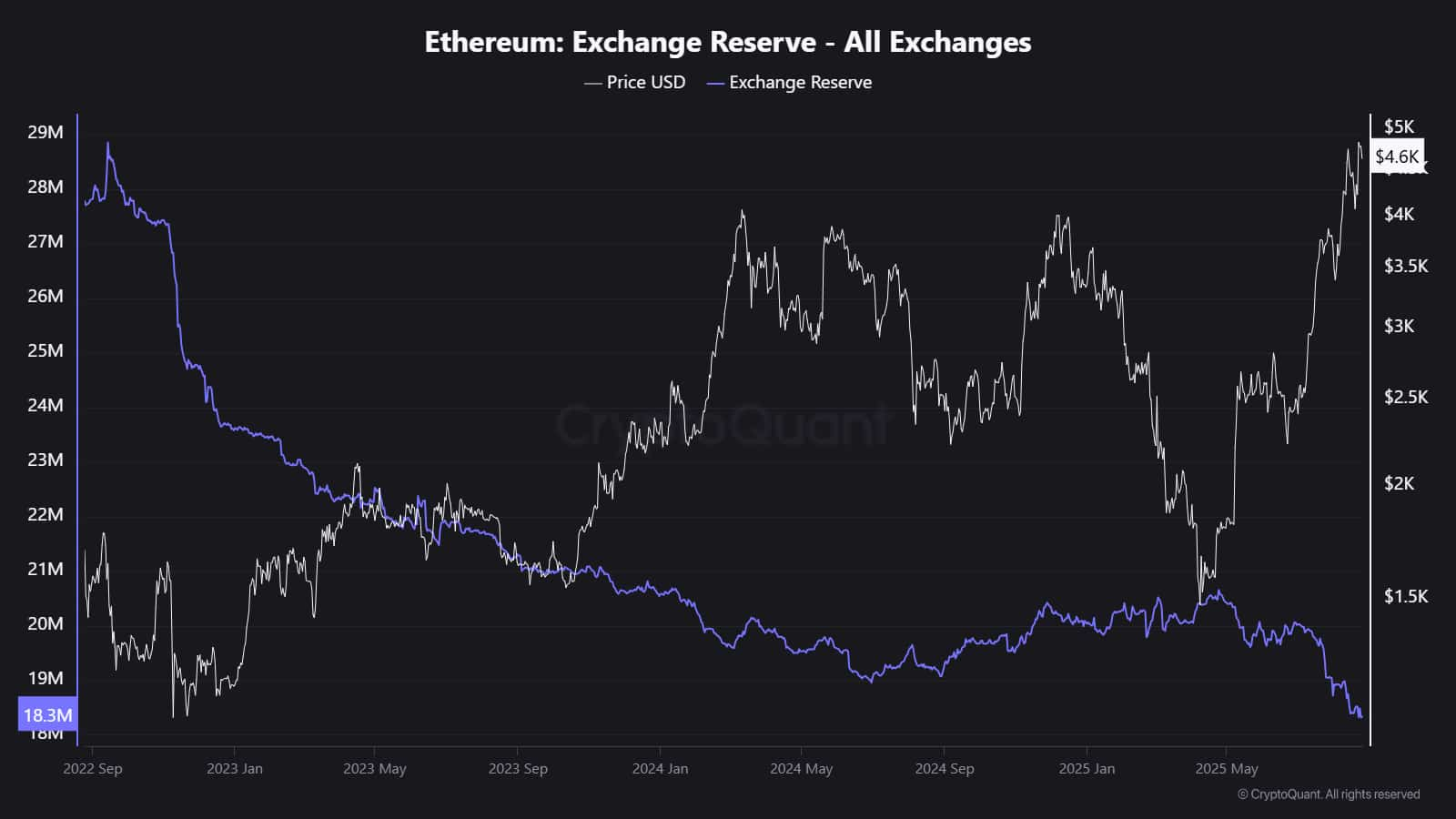

Ethereum’s (ETH) provide on centralized exchanges (CEXs) has dropped to simply 18.5 million ETH, the bottom it’s been in years.

Partly, the decline comes because of the weakening Bitcoin (BTC) dominance, with investor demand more and more tilting towards Ethereum as a result of its yield potential.

Accordingly, the market is speculating whether or not falling provide and rising demand may pave the best way for a big squeeze.

Ethereum ever extra common as a long-term holding

At press time, Ethereum’s complete circulating provide stands at 120.7 million ETH, but reserves on exchanges have now dropped to 18.5 million in line with August 25 knowledge from on-chain and market knowledge analytics platform CryptoQuant.

What’s extra, roughly 29.6% of the cryptocurrency is now staked, with roughly $89.25 billion locked throughout staking protocols.

As alluded to, one purpose for that is that yields are incentivizing long-term holding over short-term buying and selling.

In the meantime, in Q2 2025, burns outpaced new issuance, shrinking the efficient circulating provide even additional.

Institutional demand continues to develop

Ethereum’s institutionalization has accelerated sharply in 2025, and company treasuries now maintain practically 1.9% of the entire provide.

In fact, ETH exchange-traded funds (ETFs) have performed a vital function, with BlackRock (IBIT) and Constancy (FBTC) alone reporting a 65% surge in belongings below administration (AUM) final quarter.

The current reclassification of Ethereum as a utility token has additional legitimized its function in institutional portfolios.

All in all, the provision squeeze probably represents the asset’s transformation from a speculative asset to a core institutional holding.

Featured picture by way of Shutterstock