- Ethereum worth hovers above $2,500 on Friday after hovering practically 100% since early April’s backside.

- The ETH Pectra improve has boosted over 11,000 EIP-7702 authorizations in every week, indicating wholesome uptake by wallets and dApps.

- The rising stablecoin utilization and tokenization, Layer 2 institutionalization and ETH quick unwind help the worth rally.

Ethereum (ETH) is making a comeback after months of underperformance. On the time of writing on Friday, it hovers above$2,500 after hovering practically 100% since early April’s backside.

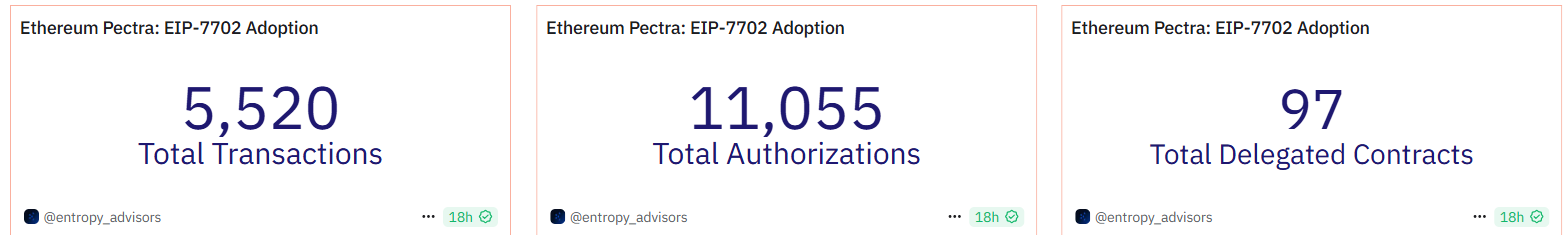

The Pectra improve has seen swift adoption, with greater than 11,000 EIP-7702 authorizations already processed in every week, indicating wholesome uptake by wallets and Decentralized Functions (dApps).

Moreover, the surge in stablecoin exercise, rising institutional adoption of Ethereum Layer 2 networks, and an unwind of ETH quick positions gas renewed market optimism. To know whether or not this rally has endurance, FXStreet spoke with a number of crypto consultants for his or her insights.

Ethereum’s Pectra improve boosts authorizations

Ethereum’s newest main community improve, Pectra, went reside on Might 7, marking a major step ahead for the ecosystem. Inside only a week of its activation, over 5,520 transactions and 11,055 authorizations have been processed below the brand new framework, based on Dune knowledge — signaling sturdy adoption by wallets and dApps.

Constructing on the momentum of final yr’s Dencun improve, Ethereum’s Pectra replace delivers crucial enhancements throughout usability, scalability, and staking infrastructure.

In an unique interview, Alvin Kan, COO of Bitget Pockets, informed FXStreet that, “Ethereum’s Pectra improve, which introduced options like gasless transactions and session-based permissions, unlocks highly effective capabilities and will deliver the following wave of customers! If wallets are in a position to deal with the problem of turning Ethereum’s complexity into one thing intuitive — clear approvals, acquainted login flows, and built-in security checks, we transfer nearer to Web3 that feels much less like developer tooling and extra like shopper software program. Pectra cuts Layer 2 charges, and this might set off a brand new wave of on-chain exercise. Wallets can scale infrastructure and provide customers sooner transaction affirmation, higher bridging between L1 and L2, and seamless dApp interactions. Efficiency, not simply options, turns into a key differentiator right here.”

Indicators of a comeback

Ethereum worth soared practically 100% from April’s low of $1,385 to Might 13’s excessive of $2,738, regardless of lagging behind BTC and different Layer 1 earlier within the cycle.

