Ethereum is ready to endure its extremely anticipated Pectra improve tomorrow, and on-chain knowledge means that validators are making ready to climate any market volatility.

Regardless of ETH’s lackluster value efficiency over the previous week, the drop in validator exit factors to a way of confidence amongst community contributors.

Ethereum Validators Maintain Agency Forward of Pectra

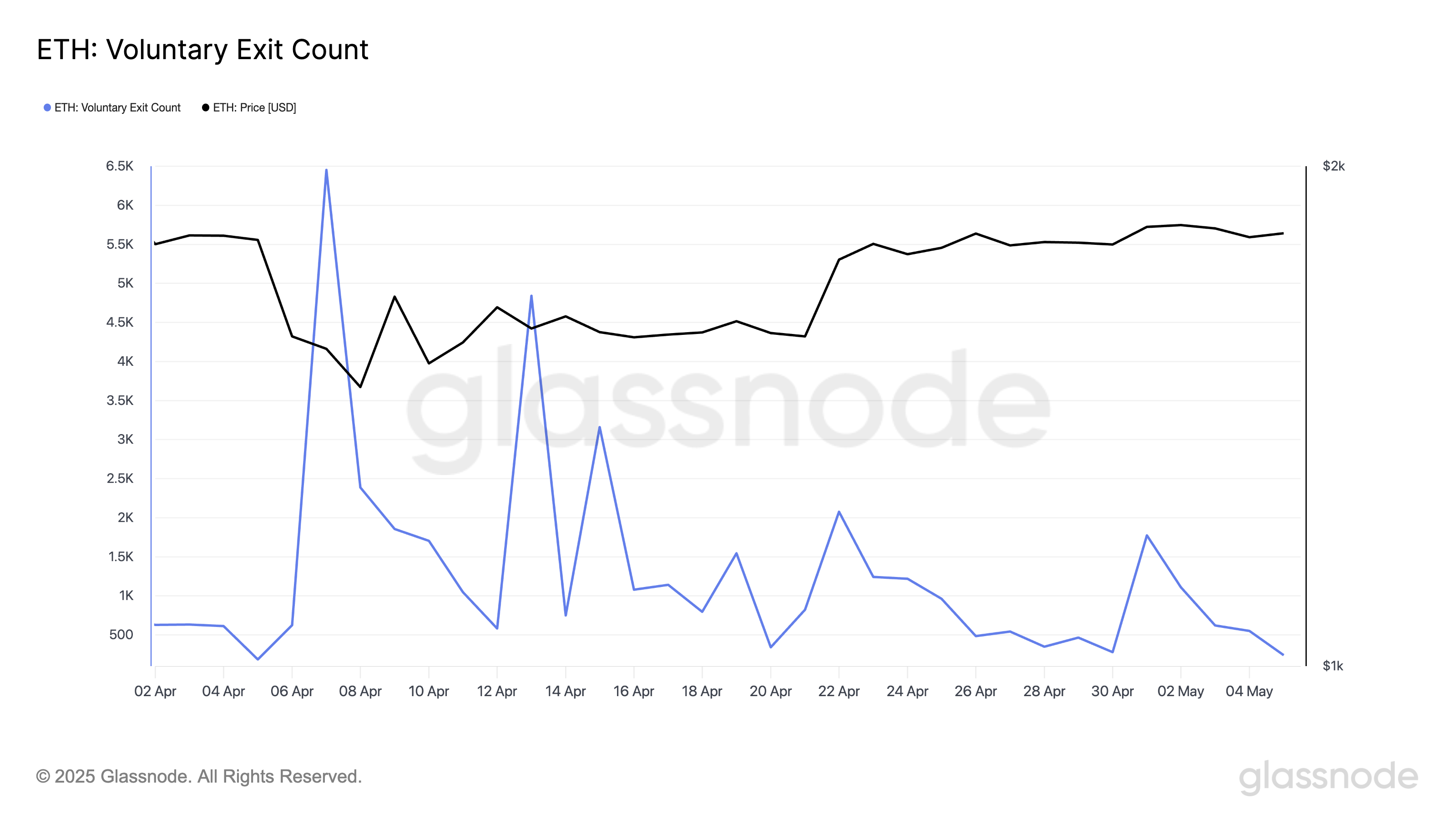

In response to Glassnode, Ethereum’s validator voluntary exit rely has declined noticeably since Might 1, signaling a drop within the variety of validators selecting to go away the community. On Might 5, solely 238 validators exited the community — the bottom every day rely of validator exits from Ethereum since April 5.

