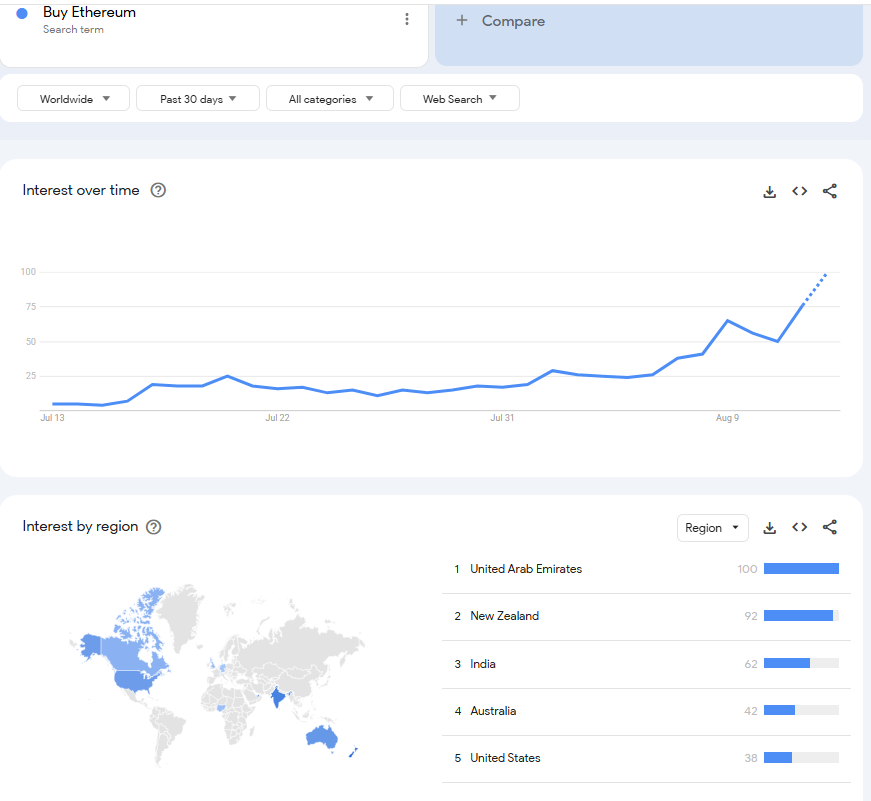

As Ethereum’s (ETH) worth tears previous main resistance ranges, international curiosity in buying the asset has surged over the previous month, leaping practically 20-fold.

On July 13, search curiosity stood at simply 5 on Google’s scale of 0 to 100. By August 13, it’s projected to hit 100, the very best stage in at the least a 12 months, marking a 1,900% improve, in keeping with Google Tendencies knowledge retrieved by Finbold.

Geographically, the United Arab Emirates recorded the very best curiosity with a rating of 100, adopted by New Zealand (92), India (62), Australia (42), and america (38).

It’s value noting that search curiosity doesn’t straight translate to purchasing exercise. Nonetheless, such spikes in on-line consideration typically precede durations of heightened market volatility.

If the pattern continues, Ethereum might face elevated upward strain, probably testing key resistance ranges within the close to time period.

ETH worth evaluation

This surge comes after Ethereum rallied previous the $4,600 mark. As of press time, ETH traded at $4,618, up over 6% prior to now 24 hours. On the weekly chart, the asset has gained 27%.

Moreover, technical setups counsel Ethereum might prolong this momentum. Particularly, evaluation by Gert van Lagen, shared in an X put up on August 13, indicated that the second-largest cryptocurrency by market capitalization has damaged out of a four-year inverse Head and Shoulders sample, probably paving the best way for a rally towards $22,000.

In accordance with the analyst, Ethereum is on monitor to finish its 2019–2025 bull market cycle with a textbook Increasing Diagonal formation. This bullish construction alerts sustained upside potential if the sample continues as anticipated.

On the similar time, for sustained momentum, Ethereum will seemingly require continued inflows from institutional buyers via exchange-traded funds (ETFs).

On this regard, Coinglass knowledge retrieved by Finbold on August 13 reveals that Ethereum spot ETFs recorded $523.9 million in internet inflows on August 12, led by BlackRock’s ETHA with $318.7 million and Constancy’s FETH with $144.9 million.

Grayscale’s ETH and ETHE merchandise added $44.3 million and $9.3 million, respectively, whereas different issuers posted smaller good points. The day before today noticed an excellent bigger $1.02 billion influx.

If these inflows persist and the $4,500 help stage holds, Ethereum might be on monitor to focus on the $5,000 mark.

Featured picture by way of Shutterstock