Ethereum has formally damaged beneath the long-standing vary it had maintained since early Could, shedding the important $2,320 assist stage. This breakdown was triggered by escalating geopolitical tensions, as information broke that the US had launched assaults on Iranian nuclear amenities. The announcement despatched shockwaves by world markets, sparking widespread risk-off habits and panic promoting throughout crypto. Ethereum, already buying and selling close to the underside of its six-week consolidation vary, shortly reacted with a pointy drop, dragging the broader altcoin market with it.

The transfer marks a important shift in sentiment, as Ethereum now trades outdoors the vary that had served as a battleground between bulls and bears for over a month. With volatility spiking and confidence shaken, merchants are re-evaluating danger in mild of escalating battle within the Center East and broader macroeconomic headwinds.

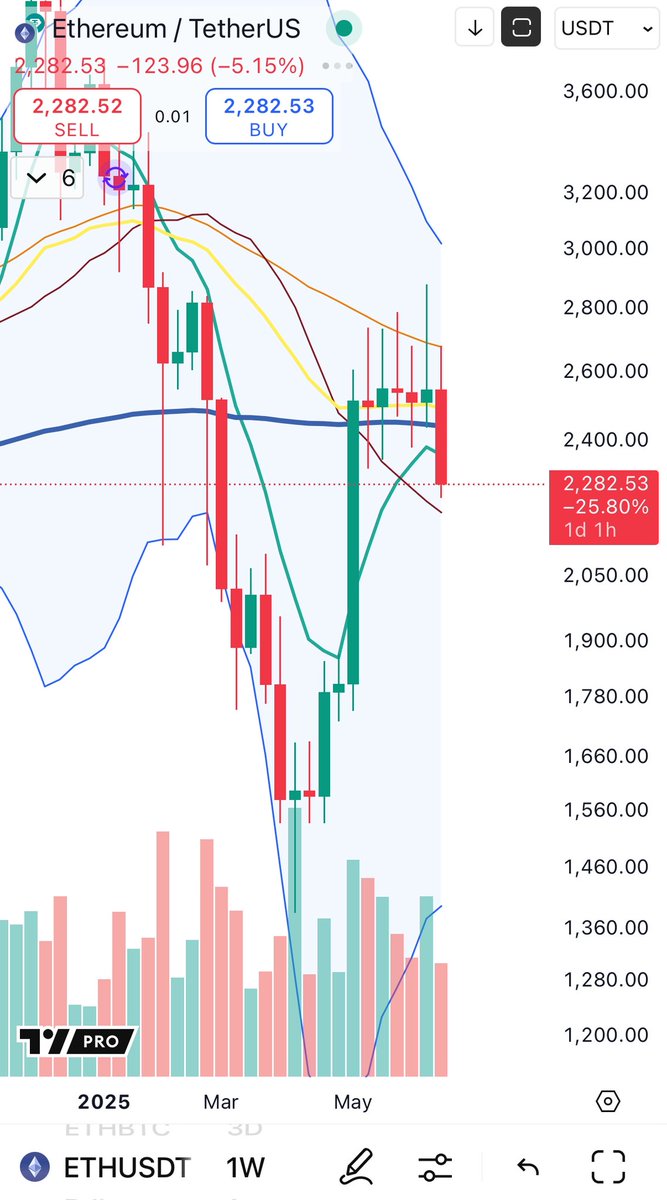

In accordance with prime analyst Huge Cheds, Ethereum’s weekly chart is now flirting with a possible tower prime sample completion — a bearish reversal construction that will sign additional draw back except consumers reclaim key ranges within the coming days. Because the scenario evolves, all eyes will stay on ETH’s skill to carry new assist ranges or danger additional decline in a fragile market setting.

Ethereum Slides 22% From June Highs – All Eyes On Weekly Construction

Ethereum has misplaced over 22% of its worth since peaking in early June, as world instability and heightened promoting stress weigh closely on market sentiment. The asset has now damaged beneath its six-week vary, triggering concern amongst traders and including to uncertainty throughout the broader crypto house. With rising tensions within the Center East—significantly following US assaults on Iranian nuclear amenities—the market has entered a risk-off setting, dragging altcoins like Ethereum into deeper retracements.

Regardless of the volatility, Ethereum stays on the heart of investor focus, as many nonetheless anticipate it to guide the following altseason. Nonetheless, with bulls shedding management of key assist zones, confidence in a near-term rally continues to waver. Analysts are actually cut up: whereas some predict a deeper retracement towards the $2,000 area, others argue that Ethereum is nearing exhaustion on the draw back and should quickly get well.

Huge Cheds factors to Ethereum’s weekly chart, the place the value is at the moment flirting with a possible tower prime sample—a bearish reversal construction. If this sample confirms, ETH might face one other wave of draw back earlier than discovering demand at decrease provide ranges.

If consumers step in throughout this pivotal second, a restoration from this construction might shortly comply with. The approaching periods shall be important in figuring out whether or not this breakdown extends or turns right into a fakeout with bullish continuation. For now, merchants ought to stay cautious, as Ethereum’s subsequent transfer might outline the tone of the altcoin market heading into July.

Ethereum Breaks Down Under Assist As Volatility Spikes

Ethereum has formally damaged beneath the $2,320 assist stage, signaling a shift in short-term market construction as proven within the 4-hour chart. After weeks of ranging between $2,320 and $2,650, ETH didn’t reclaim its transferring averages and misplaced bullish momentum. The value is now buying and selling round $2,260, down sharply from its June highs close to $2,900. This current leg down follows a clear breakdown by the 50, 100, and 200-period SMAs, confirming a robust bearish momentum.

Quantity spikes accompanied the drop, suggesting panic promoting probably triggered by geopolitical turmoil within the Center East. The value broke down aggressively with little resistance, that means earlier demand zones have now turn into weak. If consumers fail to step in shortly, Ethereum might revisit earlier Could assist ranges round $2,100 and even $2,000.

From a technical standpoint, the breakdown invalidates the earlier consolidation vary, opening the door for a attainable prolonged correction. Till ETH reclaims $2,320 and stabilizes above its transferring averages, the danger of continued draw back stays excessive. Market individuals ought to watch intently for quantity shifts or bullish divergences, however for now, Ethereum stays underneath stress as uncertainty continues to dominate the macro setting. The following few periods shall be essential for value discovery.

Featured picture from Dall-E, chart from TradingView