Ethereum Voluntary Exit Rely. Supply: Glassnode

This pattern signifies that extra validators are opting to remain put quite than liquidate their staked ETH, an indication of long-term confidence within the community and its coin.

With fewer exits, Ethereum validators seem optimistic in regards to the community’s near-term outlook and the potential affect of the Pectra improve. Such sentiment, if sustained, may assist lay the inspiration for a post-upgrade ETH rally.

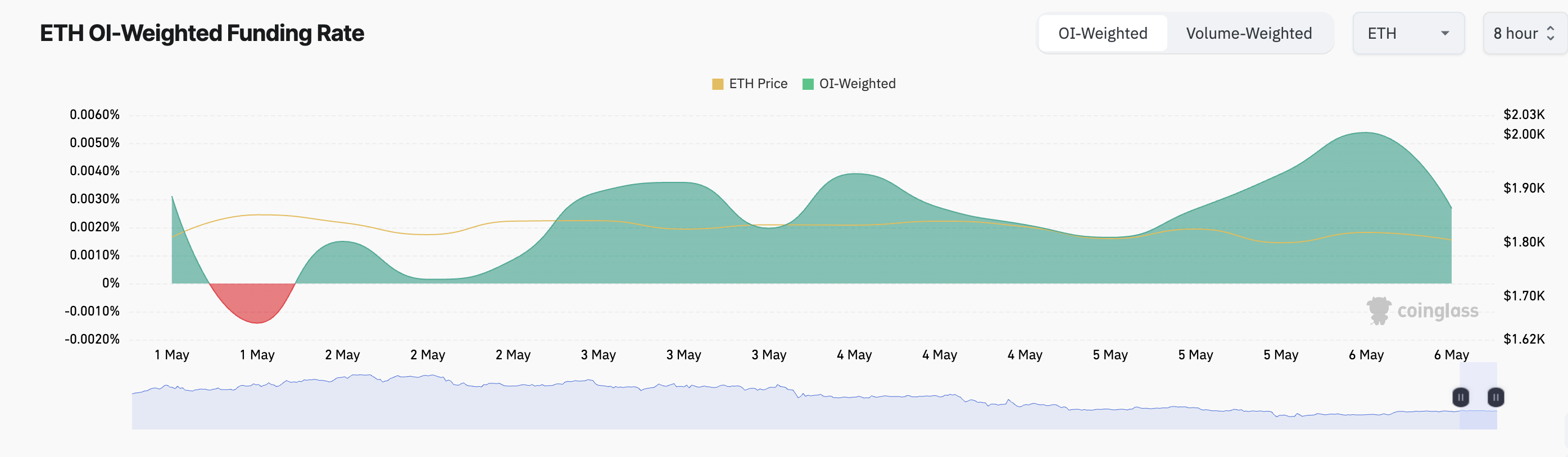

Furthermore, the coin’s persistently constructive funding charge reinforces the bullish sentiment surrounding ETH. At press time, ETH’s funding charge is 0.0027%, indicating that merchants are nonetheless keen to pay a premium to keep up lengthy positions.

Ethereum Funding Price. Supply: Coinglass

A constructive funding charge suggests bullish sentiment dominates the futures market, as long-position holders pay brief sellers to maintain their trades open. This dynamic displays merchants’ expectations of upward value motion.

Regardless of ETH’s continued battle to interrupt decisively above the $2,000 degree, futures merchants stay optimistic, constantly inserting leveraged bets in anticipation of a value surge.

Bullish Setup Meets “Promote-the-Information” Fears

Because the countdown to Pectra ticks down, the autumn in validator exit from Ethereum may tighten ETH’s circulating provide, contributing to a bullish breakout post-upgrade. If bullish sentiment persists, ETH’s value may rally to $2,027.

Nonetheless, the danger of a “sell-the-news” occasion stays.

ETH Value Evaluation. Supply: TradingView

If the improve fails to fulfill market expectations or triggers profit-taking, ETH may expertise draw back strain regardless of the optimistic indicators from validator conduct. On this state of affairs, its value may fall to $1,744.