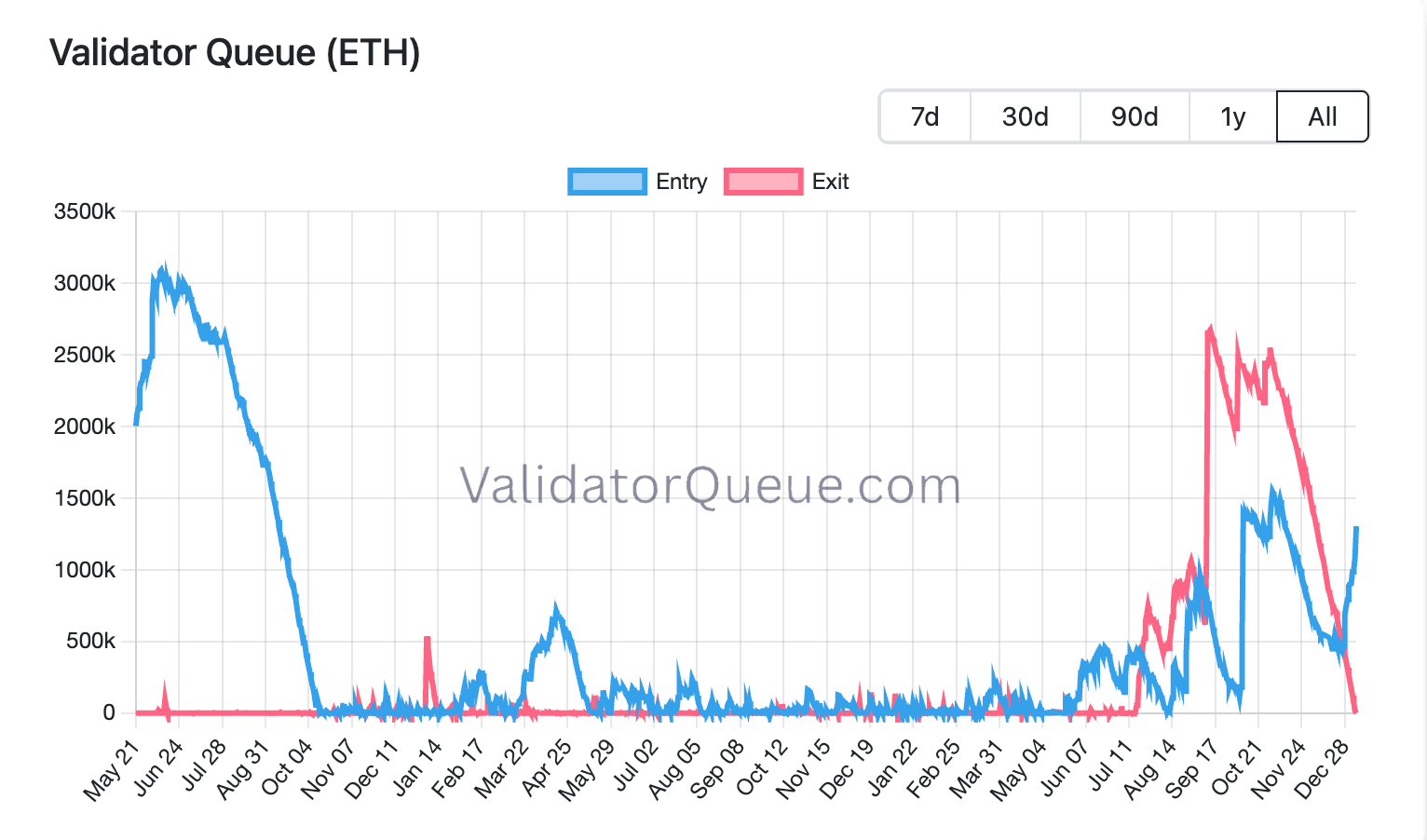

Ethereum’s staking queues have emptied out and the community can now take in new validators and exits nearly in actual time.

