Main altcoin Ethereum (ETH) has traded beneath $3,500 for seven days, mirroring a broader bearish sentiment throughout the cryptocurrency market. Because it recorded an intraday excessive of $3,744 on January 6, the coin’s worth has plummeted by 13%.

Nevertheless, regardless of this worth dip, key on-chain metrics recommend that Ethereum holders stay optimistic in regards to the altcoin’s near-term prospects.

Ethereum Merchants Stay Resilient

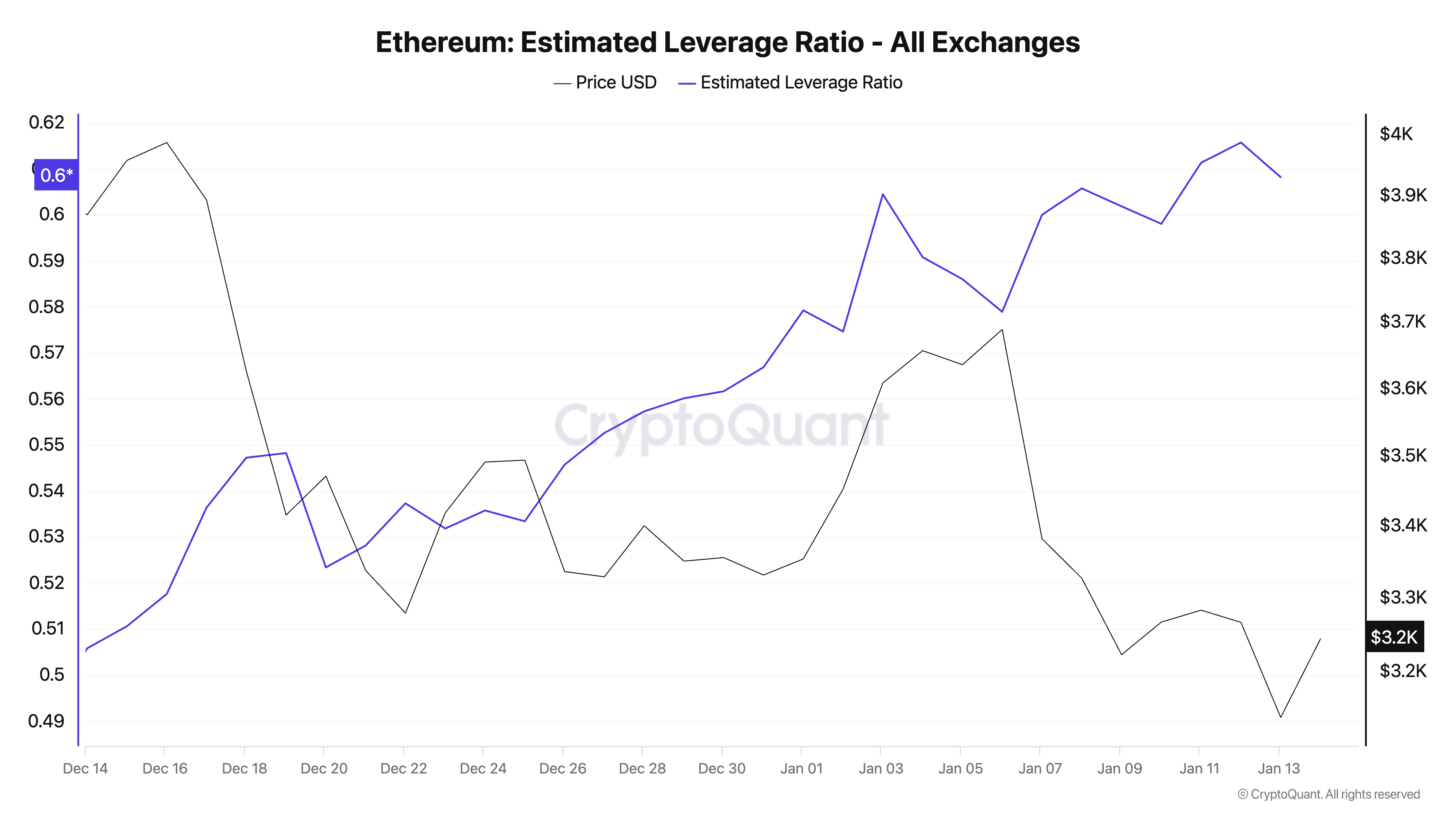

One such indicator is ETH’s rising estimated leverage ratio (ELR). Per CryptoQuant, this metric has maintained an upward development regardless of ETH’s worth decline in current weeks. At 0.60 as of press time, ETH’s Estimated Leverage Ratio (ELR) has elevated by 20% over the previous month, regardless of a 15% drop in its worth throughout the identical interval.

The ELR measures the typical leverage merchants use to execute trades on a cryptocurrency change. It’s calculated by dividing the asset’s open curiosity by the change’s reserve for that foreign money.