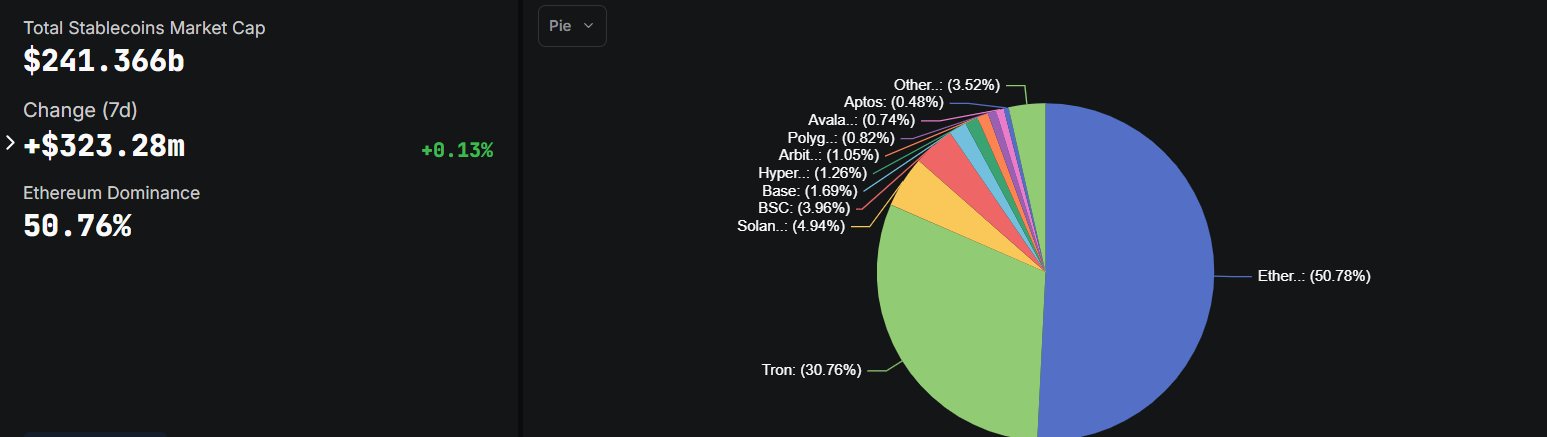

Bernstein analysts, led by Gautam Chhugani, recognized three key drivers behind Ethereum’s current worth rally. First, a surge in stablecoin adoption and asset tokenization has reignited curiosity in Ethereum’s function as foundational infrastructure, highlighted by Stripe’s $1.1 billion acquisition of Bridge and Meta’s renewed push into stablecoins.

The graph under by DefiLama reveals that Ethereum at the moment hosts practically 51% of the entire stablecoin provide, making it the prime platform benefiting from this development.