This implies the push to lock up ETH has light for now and staking is settling right into a steady-state as a substitute of a shortage commerce.

Queues are merely the time spent to start out or cease staking on the Ethereum community, appearing as a sentiment gauge and a liquidity gauge.

In a single sense, the dearth of queues is a characteristic, not a bug, as these are proof Ethereum can deal with staking flows with out locking up liquidity for weeks.

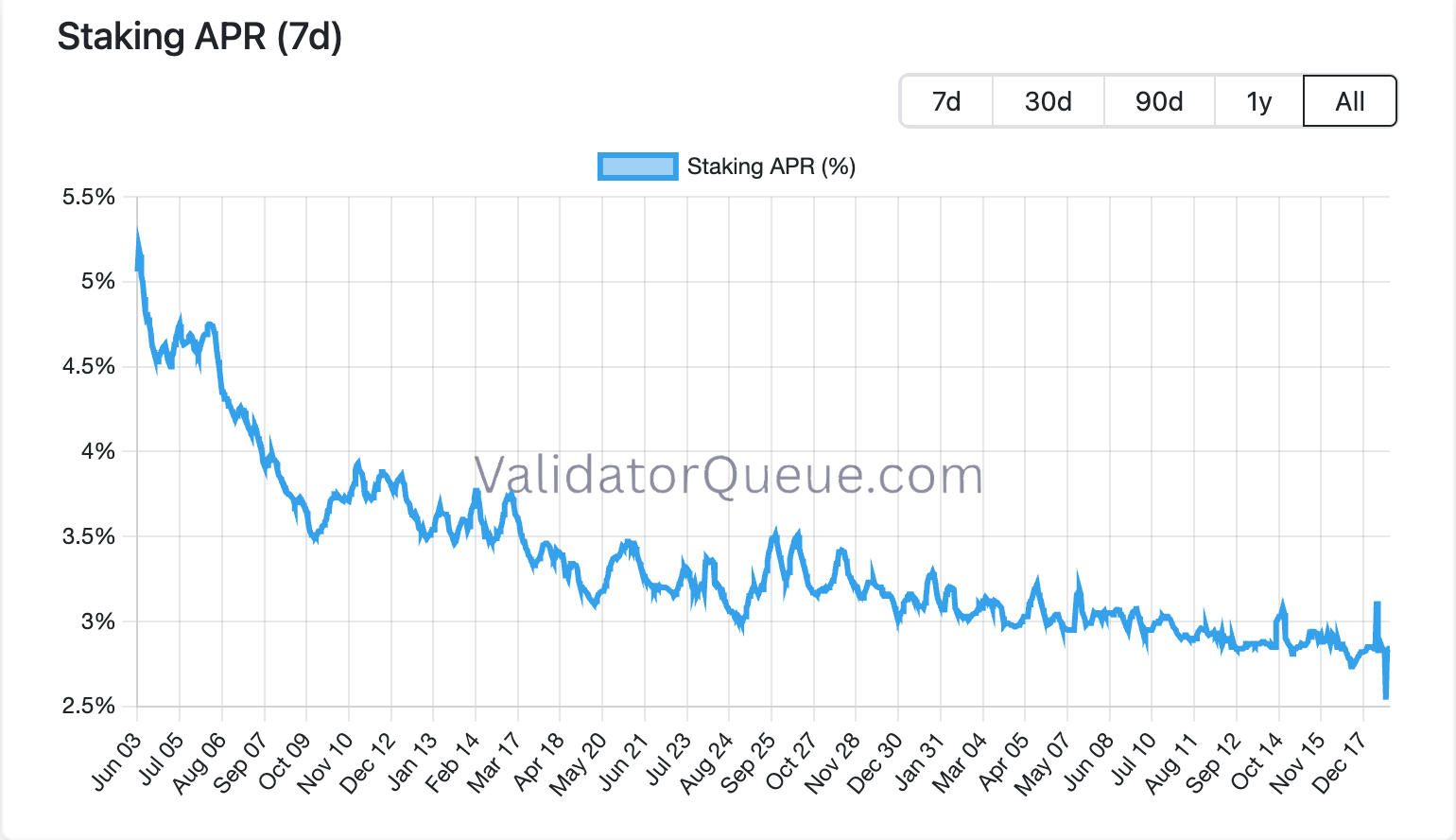

On the identical time, staking rewards have compressed towards 3% as complete staked ETH grew quicker than issuance and price revenue, limiting incentives for renewed surges in both course and leaving queues close to zero at the same time as general staking participation stays elevated.

Decrease yield can mirror crowding, but in addition the next ‘belief premium’ — extra ETH is selecting to take a seat in staking reasonably than on change order books.

What this implies in plain phrases is that “staking stress” is not a day by day narrative.

When queues are lengthy, ETH provide is successfully being locked quicker than the community can onboard validators, and that may create a way of shortage.

When queues sit close to zero, the system is nearer to impartial. Individuals can stake or unstake with out ready weeks, which makes staking really feel much less like a one-way door and extra like a liquid allocation.

This modifications the psychology across the ether commerce.

Staking nonetheless reduces instant promote stress, however it’s not the identical as cash being caught. With withdrawals functioning easily, ETH behaves much less like a compelled lockup asset and extra like a yield-bearing place that may be resized when sentiment shifts.

Total, Ethereum’s staking provide is at round 30%, nicely beneath the 50% that Galaxy Digital predicted on the finish of 2025. Expectations Galaxy had that ETH would maintain costs above $5,500 because of staking-induced provide shock, and that layer-2s would overtake layer-1s in financial exercise, didn’t materialize.

ETH all-time highs may very well be some time away

Ethereum’s DeFi TVL sits round $74 billion, nicely beneath its roughly $106 billion peak in 2021, at the same time as day by day lively addresses have almost doubled over the identical interval, based on DeFi Llama.

