Ethereum to $10K: The Institutional Guess Is On

Ethereum is exhibiting all of the indicators of being the following huge institutional play. Previously weeks, BlackRock and different main ETFs have gathered $240 million price of ETH, even earlier than the Ethereum spot ETF formally launches.

However they’re not simply positioning for the spot ETF.

The Actual Goal: ETH Staking ETFs

Establishments are getting ready for the future SEC approval of staking-based ETFs, which might permit them to supply yield-generating merchandise. If accepted, this could be a game-changer:

- ETH staking = passive earnings

- ETH provide is deflationary, particularly post-merge

- Actual World Property (RWA) price trillions are being tokenized on Ethereum

- ETH stays the greatest tech infrastructure in crypto

- Retail continues to be watching. Good cash is already transferring.

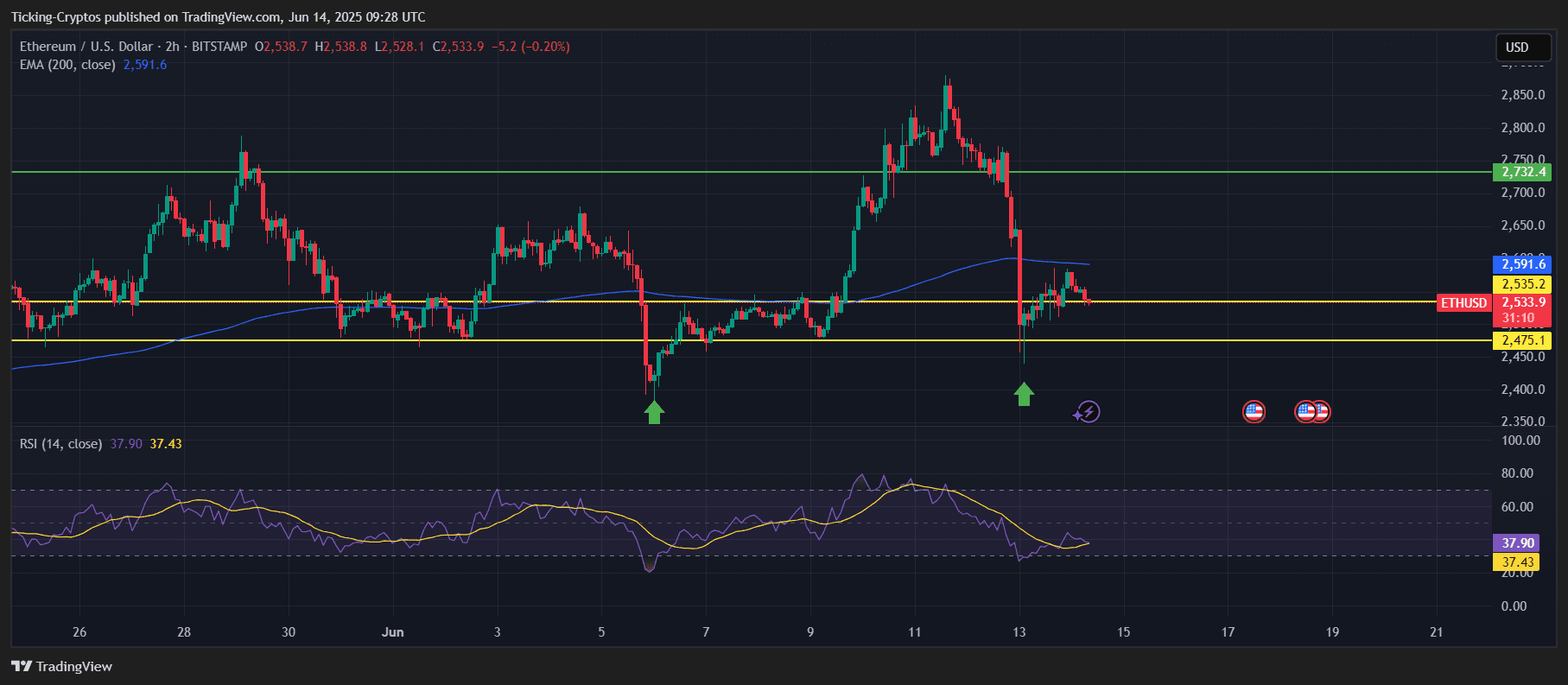

ETH Chart Evaluation: Assist Nonetheless Holding

Trying on the chart, Ethereum is buying and selling round $2,533, simply above the important thing assist stage at $2,475. The worth has bounced from this stage twice, exhibiting it is performing as a powerful demand zone.

ETH/USD 2-hours chart – TradingView

Nevertheless, the 200 EMA at $2,591 is performing as a ceiling. ETH should break above this stage to substantiate momentum and enter a bullish continuation.

The RSI on the 2-hour timeframe sits round 37.90, barely oversold, which suggests the draw back is proscribed until assist breaks.

Key ranges:

- Assist: $2,475

- Resistance: $2,591 and $2,732

- Breakout Zone: A transfer above $2,732 would sign acceleration towards $3,000+

Ethereum Value Prediction: Highway to $10,000

The trail to $10,000 ETH gained’t occur in a single day, however the basis is already being laid:

- Institutional shopping for is rising

- Spot + staking ETFs are on the horizon

- Provide is shrinking (burn mechanism + staking)

- Ethereum dominates good contracts, DeFi, NFTs, and now RWAs

By the point retail FOMO kicks in, ETH might already be midway there.