Ethereum seems to be stabilizing after a pointy correction. $ETH is buying and selling close to $2,950 after falling roughly 15.6% from its January highs earlier than bouncing off key assist. Whereas the Ethereum worth motion nonetheless appears to be like weak on the floor (11% down weekly), a number of underlying indicators recommend situations could also be shifting.

A accomplished bearish momentum reset, aggressive whale accumulation, and a sudden restoration in community utilization at the moment are lining up. Collectively, these indicators elevate an essential query: is Ethereum establishing for a stronger rebound, or is that this solely a short-term bounce?

Bearish Breakdown Performs Out as Quantity Diverges and Whales Step In

Ethereum’s latest weak spot didn’t come out of nowhere. Between January 6 and January 14, $ETH printed a bearish RSI (relative power index) divergence on the day by day chart. Whereas worth pushed to a better excessive, the RSI, a momentum indicator, fashioned a decrease excessive, a setup that usually indicators development exhaustion.

That sign performed out cleanly. Ethereum corrected about 15.6%, sliding into the $2,860 assist zone earlier than stabilizing.

What modified at assist is essential.

As costs trended decrease (between January 20 and January 21), On-Steadiness Quantity (OBV) fashioned a better low, indicating that promoting strain was weakening and that bigger patrons have been absorbing provide fairly than exiting. OBV tracks quantity circulation, and one of these divergence typically seems close to native bottoms.

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto Publication right here.