The community nonetheless accounts for near 58% of complete DeFi TVL, however that share masks a extra fragmented actuality.

Incremental progress is more and more being captured by ecosystems comparable to Solana, Base, and bitcoin-native DeFi, permitting exercise to increase throughout the Ethereum orbit with out translating into the identical focus of worth or demand for ETH itself.

That fragmentation issues as a result of Ethereum’s strongest bull arguments was easy. Extra utilization meant extra charges, extra burns, and extra structural stress on provide.

The 2021 TVL peak was additionally a leverage period; a decrease TVL as we speak doesn’t essentially imply much less utilization, simply much less froth.

Within the present regime, nonetheless, a significant chunk of person exercise can occur on layer-2 networks the place charges are cheaper and expertise is smoother, however the worth seize that accrues again to ETH may be much less apparent to identify markets in the mean time.

“One approach to body it’s that Ethereum has misplaced directional readability,” shared DNTV Analysis founder Bradley Park in a be aware to CoinDesk. “If ETH is handled primarily as a belief asset to be staked reasonably than actively used, it weakens the burn mechanism: much less ETH will get burned, issuance continues, and sell-side stress builds over time.”

“Over the previous 30 days, Base has generated considerably extra charges than Ethereum itself. That distinction raises a tougher query for Ethereum, whether or not its present trajectory adequately channels utilization again into worth for ETH,” Park added.

That hole between exercise and worth seize is displaying up in prediction markets.

On Polymarket, merchants assign simply an 11% likelihood that ETH reaches a brand new all-time excessive by March 2026, regardless of greater lively addresses and a still-dominant share of DeFi TVL.

The pricing suggests the market views fragmentation and unconstrained staking provide as limiting elements, with utilization alone not ample to drive a problem of the all-time excessive.

However that image might shift shortly if U.S. coverage evolves to permit yield-bearing ETH merchandise, a change that may re-open the ‘staking premium’ commerce.