Whole Stablecoin by chain chart. Supply: DefiLlama

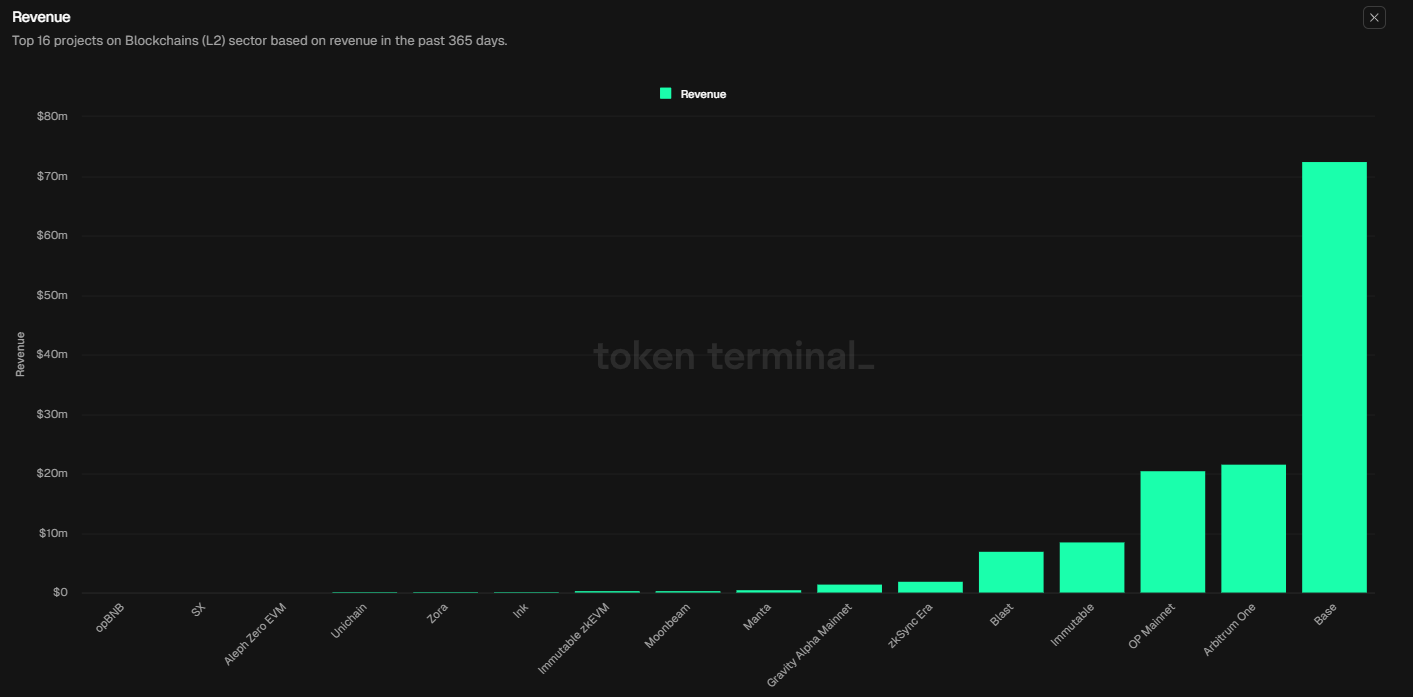

Second, Ethereum’s Layer 2 networks have gotten integral to institutional crypto infrastructure. Platforms like Base are producing substantial income, as proven within the graph under, and Robinhood’s acquisition of WonderFi alerts a possible growth into tokenized equities utilizing Ethereum-based techniques.

Layer 2 tasks income previously 365-day chart. Supply: Token Terminal

Lastly, hedge funds that beforehand shorted ETH to hedge lengthy positions in Bitcoin (BTC) and Solana (SOL) are actually reversing these trades. As Ethereum’s fundamentals strengthen and the market narrative shifts in its favor, the unwinding of those shorts has added additional upward strain to ETH’s worth.

Furthermore, Derive.xyz analyst informed FXStreet that ETH has a 20% probability of exceeding $4,000 by Christmas (up from 9% final week) and a 12% probability of hitting $5,000. The possibility of ETH falling under $1,500 by Christmas has dropped to fifteen% (down from 40%).

Technical outlook suggests rally continuation as 200-week EMA holds sturdy

The weekly chart reveals that Ethereum broke above the descending trendline (drawn by connecting a number of weekly highs since mid-December) within the first week of Might, rallying 39% and shutting above its 200-week Exponential Transferring Common (EMA) at $2,243. Ethereum continues its positive factors by 3.26% up to now this week, and when writing on Friday, it trades above $2,500.

Taking a look at technical indicators, bullish momentum is gaining traction. The Relative Power Index (RSI) reads 53 and factors upward on the weekly chart, indicating slight bullish momentum. The Transferring Common Convergence Divergence (MACD) is exhibiting a bullish crossover this week, additional supporting the bullish thesis, giving a purchase sign and indicating an upward development.

If ETH continues its upward transfer, it may prolong the rally to retest the 50% Fibonacci retracement (drawn from the December excessive of $4,107 to the April low of $1,385) at $2,746. A profitable weekly shut above this degree may prolong extra positive factors to check the 61.8% Fibonacci retracement degree at $3,067.

