Korean retail investor capital is fueling Ether’s worth momentum and the rise of company Ether treasury corporations, in line with trade insiders, because the world’s second-largest cryptocurrency trades simply 7% under its all-time excessive.

The “solely factor” conserving the Ether (ETH) worth and Ether treasury corporations at their present ranges is round $6 billion price of Korean retail capital, in line with Samson Mow, the CEO of Bitcoin know-how firm Jan3.

“ETH influencers have been flying to South Korea simply to market to retail. These buyers have zero thought concerning the ETHBTC chart and suppose they’re shopping for the subsequent Technique play,” stated Mow in a Monday X publish, warning that this “received’t finish nicely.”

Supply: Samson Mow

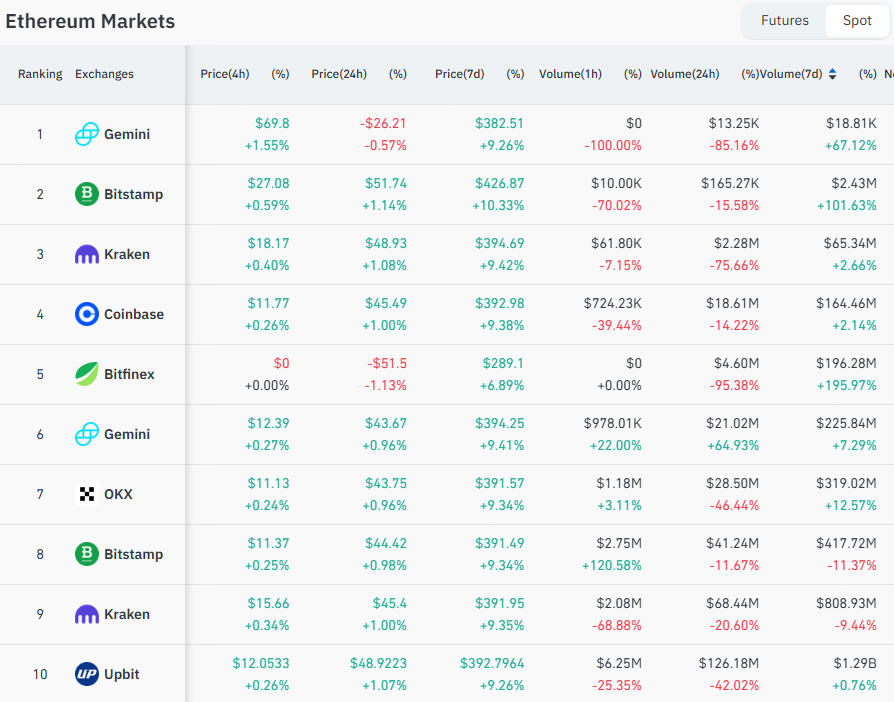

Upbit and Bithumb are the 2 foremost centralized exchanges (CEXs) utilized by South Korean retail merchants.

Taking a look at futures information, Upbit ranked because the tenth largest CEX by way of Ether futures buying and selling, with $1.29 billion price of buying and selling quantity over the previous week, in line with CoinGlass information.

CEXs by Ethereum futures buying and selling quantity. Supply: CoinGlass

Crypto futures buying and selling often exceeds the amount of spot buying and selling and thus has the next influence on the underlying asset’s worth.

Associated: Japan’s new PM could also be a boon for danger property, crypto markets