$ETH Construction”>

$ETH Construction”>Bullish $ETH Construction: TradingView

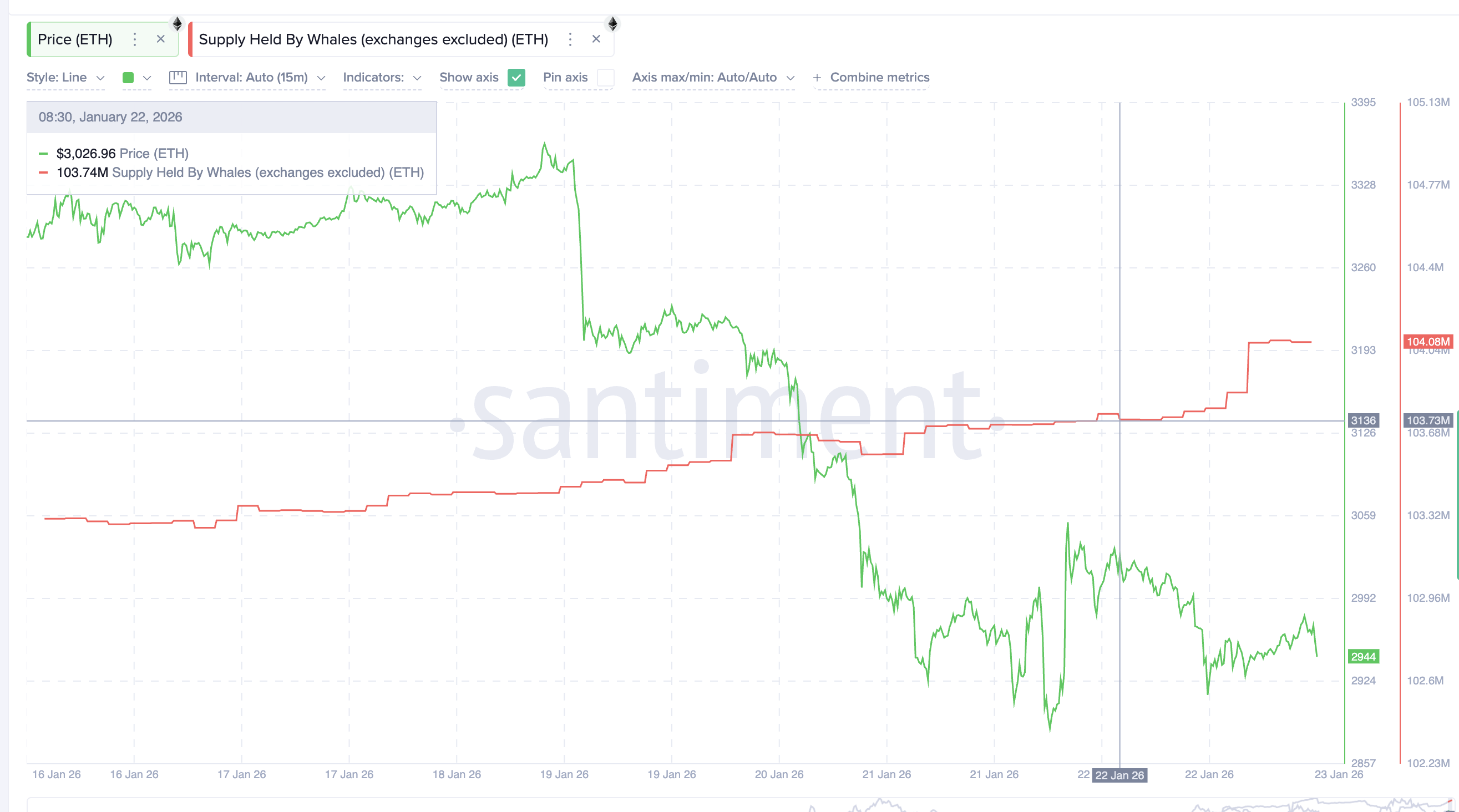

Whales seem to have reacted to that shift.

Over the previous 24 hours, Ethereum provide held by whales (excluding exchanges) elevated from 103.73 million $ETH to 104.08 million $ETH. That’s an addition of roughly 350,000 $ETH in a single day.

$ETH Whales”>

$ETH Whales”>$ETH Whales: Santiment

On the present $ETH worth, that accumulation is value simply over $1.03 billion.

This means whales didn’t purchase the highest. They stepped in after the momentum reset and worth examined main assist, treating the correction as an entry fairly than an exit. However which may not be the one cause.

Ethereum Reclaims No. 2 in Day by day Distinctive Addresses, Beating $SEI

The technical setup shouldn’t be the one factor enhancing.

