Ethereum (ETH) is coming into October with heightened expectations as optimism round “Uptober” fuels hopes of a powerful rally.

But beneath the floor, a number of regarding indicators counsel Ethereum buyers could have to tread rigorously.

Ethereum Faces Hidden Risks This Uptober: 3 Dangers Traders Can’t Ignore

The constructive sentiment comes after the second-largest altcoin on market cap metrics recorded vital Ethereum ETF inflows in Q3 and loved a broader constructive sentiment throughout the crypto market, particularly from establishments.

Nonetheless, on-chain knowledge paints a distinct image, displaying looming dangers as buyers progressively present warning.

Staking Progress Has Stalled

One among Ethereum’s greatest strengths for the reason that Merge has been the regular rise in staked ETH. Nonetheless, that pattern has now stalled.

In line with CryptoQuant knowledge, the legitimate ETH steadiness of the Ethereum deposit contract has flattened since round July 20, holding regular at round 36 million ETH.

Complete worth of ETH Staked. Supply: CryptoQuant

This stagnation factors to larger warning amongst buyers relating to staking ETH in DeFi protocols. For months, staking progress offered a structural tailwind for Ethereum, locking up provide and reinforcing the community’s safety.

The chart reveals that the Ethereum worth rally coincided with a rise in staking, simply because the lull aligned with worth stagnation.

A pause on this trajectory suggests buyers are weighing dangers extra rigorously, probably as a result of market uncertainty, yield compression, or capital rotation to Bitcoin.

ETF Shopping for Momentum Has Light

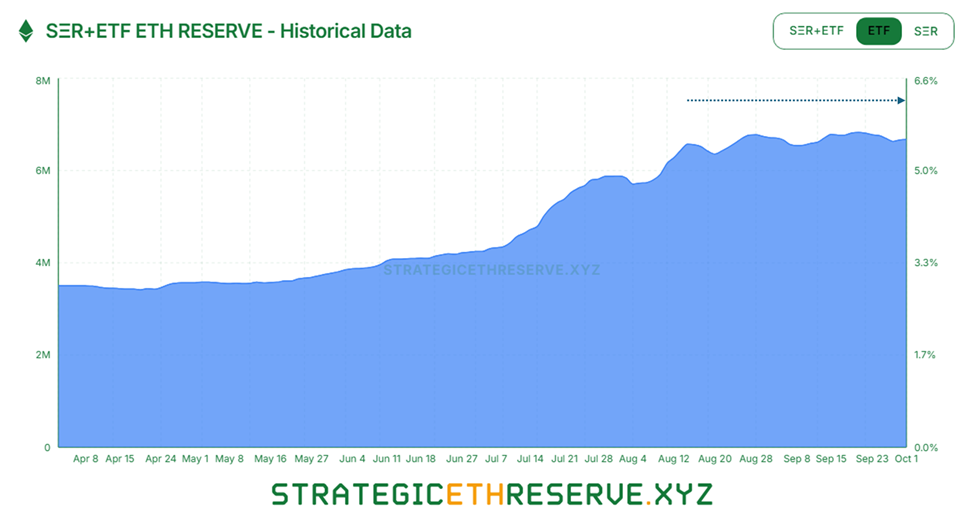

One other threat comes from Ethereum ETFs (exchange-traded funds). After initially attracting inflows earlier this 12 months, accumulation has slowed dramatically.

Information from StrategicETHReserve.xyz reveals that ETH ETF holdings have stopped rising since early August, as inflows and outflows reached a fragile steadiness.

Ethereum ETF Inflows. Supply: StrategicETHReserve.xyz

This lack of internet shopping for undermines a key bullish narrative. ETFs had been anticipated to offer a gradual demand base for Ethereum, just like how Bitcoin ETFs absorbed institutional curiosity.

As an alternative, ETH ETF flows now replicate hesitation, suggesting that whereas shopping for demand exists, it solely matches the promoting stress. Ethereum’s worth pushing decisively larger could hinge on ETFs returning to internet accumulation.

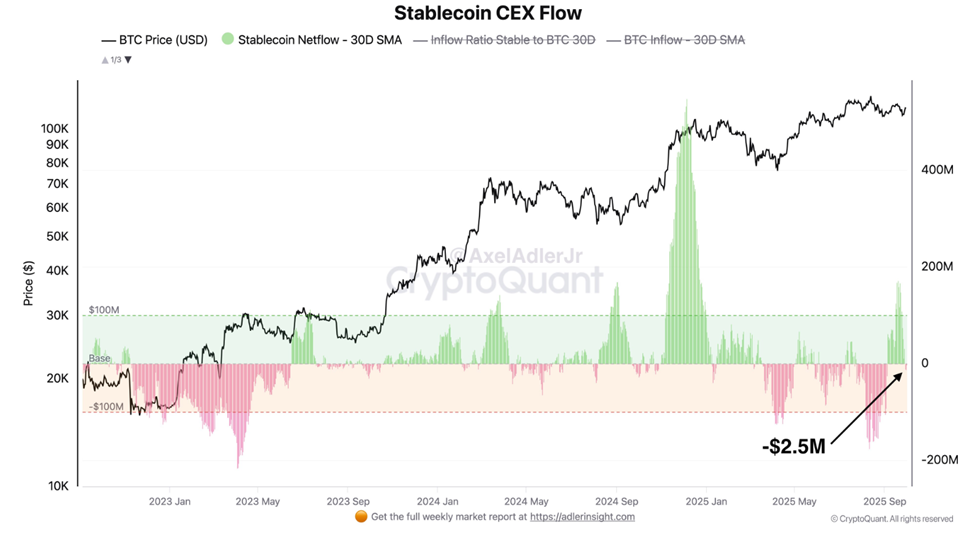

Stablecoin Liquidity Is Drying Up

Maybe probably the most fast concern is liquidity. On-chain knowledge reveals that common stablecoin netflows to centralized exchanges (CEXs) have turned unfavorable since September 22.

Stablecoin flows into CEXs. Supply: CryptoQuant

This pattern, highlighted by on-chain analyst Axel Adler, signifies that much less capital is out there for spot shopping for exercise.

“Common Stablecoin NetFlow to CEX has gone unfavorable and declining since September 22. Spot liquidity is lowering, whereas BTC worth stays elevated. It is a regarding sign,” wrote Adler.

He added that whereas ETFs introduced $947 million in inflows over the previous few days, that help alone is probably not sufficient to maintain a full Uptober rally with out stronger spot liquidity.

Balancing Optimism with Threat

Nonetheless, Ethereum’s fundamentals stay sturdy, and October might nonetheless ship upside if broader threat urge for food continues to enhance.

ETF inflows into Bitcoin and bullish seasonality traits are offering a supportive backdrop. But these dangers (stalled staking, stagnant ETF demand, and shrinking spot liquidity) provide vital context towards overly optimistic predictions.

Understanding these undercurrents may also help reduce losses if the market strikes towards expectations. Subsequently, buyers ought to train warning and conduct their very own analysis as October might deliver each alternative and disappointment.

The submit Ethereum’s Uptober at Threat? Key Information Reveals Rising Investor Warning appeared first on BeInCrypto.