Ethereum’s largest consumers maintain including to their ETH stacks even because the greenback worth of these purchases shrinks. On-chain flows and DAT demand nonetheless soak up extra provide than the market creates, whereas a contemporary RSI breakout suggests momentum could quickly spill into value.

Bitmine’s ETH Buys Gradual in Greenback Phrases as Month-to-month Totals Drop Sharply

Bitmine retains growing its Ethereum holdings, but the worth of these purchases exhibits a transparent downward development. The newest chart shared by Maartunn illustrates regular hourly inflows into the treasury whereas the broader market downturn reduces their greenback influence. As costs eased from mid-November, every tranche of gathered ETH translated right into a smaller month-to-month complete.

Bitmine Ethereum Treasury Inflows. Supply: CryptoQuant / X

The decline turns into evident when evaluating latest figures. July noticed Bitmine add about 2.6 billion {dollars}’ price of Ethereum. August then peaked close to 4.3 billion {dollars}, marking the strongest month within the interval. Nonetheless, the momentum reversed in September with 3.4 billion {dollars}, adopted by 2.3 billion {dollars} in October. By November, the month-to-month worth fell to simply 892 million {dollars}, although Bitmine continued shopping for constantly.

These numbers present that Bitmine’s accumulation technique has not modified, however market circumstances have. As ETH costs moved decrease, the identical influx volumes produced smaller valuations. Subsequently, the agency’s rising on-chain balances now distinction with the sharp slide in month-to-month greenback totals, signaling how value stress has reshaped the size of its treasury growth.

ETH DAT Shopping for Outpaces New Provide At the same time as Month-to-month Totals Decline

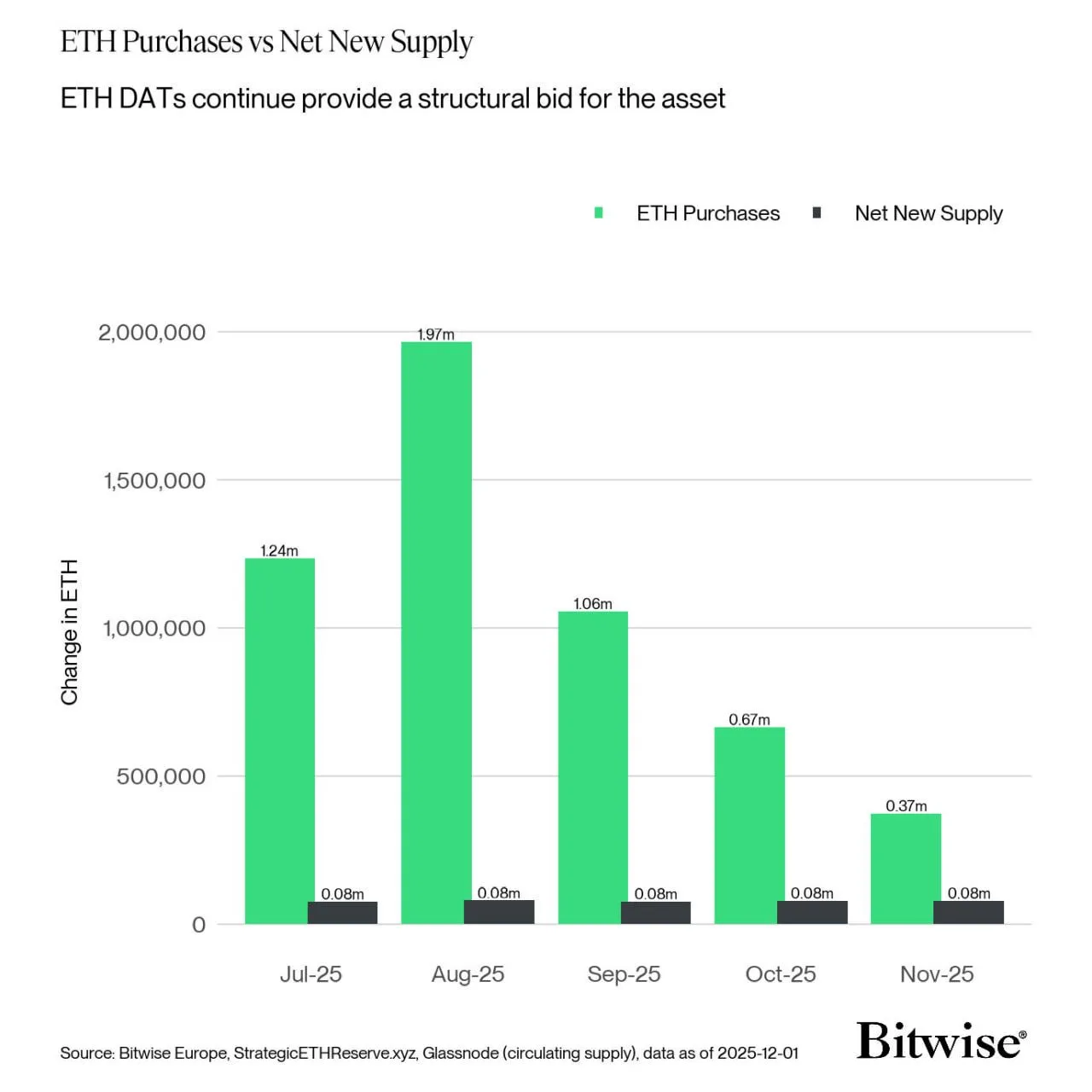

Furthermore, ETH demand from DAT constructions stays sturdy, but the newest figures present a gentle drop in month-to-month buy volumes. The chart shared by Max Shannon highlights that DATs proceed to supply a structural bid for Ethereum, although the size of that help has weakened because the summer time peak.

ETH Purchases vs Internet New Provide. Supply: Bitwise / X

In July, DATs absorbed about 1.24 million ETH whereas web new provide held close to 80,000 ETH. August marked the excessive level with roughly 1.97 million ETH bought, once more far above the modest month-to-month issuance. After that surge, shopping for slowed. September recorded round 1.06 million ETH, adopted by 670,000 ETH in October. By November, purchases slipped to roughly 370,000 ETH at the same time as web new provide stayed anchored at about 80,000 ETH every month.

This sample exhibits that DAT demand nonetheless exceeds Ethereum’s new provide by a large margin. Nonetheless, the progressive decline in month-to-month inflows underscores how the tempo of accumulation has cooled since late summer time, leaving a narrower cushion between purchaser demand and circulating issuance.

Analyst Flags Ethereum RSI Breakout as Worth Compresses Close to Assist

In the meantime, Ethereum chart from dealer Merlijn exhibits momentum indicators turning increased at the same time as value trades inside a good triangle. On the two-day ETH/USD view, candles cluster simply above horizontal help whereas a descending trendline caps latest highs, forming a compression zone.

Ethereum RSI Breakout Sign. Supply: Merlijn The Dealer

On the similar time, the relative power index has already damaged its personal downward resistance, hinting that purchasing stress could also be returning forward of value. Merlijn wrote that “momentum leads, value follows” and pointed to three,400 {dollars} as the subsequent upside degree if the breakout extends. He added that “the transfer is brewing,” urging market watchers to observe Ethereum intently because it approaches the apex of the present sample.