A current Ethereum transaction caught widespread consideration after a person paid 58.76 ETH, valued at $129,139, as a price to switch 285.85 WETH.

This unusually excessive price, which occurred on March 4, has sparked discussions inside the neighborhood about Ethereum’s transaction prices. Many customers expressed frustration with the community, significantly in mild of fluctuating gasoline charges, which had just lately hit a five-year low earlier than seeing a rise.

Excessive Payment Sparks Neighborhood Reactions

Customers on social media reacted strongly to the excessive transaction price, questioning Ethereum’s effectivity and price construction. Some customers cited the community’s sluggish transaction speeds and excessive prices as main drawbacks, arguing that safety alone is inadequate if charges stay unpredictable.

In the meantime, the price anomaly occurred simply as Ethereum gasoline charges dropped to their lowest stage in 5 years. The common transaction price is at present at a mean of 0.642 gwei. This vital decline adopted years of fluctuating prices, with gasoline charges peaking at 709.7 gwei, or roughly $196 per transaction, in 2020 because of elevated DeFi exercise and NFT adoption.

Ethereum’s Payment Tendencies Present Volatility

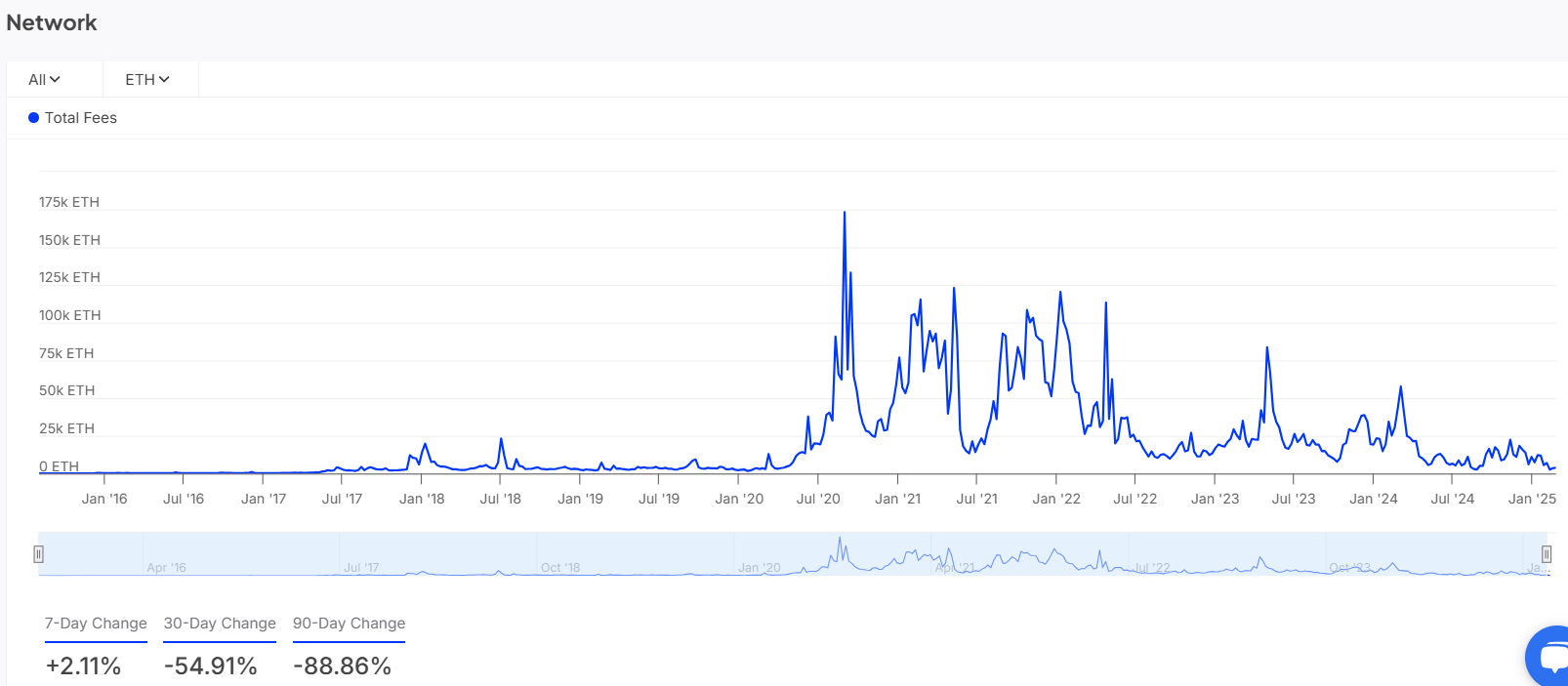

A historic evaluation of Ethereum’s whole charges suggests fluctuating prices over time. In accordance with IntoTheBlock information, the seven-day change in whole charges remained constructive at +2.11%, indicating a current enhance.

Ethereums Complete Charges

Nevertheless, the 30-day and 90-day adjustments stood at -54.91% and -88.86%, respectively, signaling a longer-term decline in charges.

Ethereum’s gasoline charges have lengthy been a topic of comparability, particularly in opposition to Solana, which affords decrease transaction prices and better throughput. Whereas Ethereum’s price discount was notable, current information suggests shifts in transaction prices throughout completely different blockchains.

Solana’s Charges and Market Comparability

Solana’s community exercise has continued to rise, influencing its transaction price construction. In February, on-chain information from Glassnode confirmed that Solana’s seven-day common transaction charges had persistently outpaced Ethereum’s since January 9, 2025.

Though Solana’s price dominance weakened in February, the weekly distinction remained above $3 million.