The Ethereum worth has traded largely sideways this week, rising simply 1.3% over the previous seven days to hover round $4,430. Even the month-on-month ETH worth efficiency isn’t aggressive, with a minor 2.7% uptick.

Regardless of the muted efficiency, accumulation is quietly underway, suggesting that one thing larger could possibly be brewing beneath the floor.

Whales and Quick-Time period Holders Quietly Accumulate

Essentially the most notable shift comes from Ethereum whales. On-chain information reveals that enormous holders have added practically 870,000 ETH up to now 24 hours, growing their mixed stash from 99.34 million to 100.21 million ETH.

On the present worth of roughly $4,440, this addition is value near $4 billion — one of many largest single-day whale inflows in current weeks.

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto E-newsletter right here.

Ethereum Whales In Motion: Santiment

Such strikes sometimes recommend that deep-pocketed traders are positioning for an upward breakout fairly than exiting after a rally.

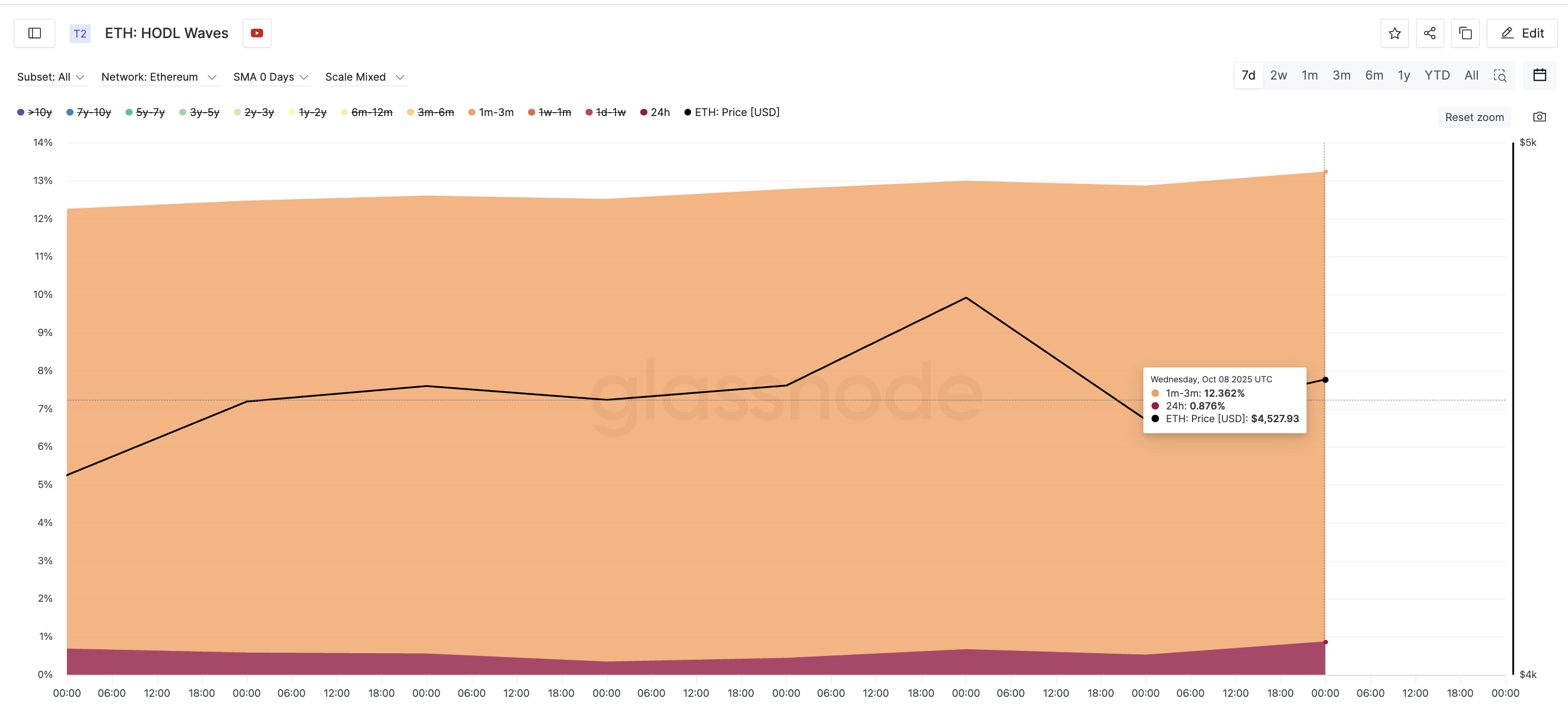

On the identical time, exercise amongst smaller however lively cohorts can be rising. In keeping with Glassnode’s HODL Waves, a metric that tracks how lengthy cash have been held by completely different age teams, each short-term bands have expanded notably.

The 24-hour cohort grew from 0.34% to 0.87% since October 4, whereas the 1–3 month group rose from 11.57% to 12.36%, week-on-week.

Ethereum Accumulation Continues: Glassnode

Rising short-term holdings, particularly throughout a sluggish worth week, usually point out that extra merchants are re-entering the market, including liquidity and momentum throughout early accumulation phases.

The mixture of whale inflows and short-term buildup hints that Ethereum’s present calm could possibly be masking preparation for a stronger directional transfer.

Ethereum Value Chart Construction Helps the Accumulation Narrative

Ethereum’s chart setup echoes this on-chain optimism. The asset trades between two key Fibonacci ranges — $4,400 and $4,620 — whereas forming an ascending triangle, a construction the place the value makes increased lows towards a flat resistance line.

This sample typically alerts a buildup earlier than a breakout.

Furthermore, a hidden bullish divergence appeared on the each day chart between August 25 and October 9. This occurs when the value types increased lows whereas the Relative Power Index (RSI), a software that measures market momentum and overbought or oversold situations, types decrease lows.

Ethereum Value Evaluation: TradingView

Hidden bullish divergence sometimes seems throughout corrections inside an uptrend, signaling that the broader transfer increased is prone to proceed.

The sign often factors to weakening promoting stress and potential continuation of the continuing pattern, which is on the upside for the Ethereum worth.

If Ethereum closes decisively above $4,620, a rally towards $4,870 and $5,130 might comply with because the breakout confirms. Conversely, if it slips beneath $4,400 (each day candle shut and never only a breakout), a pullback towards $4,240 and even $4,070 turns into possible, invalidating the short-term bullish case.

For now, each whales and short-term merchants look like betting on one key occasion: whether or not Ethereum can lastly break and maintain above $4,620 to start out its subsequent main leg increased.

The submit Ethereum Whales Pin Almost $4 Billion on Breakout Hopes, however $4,620 Is the Key appeared first on BeInCrypto.