Ethereum is making an attempt to push again above the $2,000 stage because the broader crypto market navigates persistent uncertainty and ongoing promoting strain. Latest value motion displays a fragile restoration effort reasonably than a confirmed development reversal, with volatility remaining elevated and merchants cautious after months of corrective momentum. The $2,000 threshold has turn into a key psychological and technical battleground, shaping short-term sentiment as buyers consider liquidity situations, macro alerts, and derivatives positioning.

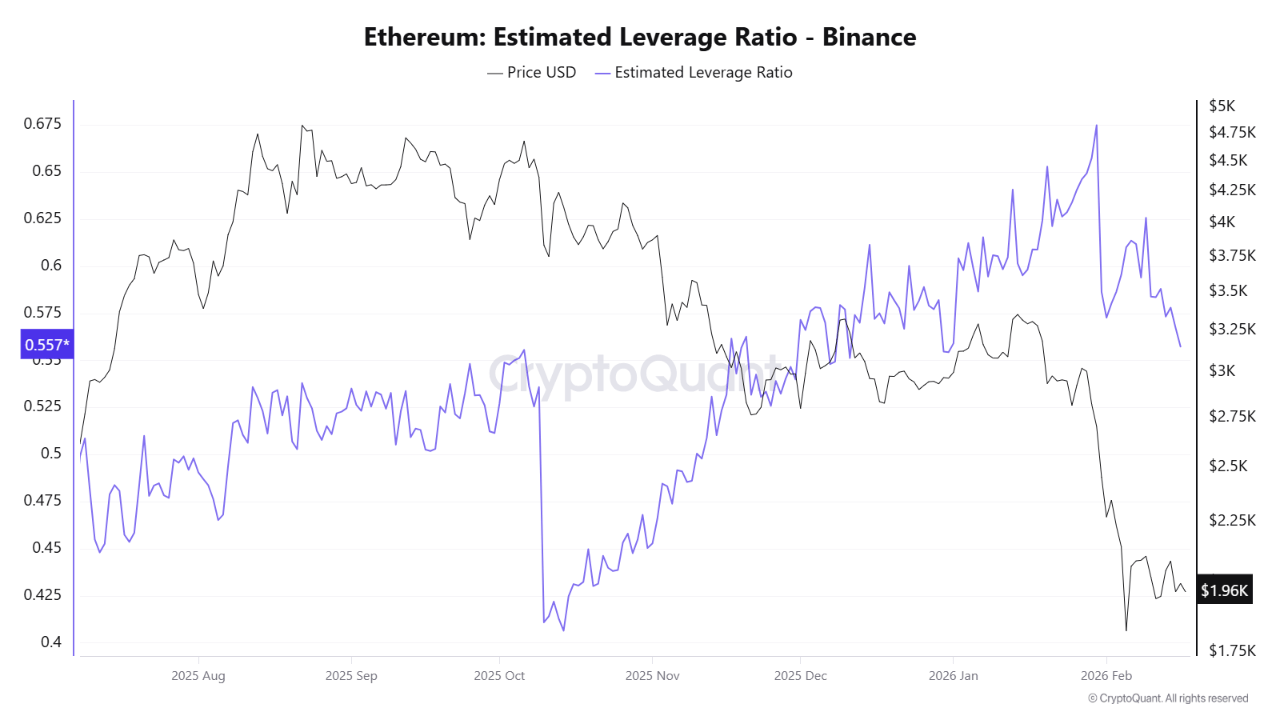

A latest CryptoQuant evaluation affords further perception into evolving market dynamics, significantly inside Ethereum’s derivatives panorama. Knowledge monitoring the Estimated Leverage Ratio on Binance exhibits a transparent shift in dealer habits. The indicator just lately dropped to round 0.557, marking its lowest studying since final December. This decline follows a interval of heightened leverage, when the ratio peaked close to 0.675, reflecting a extra aggressive danger atmosphere earlier within the cycle.

The discount in leverage suggests merchants are scaling again danger publicity, closing extremely leveraged positions, or transferring towards extra conservative methods. Such transitions typically happen throughout consolidation phases, when markets try to stabilize after volatility spikes.

Declining Leverage Factors To Potential Market Stabilization

The analyst additional notes that the latest decline in Ethereum’s estimated leverage ratio displays a broader discount in speculative danger throughout the derivatives market. Decrease leverage usually signifies that merchants are trimming extremely leveraged positions or closing them altogether, shifting towards extra conservative publicity. Traditionally, such deleveraging phases have typically preceded the formation of recent value bases, as market members prioritize capital preservation over short-term speculative beneficial properties.

The drop from roughly 0.675 to round 0.557 is subsequently not merely a minor technical fluctuation. As a substitute, it alerts a significant shift in market sentiment. Durations characterised by elevated leverage are likely to amplify volatility and enhance the likelihood of abrupt liquidations. Conversely, declining leverage usually corresponds with calmer market situations, the place value actions are much less pushed by compelled liquidations and extra by underlying demand dynamics.

From a medium-term perspective, this transition could also be constructive. Decreased leverage can create a more healthy basis for value discovery, significantly if accompanied by strengthening spot demand. On this context, the mixture of decrease leverage readings and comparatively steady value motion suggests the market could possibly be present process a consolidation or repositioning part. Such environments typically precede extra decisive directional strikes as soon as liquidity and sentiment situations align.

Ethereum Worth Stays Underneath Stress Beneath Key Averages

Ethereum continues to commerce close to the $2,000 stage after a pointy corrective transfer that adopted its late-2025 highs. The chart exhibits a transparent bearish construction, with value persistently printing decrease highs for the reason that October peak whereas failing to maintain recoveries above key transferring averages. Latest makes an attempt to stabilize have produced solely shallow rebounds, indicating persistent promoting strain and cautious market positioning.

Notably, ETH stays beneath its short-, medium-, and long-term transferring averages, that are all trending downward. This alignment usually displays sustained bearish momentum and means that rallies might proceed to face resistance except the value can reclaim these ranges decisively. The 200-day transferring common, at the moment nicely above spot value, stands out as a serious structural resistance zone.

Quantity knowledge additionally supplies context. The newest sell-off was accompanied by a noticeable spike in buying and selling exercise, typically related to liquidation occasions or accelerated distribution. Since then, quantity has moderated, in line with a consolidation part reasonably than a direct reversal.

From a technical perspective, the $1,900–$2,000 vary now acts as a short-term stabilization zone. Nevertheless, failure to carry this space may expose decrease help ranges, whereas a sustained break above close by resistance can be wanted to sign bettering momentum.

Featured picture from ChatGPT, chart from TradingView.com