ETH’s climbing ELR signifies an elevated danger urge for food amongst its merchants. It means that the altcoin’s merchants are more and more prepared to tackle danger regardless of its present worth weak spot. A constantly excessive leverage ratio is an indication of sturdy conviction amongst merchants that the value of ETH is poised for a rebound despite current headwinds.

Ethereum Estimated Leverage Ratio. Supply: CryptoQuant

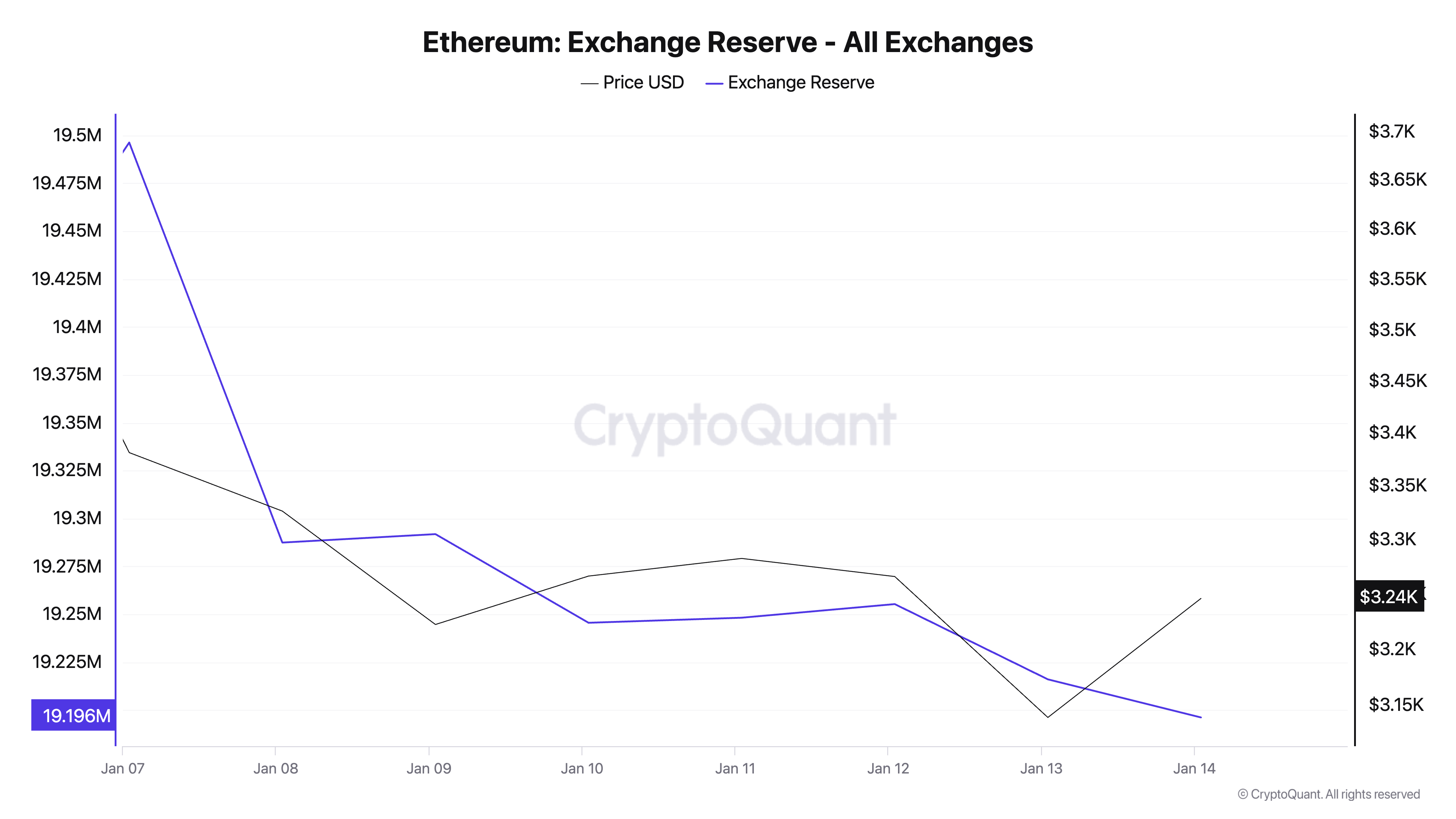

Moreover, ETH’s change reserve has dropped to a two-month low of 19.19 million ETH, with the quantity held in change wallets reducing by 2% over the previous week. This discount means that market individuals are decreasing promoting stress and selecting to carry onto their ETH tokens.

Because of this, it seems that ETH’s current worth decline is extra influenced by the broader market’s bearish developments than by important selloffs of ETH itself.

Ethereum Alternate Reserve. Supply: CryptoQuant

ETH Value Prediction: All Rests on the Broader Market

As of this writing, ETH trades at $3,226, simply above the assist stage at $3,186. If broader market sentiment improves and ETH accumulation picks up, its worth might rise towards $3,563.

Ethereum Value Evaluation. Supply: TradingView

Nevertheless, if the market continues to expertise a downturn, ETH could check the $3,186 assist. If this stage fails to carry, the coin’s worth might drop to $2,945.