ETH continues to consolidate beneath a key resistance degree round $2,800, struggling to interrupt larger after a powerful rally earlier in Might.

Whereas the bulls have held larger lows within the quick time period, repeated rejection from the identical degree raises questions on purchaser conviction at these highs.

Technical Evaluation

The Every day Chart

Ethereum is at the moment consolidating beneath the most important resistance at $2,800, which aligns with the 200-day transferring common. The uptrend that started close to $1,500 has paused, and the RSI has barely dropped beneath 70, reflecting weakening bullish momentum.

Regardless of this, the worth stays above the 100-day MA and the earlier breakout zone close to $2,200, indicating construction stays bullish except these ranges are misplaced. A clear breakout above $2,800 would open the trail towards the $3,400–$3,600 provide zone. Alternatively, failure to take action might set off a retest of the $2,200 demand block.

The 4-Hour Chart

The 4H chart exhibits that the worth has fashioned a transparent ascending triangle between the $2,800 resistance and roughly $2,500 assist. The construction resembles a possible distribution part following two robust accumulation zones beneath $1,850 earlier this month. Whereas ETH continues to set larger lows, the repeated rejection on the highs is beginning to weigh on the short-term outlook.

The RSI can be hovering close to 47, suggesting a impartial momentum shift. A break beneath $2,500 and the decrease boundary of the sample would sign bearish reversal towards $2,100, whereas a confirmed breakout above $2,800 would invalidate the distribution thought and favor upside enlargement.

Sentiment Evaluation

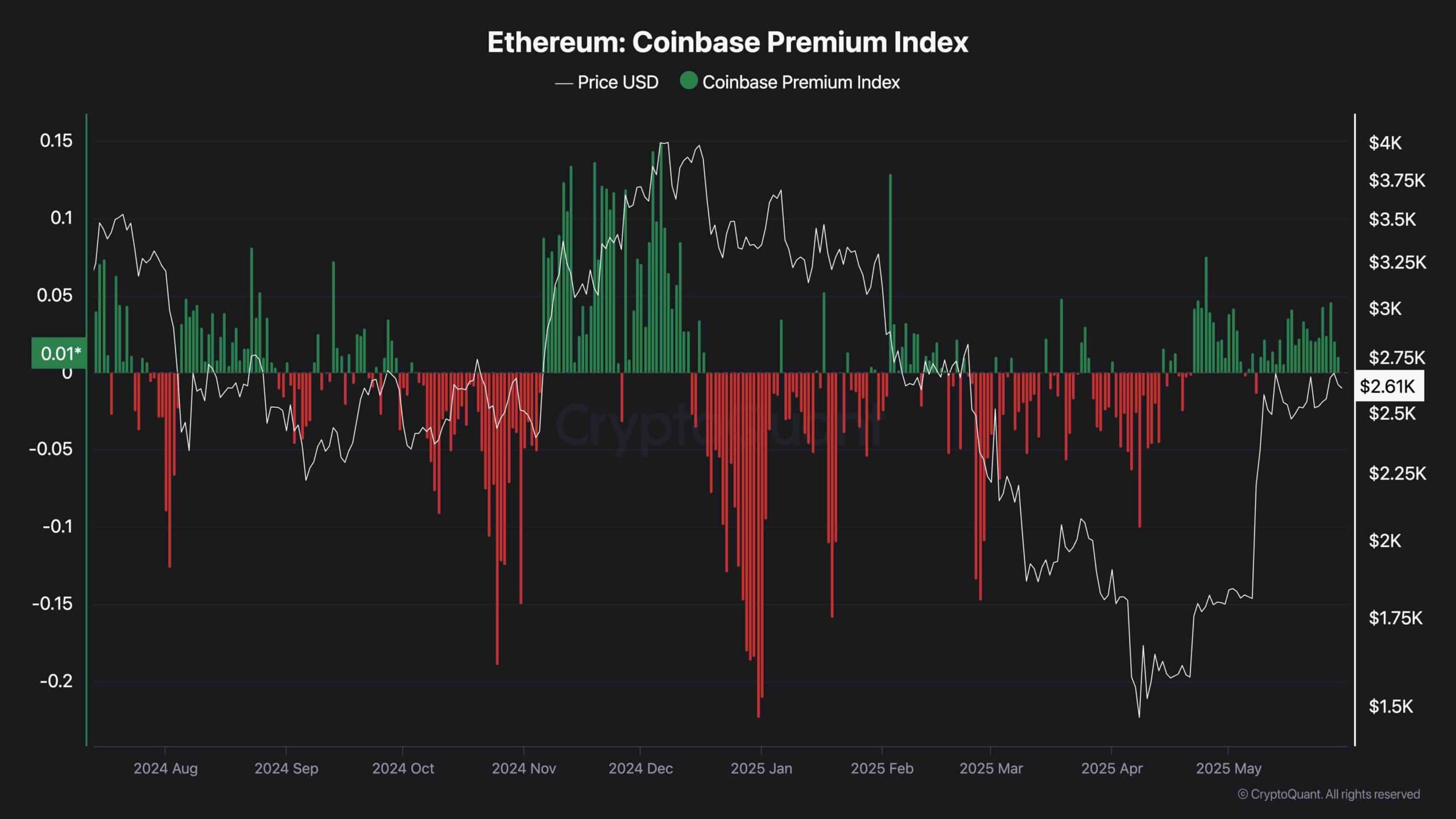

The Coinbase Premium Index is at the moment holding barely above zero, indicating reasonable spot demand from US-based buyers. Traditionally, a rising premium has usually preceded robust bullish developments pushed by institutional or high-volume retail patrons on Coinbase. Though the present ranges will not be aggressively excessive, they replicate underlying power within the spot market and a willingness to pay barely extra for ETH on U.S. exchanges.

If this premium begins increasing whereas ETH approaches resistance once more, it might sign renewed confidence and front-running of a breakout. Alternatively, if the premium fades or turns damaging, it could sign waning curiosity and a doable short-term prime, which is the state of affairs that’s seemingly occurring in the mean time.

Due to this fact, if the demand from the US declines, it could be extremely possible for ETH to enter a correction part as soon as extra.