Ethereum inflows into centralized exchanges surged sharply in early July, which might fear traders hoping for an ETH restoration.

Under are on-chain indicators suggesting that many whales is likely to be seeking to promote, simply as ETH ETF inflows present indicators of slowing.

Ethereum Strikes to Exchanges — What Do Analysts Say?

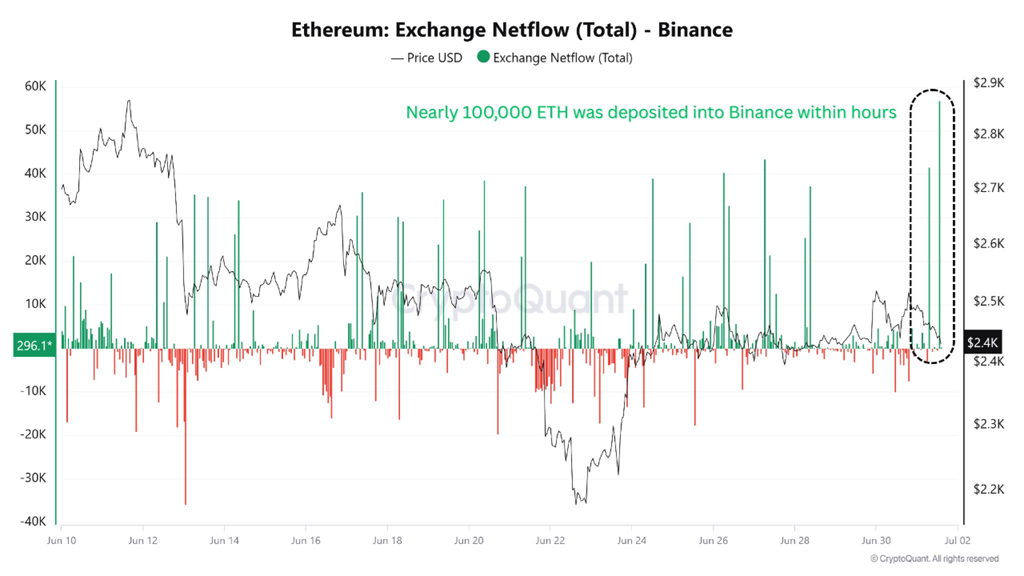

In accordance with information from CryptoQuant, on July 1, 2025, almost 100,000 ETH, price about $250 million, have been deposited into Binance. This marks the best single-day influx to the trade over the previous month.

Ethereum Trade Netflow – Binance. Supply: CryptoQuant.

In comparison with current value habits, giant day by day inflows usually result in ETH value corrections or hold the worth buying and selling inside a decent sideways vary.

As well as, an on-chain observer famous that over the previous three weeks, a big entity withdrew 95,313 ETH from staking contracts utilizing two pockets addresses. The entity then transferred 68,182 ETH (about $165 million) to centralized exchanges comparable to HTX, OKX, and Bybit.

With a median staking value round $2,878 per ETH and the present value close to $2,431, this entity has suffered a roughly $42.6 million loss. This motion suggests a stop-loss technique or portfolio restructuring, which provides to market promoting stress.

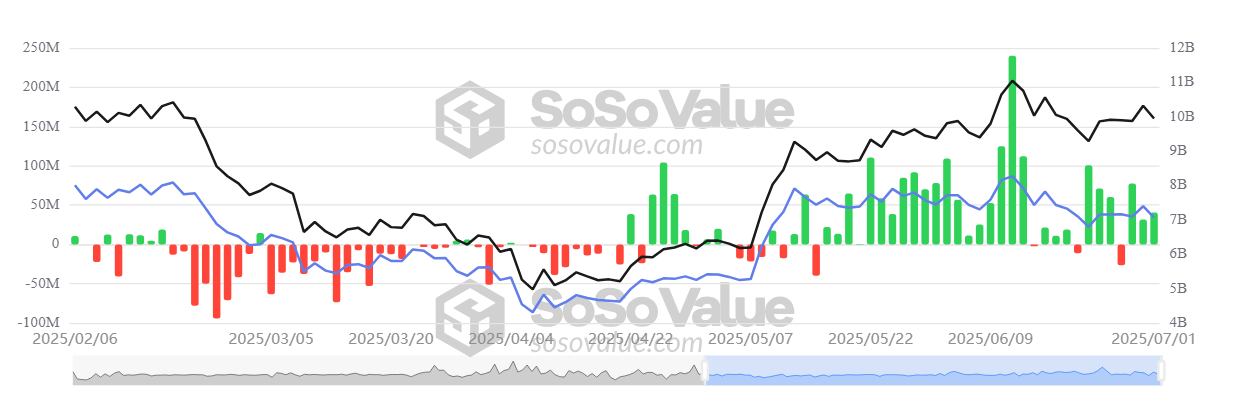

In the meantime, information from Sosovalue reveals that whereas web inflows into spot ETH ETFs within the US stay optimistic, they’re slowing down.

Whole Ethereum Spot ETF Internet Influx. Supply: SoSoValue

Particularly, the online move of those ETH ETFs dropped from over $240 million on June 11 to only over $40 million on July 1. This displays a slowdown in ETF shopping for momentum.

All these information factors mixed might weigh ETH’s value throughout the first week of July. On the identical time, statistics from Coinglass point out that Q3 has traditionally been ETH’s weakest quarter, with a median return of simply 0.59%.

“The long-term bullish outlook for Ethereum stays intact, relying on an enchancment in broader macroeconomic situations. Nonetheless, Ethereum might face a slight short-term pullback,” analyst Amr Taha from CryptoQuant famous.

Specialists Present Consensus on ETH’s Lengthy-term Upside Potential

Evidently consultants broadly agree on ETH’s long-term potential.

MEXC Analysis famous that Ethereum is staging a powerful restoration, due to validator upgrades that enhance staking effectivity and clearer stablecoin laws introduced by the GENIUS Act.

“With danger urge for food slowly returning to the market, together with stabilizing geopolitical scenario and improved world liquidity, ETH seems to be well-positioned for additional positive factors within the coming weeks. If present momentum persists and macro situations stay favorable, a transfer in direction of $3,000 and doubtlessly $3,300 appears more and more believable. Conversely, a black swan occasion could set off a break beneath $2,350 and trigger a steeper decline in direction of $2,100,” MEXC Analysis advised BeInCrypto.

In the meantime, Ryan Lee, Chief Analyst at Bitget, additionally emphasised core components comparable to clearer regulatory indicators via the GENIUS Act and powerful on-chain exercise that would drive ETH’s value larger.

“Ethereum is gaining notable momentum, buoyed by its validator spine improve, which has improved staking effectivity and contributed to decreased ETH provide… Within the close to time period, Ethereum could check the $2,800–$3,000 vary by mid-July,” Ryan Lee advised BeInCrypto.