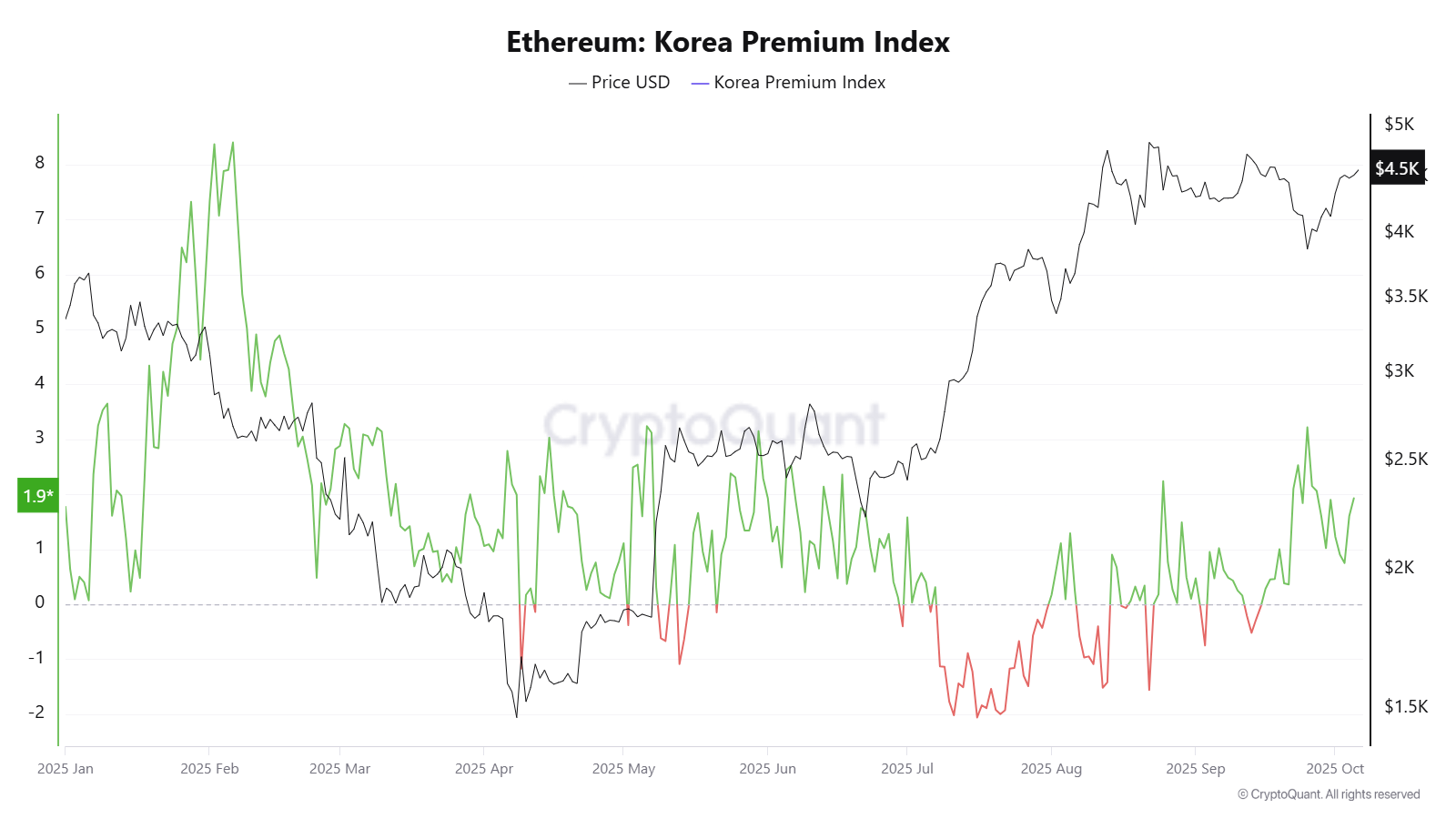

Ether’s “Kimchi premium” alerts rising Korean retail investor engagement

Ether’s “Kimchi premium” additionally alerts rising demand from Korean retail buyers, which describes when the worth of a cryptocurrency is greater on South Korean exchanges than on different exchanges.

Ether’s Kimchi premium rose to 1.93 on Sunday, up from -2.06 on July 16, when Ether traded under $2,959, in line with blockchain information platform CryptoQuant.

Ethereum: Korea Premium Index, year-to-date chart. Supply: CryptoQuant

This indicator measures the worth hole for Ether between South Korean exchanges and others.

Korean retail buyers are important members within the crypto market, as mirrored by Ether’s “kimchi premium,” in line with Marcin Kazmierczak, co-founder of blockchain oracle agency RedStone.

Nevertheless, Kazmierczak stated this represents solely a fraction of Ether’s total momentum.

“Characterizing them as the first assist for Ethereum considerably understates the community’s various international capital base, which incorporates substantial US institutional funding via ETFs, company treasuries, and the huge DeFi ecosystem that depends on ETH.”

Kazmierczak added that Ethereum’s power lies in its “borderless nature,” combining Korean retail and international institutional participation.

Associated: Ageing boomers and international wealth seen boosting crypto till 2100

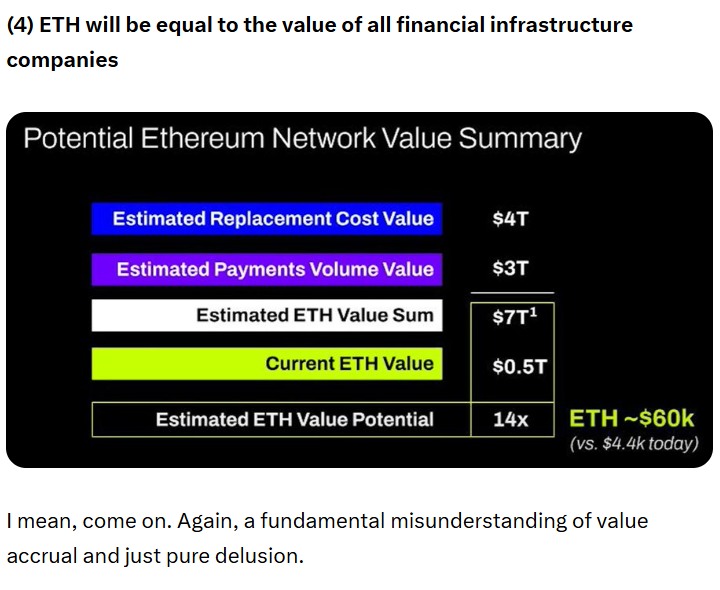

Mow’s insights come as many different trade watchers have questioned the sustainability of Ether treasury corporations.

In September, Mechanism Capital founder Andrew Kang criticized BitMine founder Tom Lee’s Ether thesis, arguing that it overstated Ether’s worth accrual from stablecoins and real-world asset (RWA) tokenization.

Supply: Andrew Kang

“Ethereum’s valuation comes primarily from monetary illiteracy. Which, to be honest, can create a decently massive market cap,” stated Kang in a Sept. 24 X publish, including that “the valuation that may be derived from monetary illiteracy just isn’t infinite.”

Whereas “broader macro liquidity” has maintained Ether’s worth momentum, it wants “main organizational change” to put it aside from “indefinite underperformance,” Kang stated.

Journal: Low customers, intercourse predators kill Korean metaverses, 3AC sues Terra