ETH/USDT weekly chart

Nevertheless, if ETH breaks and closes under its 200-week EMA at $2,243 on a weekly foundation, it may prolong the decline to retest its psychological significance degree at $2,000.

Specialists’ insights on Ethereum

To realize extra perception, FXStreet interviewed some consultants within the crypto markets. Their solutions are said under:

Marcin Kaźmierczak, Co-founder & COOat RedStone Oracles

Q: How crucial is Ethereum’s dominance in stablecoins to its long-term valuation?

It’s a significant pillar of Ethereum’s moat, particularly as stablecoins underpin a lot of onchain exercise. If Solana or different chains begin to acquire important stablecoin share, it may undermine Ethereum’s perceived dominance, however the L2 vs L1 worth break up complicates the image — most burn nonetheless comes from L1 exercise, despite the fact that the roadmap has lengthy deliberate for L2s to scale throughput.

Q: Can Ethereum compete with Bitcoin as a retailer of worth, or ought to it focus solely on utility?

Ethereum doesn’t want to decide on. Its edge lies in being a hybrid — a utility asset powering onchain economies and a technological retailer of worth backed by ongoing innovation. That mixture is tough to copy and stays compelling for long-term believers.

Q: Is Ethereum the clear winner in real-world asset tokenization infrastructure?

Proper now, sure. Over 80% of tokenized property reside on Ethereum or its L2s, pushed by institutional belief and tooling maturity. However as utilization strikes towards DeFi, price and UX will matter extra, opening the door for competitors and L2s if Ethereum doesn’t maintain executing on the scaling.

Jaehyun Ha, Analysis Analyst at Presto Analysis

Q: What drives Ethereum’s current 100% rally since April — fundamentals or positioning?

Ethereum’s current rally seems extra positioning-driven than basically led. Whereas the Pectra improve launched significant enhancements in scalability, staking economics, and UX (through EIPs 7251, 7702, and 7623), these modifications are nonetheless within the early part of being priced in. The true catalyst appears to be a mixture of technical exhaustion, with ETH/BTC at decade lows, mixed with a sentiment shift sparked by management messaging and a visual crypto-native rotation. ETF flows stay minimal, underscoring that this transfer is essentially pushed by intra-crypto positioning somewhat than institutional inflows.

Q: How crucial is Ethereum’s dominance in stablecoins to its long-term valuation?

Ethereum’s function because the dominant settlement layer for stablecoins is foundational to its long-term relevance. Nevertheless, that lead is being examined by extra performant chains like Solana. Finally, Ethereum’s potential to keep up composability, function a last settlement layer, and host institutional-grade stablecoins — together with potential sovereign-backed ones like a KRW stablecoin — will likely be key to long-term worth accrual. Dominance in stablecoin issuance issues, but it surely’s Ethereum’s settlement layer stickiness that may decide its endurance.

Q: How a lot upside does Ethereum acquire from Layer 2 adoption and income progress?

L2 adoption is a crucial unlock for Ethereum, enabling scalability with out compromising decentralization. EIP-4844 and the Pectra improve additional cut back L2 prices through blobspace growth, however the important thing situation now could be worth seize. ETH should show it might retain significant income and validator incentives in a world the place L2s settle cheaply. Whereas L2s act as distribution channels, current L1 income drops post-Dencun present that Ethereum’s monetary sustainability wants recalibration to match this scaling success

Q: What are the primary dangers to Ethereum’s present worth momentum?

Ethereum faces a number of headwinds: regulatory uncertainty round ETF staking and broader compliance points, weakening validator economics from declining L1 revenues, and the persistent concern that L2s could not contribute sufficient to ETH burn or worth accrual. If the bottom layer’s safety finances erodes, validator participation and decentralization may endure. In the meantime, except Ethereum finds a technique to sustainably monetize the L2 growth, momentum could stall regardless of sturdy adoption metrics.