Ethereum has as soon as once more didn’t reclaim the important $4K resistance stage, resulting in a notable decline in value. Nevertheless, the cryptocurrency has now reached a big help zone, the place a rebound adopted by consolidation is anticipated.

By Shayan

The Day by day Chart

Ethereum’s $4K value area has confirmed to be a important resistance zone over the previous yr, persistently halting bullish advances as a consequence of robust promoting strain.

Most lately, the value confronted one other rejection at this stage, triggering a big sell-off. This decline was additional fueled by Federal Reserve Chairman Jerome Powell’s remarks, suggesting the central financial institution would possibly pause its present coverage of decreasing key rates of interest.

Regardless of this setback, ETH has discovered help on the $3K stage, an important value zone, resulting in a rebound above the $3.5K threshold. At present, the cryptocurrency is consolidating inside the $3.5K–$4K vary, with expectations of a possible bullish try and retest the $4K resistance following this consolidation section.

The 4-Hour Chart

On the 4-hour chart, Ethereum’s rejection on the $4K resistance triggered a pointy decline, breaking under the ascending wedge sample—a transparent indication of sellers’ dominance. This bearish momentum pushed the value decrease, resulting in a pullback earlier than resuming its downtrend.

At current, Ethereum is buying and selling inside a big help zone, outlined by the 0.5 ($3.2K)–0.618 ($3K) Fibonacci retracement ranges.

That is anticipated to offer stability within the brief to mid-term, with the chance of continued consolidation and minor retracements. If this help holds, patrons might re-enter the market, setting the stage for one more try and problem the $4K resistance.

By Shayan

Ethereum’s failure to reclaim the $4K threshold triggered important liquidations within the futures market, adopted by a flash crash that seems to have considerably cooled the broader sentiment.

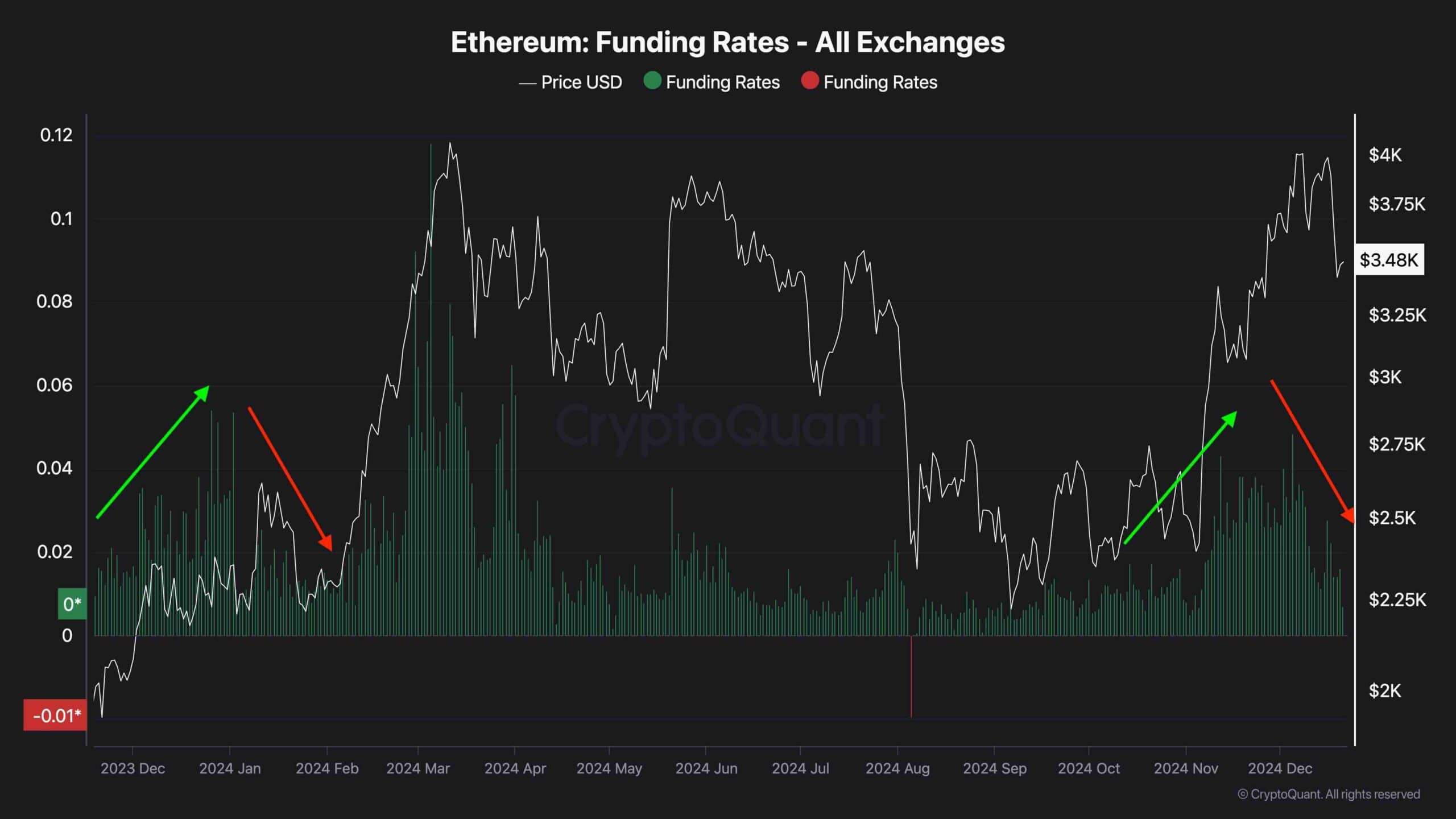

The chart illustrates the funding charges metric, a dependable indicator of futures market sentiment. Whereas Ethereum’s combination funding charges noticed a pointy spike final week, the rejection at $4K led to substantial liquidations, bringing funding charges again to ranges conducive to a bullish pattern.

This cooling impact might pave the best way for a extra sustainable rally within the coming weeks. An analogous sample was noticed in January 2024 when a pointy decline in funding charges calmed the futures market, setting the stage for Ethereum’s subsequent main impulsive rally. This historic precedent means that the present market reset might mark the start of one other bullish section.