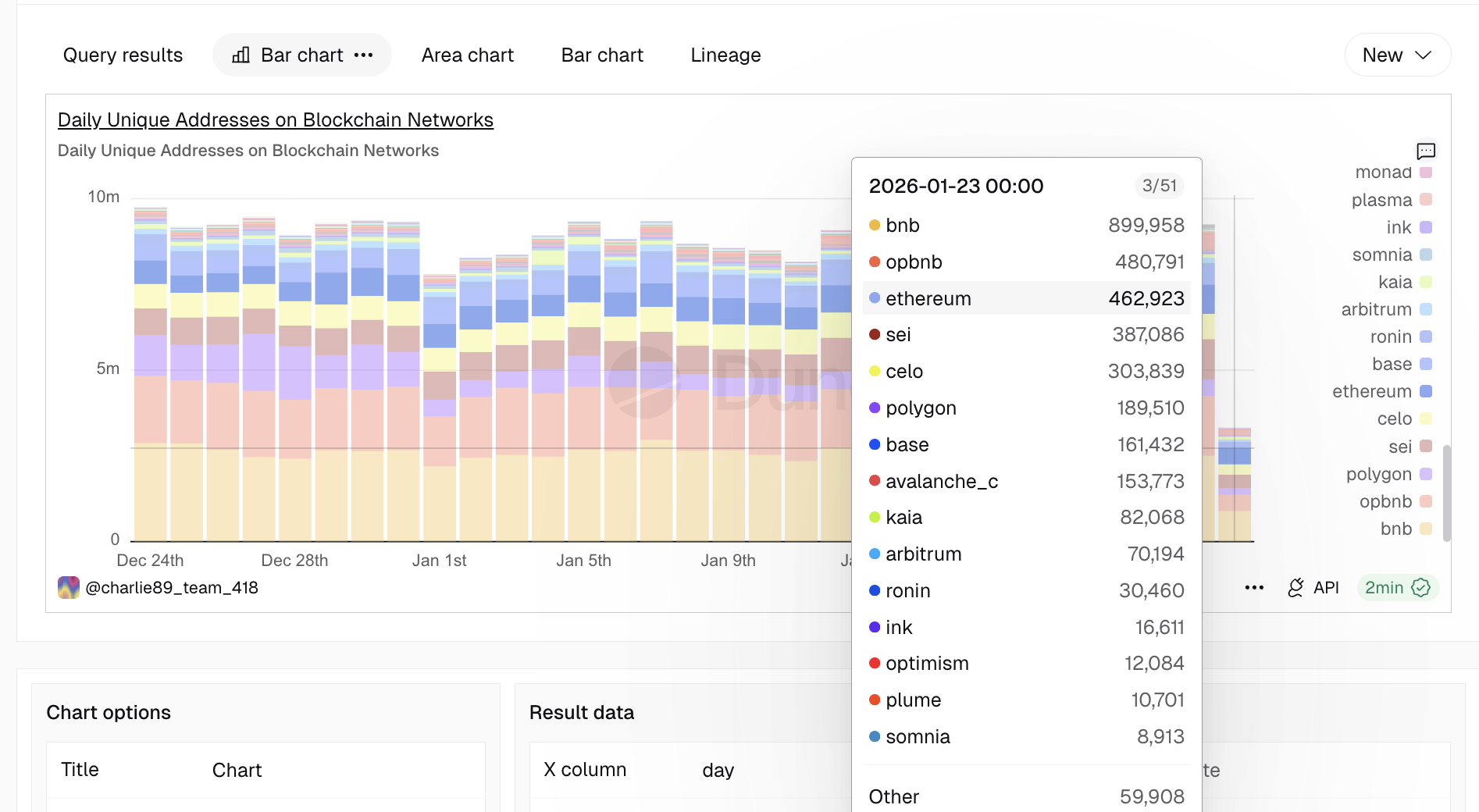

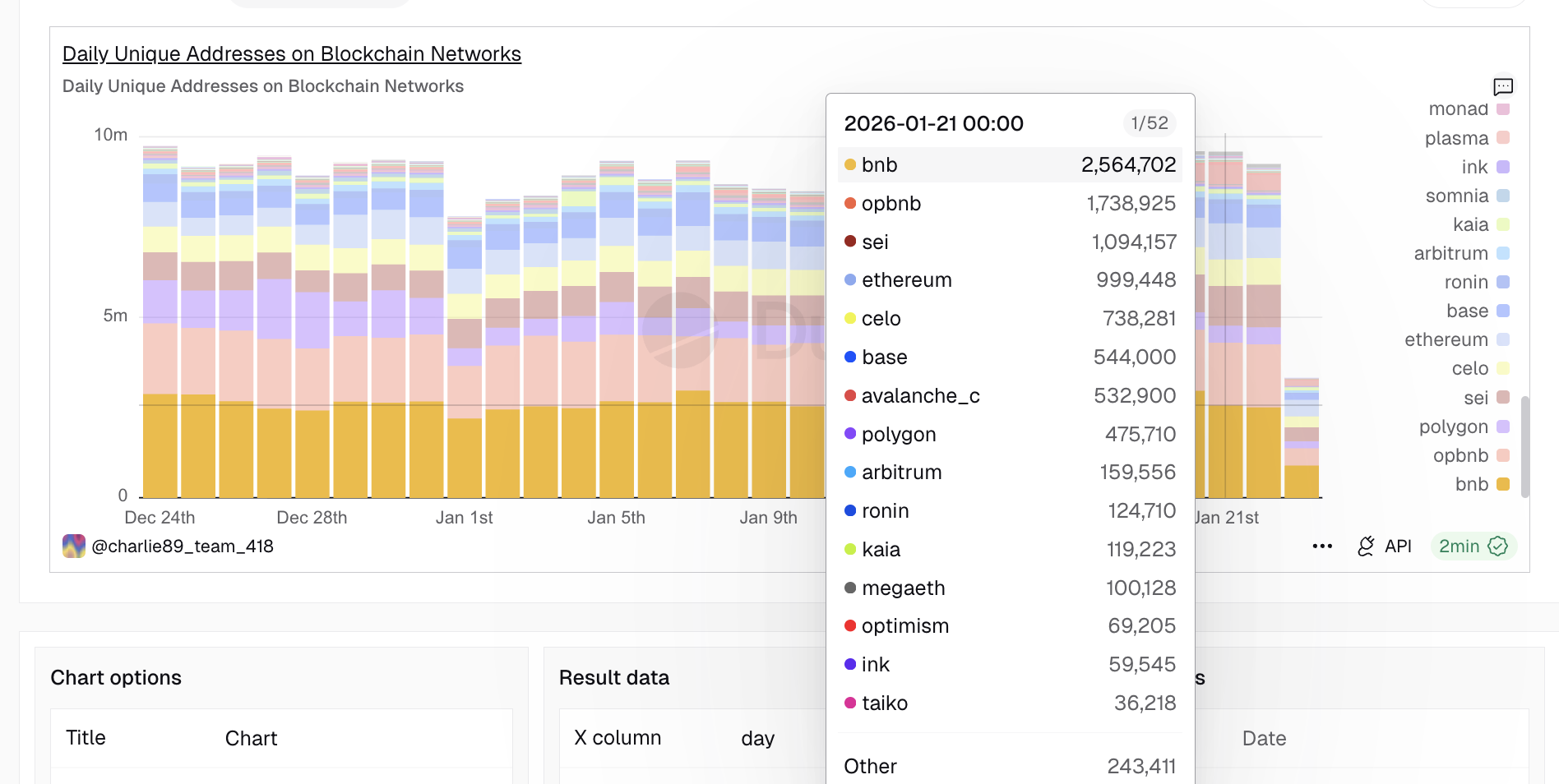

At press time on January 23, Ethereum has reclaimed the No. 2 spot in Layer-1 DUAs (day by day distinctive addresses) behind $BNB, as recognized completely by BeInCrypto analysts. It simply overtook $SEI (one other layer-1), which has seen robust exercise lately because of gaming-related progress. opBNB (layer-2 for $BNB), one other frequent competitor, nonetheless stays larger.

$ETH Reclaims Quantity 2 Place”>

$ETH Reclaims Quantity 2 Place”>$ETH Reclaims Quantity 2 Place: Dune

This issues as a result of day by day distinctive addresses mirror precise community utilization, not worth hypothesis. Ethereum reclaiming this place indicators that on-chain exercise as a layer-1 is recovering whilst worth stays beneath latest highs. $SEI has been Ethereum’s nemesis for fairly a while now.

Sei Was Beating Ethereum Earlier: Dune

Plus, Ethereum nonetheless outpaces all main layer-2 ecosystems by way of handle progress.

That restoration has already began to spill into social chatter.

Ethereum’s social dominance jumped sharply from round 0.37% to 4.43% since yesterday, briefly peaking close to 5.8% earlier than cooling. Traditionally, native peaks in social dominance have preceded short-term worth advances for $ETH. This is similar timeframe when whales picked up over $1 billion in $ETH.

Social Quantity Surges: Santiment

For instance:

