Main altcoin Ethereum has struggled over the previous week, shedding almost 10% of its worth as bearish sentiment grips the market.

On-chain information exhibits that the highest traders have diminished their holdings because the coin battles a lackluster efficiency. With this pattern, ETH faces mounting headwinds that would drag its value beneath the essential $4,000 degree.

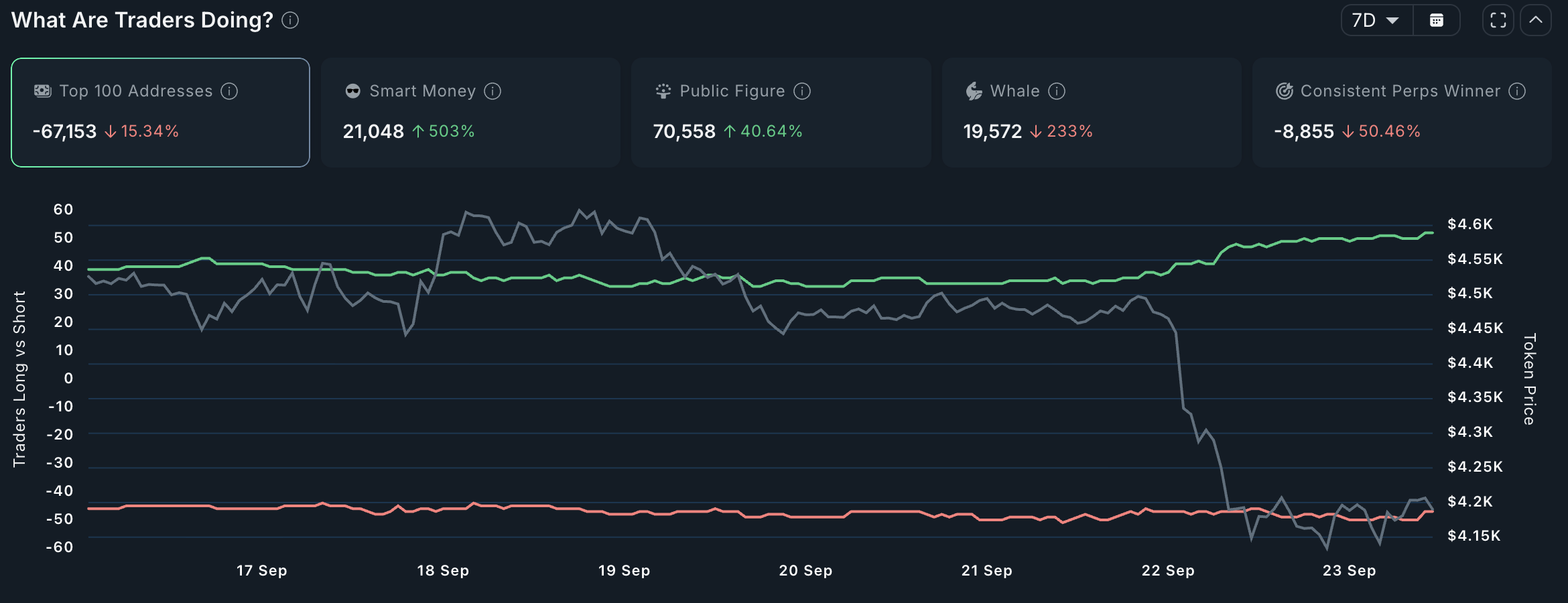

Prime Buyers Dump ETH, Elevating Quick-Time period Breakdown Fears

Information from Nansen exhibits that the ETH stability of the highest 100 largest wallets has dipped by 10% previously week.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto Publication right here.

Prime 100 Addresses ETH Holdings. Supply: Nansen

Based on the blockchain analytics platform, this metric tracks the token balances of the 100 largest crypto wallets. These holders management a big share of an asset’s circulating provide, so adjustments of their balances are often markers of sentiment shift amongst huge gamers.

The ten% decline in ETH’s high pockets stability confirms that these holders have been offloading the coin into the market over the previous week. Such a transfer is a robust bearish sign, including downward strain on ETH’s value.

Moreover, in accordance with the on-chain information supplier, ETH’s whale exercise has additionally declined, exacerbating the probability of a dip beneath $4,000.

Over the previous week, whale wallets with cash value greater than $1 million have diminished their ETH holdings by over 200%. As of this writing, this cohort of ETH traders holds 19,577 cash valued at $66.20 million at present market costs.

A decline in whale holdings like this often ripples into broader market sentiment. Retail merchants carefully monitor whale exercise as a sign of confidence. So, when massive traders start to dump their belongings, smaller holders might observe swimsuit out of warning.

This will amplify ETH’s promoting strain and push it additional down within the near-term.

Heavy Promote-Offs Take a look at Market Resilience

ETH at present trades at $4,196, with rising sell-offs from massive traders driving fears of deeper losses. If the promoting strain continues, ETH may break beneath the $4,000 degree and check help round $3,875.

Alternatively, contemporary demand getting into the market to soak up this wave of provide may stabilize the coin’s value.

ETH Worth Evaluation. Supply: TradingView

Such a shift may set off a rebound, placing ETH again on monitor towards $4,497.

The put up Ethereum Prime Holders Slash Holdings, Sparking $4,000 Breakdown Fears appeared first on BeInCrypto.