Ethereum’s value has been on a big decline currently and has but to reverse. If issues stay the identical, a lot decrease costs may very well be anticipated.

Technical Evaluation

By Edris Derakhshi (TradingRage)

The Day by day Chart

On the every day chart, the value has been making decrease highs and lows since getting rejected by the $4,000 resistance stage twice in December.

At the moment, ETH is buying and selling under the 200-day shifting common, situated across the $3,000 mark, and is making an attempt to interrupt again above $2,700. If the market is in a position to take action, a bullish reversal will turn into possible. In case of failure, a drop towards the $2,350 assist zone can be imminent.

The 4-Hour Chart

Trying on the 4-hour chart, the value has been consolidating over the previous couple of weeks. Whereas the market is testing the $2,700 stage in the meanwhile, the RSI is on the verge of dropping under 50%.

This sign would point out a bearish shift in momentum and will lead to one other push decrease towards the $2,000 zone within the coming weeks.

Sentiment Evaluation

By Edris Derakhshi (TradingRage)

Funding Charges

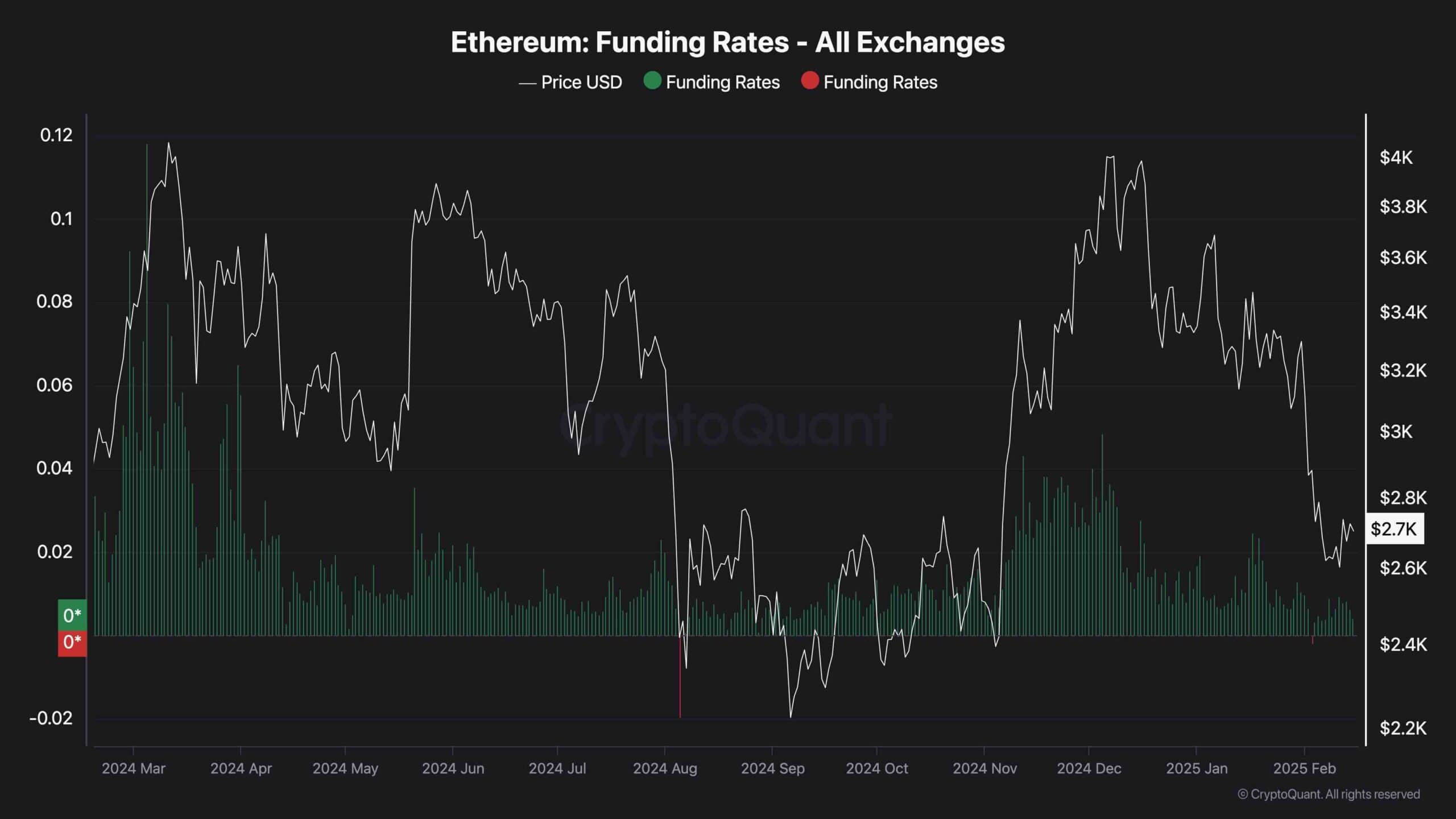

The futures market has been very influential on the Ethereum value motion over the previous few years. The funding charges metric is among the most essential indicators of its sentiment, exhibiting whether or not the patrons or sellers are executing their orders extra aggressively.

Because the chart suggests, the funding charges have been reducing persistently amid the current drop in value. This means that the futures market is now not overheated, and with enough spot demand, the market will probably get well.