- On January 17, a neighborhood social dominance spike was adopted by a 2.1% $ETH transfer larger over the following periods.

- On January 21, one other spike preceded a 3.4% upside transfer inside 24 hours.

This doesn’t assure a rally, however it exhibits that renewed community relevance has beforehand translated into short-term worth follow-through. The return to No. 2 in L1 day by day distinctive addresses (at press time) gives a basic cause for the rise in consideration.

Ethereum Worth Ranges Now Maintain The Key

From right here, Ethereum’s construction is obvious.

On the draw back, $2,860 stays the vital assist. This stage marked the tip of the 15.6% correction and is the place whales stepped in aggressively. A clear lack of this zone would weaken the bullish case and open draw back towards decrease helps.

On the upside, $ETH must clear $3,010, a stage simply 2.6% above the present worth, to substantiate short-term power. A sustained transfer larger would then carry $3,350 into focus, a resistance zone that has capped worth since mid-January.

Ethereum Worth Evaluation: TradingView

If that stage breaks, the Ethereum worth might goal larger extensions close to $3,490 and $3,870. Nevertheless, failure to carry $2,860 would shift focus again towards $2,770, invalidating the rebound thesis.

The submit Ethereum Whales Add $1 Billion After 15% Correction — What’s Subsequent for Worth? appeared first on BeInCrypto.