Ethereum (ETH) has been buying and selling inside a slender vary because the starting of February, oscillating between key help and resistance ranges.

Nevertheless, regardless of this sideways worth motion, futures merchants stay resilient as they proceed to open purchase contracts, signaling confidence in ETH’s potential upside.

Ethereum’s Futures Market Exhibits Resilience

Readings from the ETH/USD one-day chart reveal that the main altcoin has traded inside a horizontal channel because the starting of the month, dealing with resistance at $2,799 whereas discovering help at $2,585. Regardless of this, its futures merchants have maintained their bullish stance and have elevated their purchase orders.

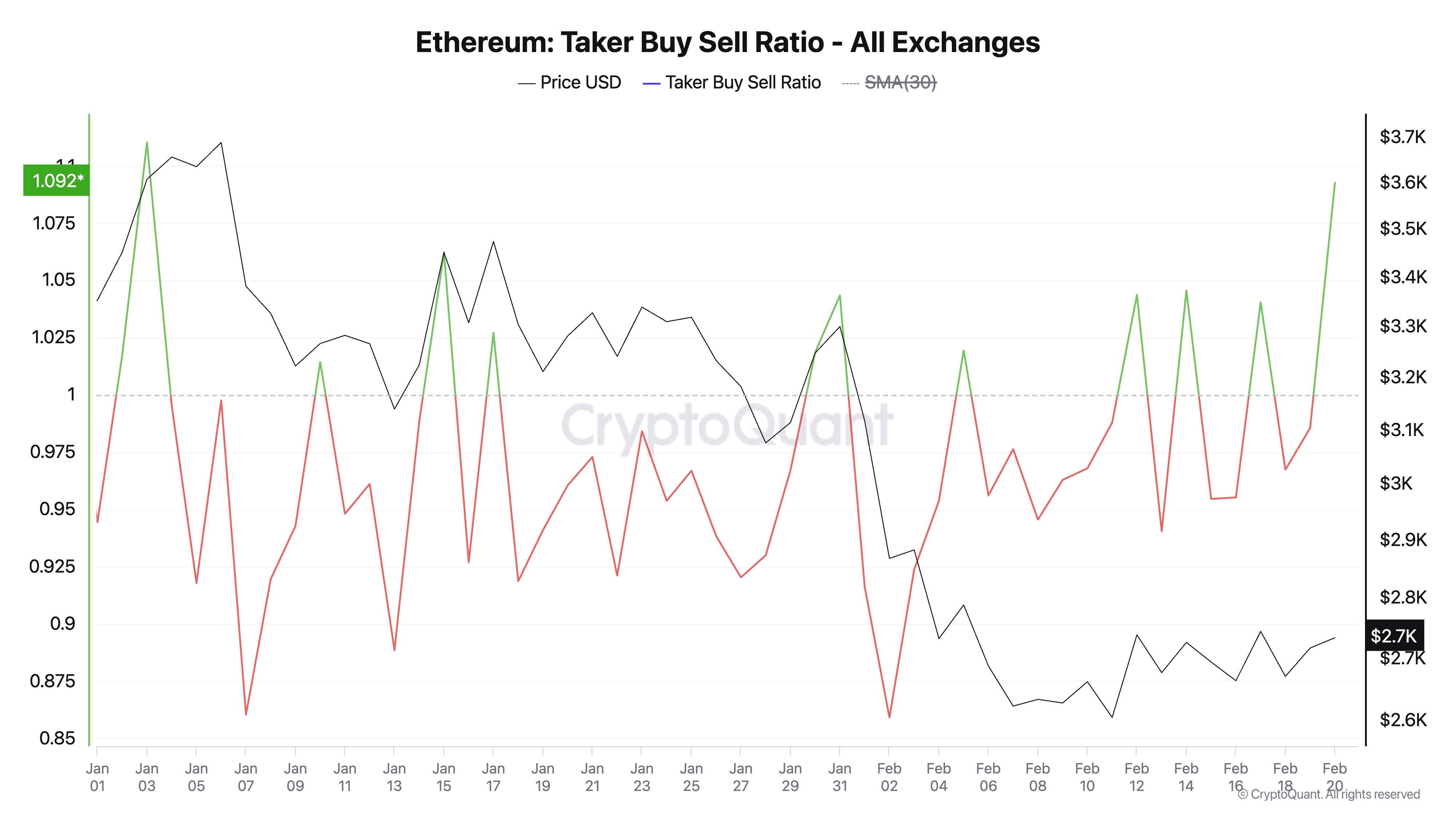

A key indicator of this bullish sentiment is Ethereum’s Taker-Purchase-Promote Ratio, which has surged to its highest level since early January. In keeping with CryptoQuant, it’s at 1.09 at press time.

Ethereum’s Taker-Purchase-Promote Ratio. Supply: CryptoQuant

An asset’s taker buy-sell ratio measures the ratio between the purchase and promote volumes in its futures market. Values above one point out extra purchase than promote quantity, whereas values under one recommend that extra futures merchants are promoting their holdings.

ETH’s taker-buy-sell ratio at 1.09 displays the rising optimism amongst its futures merchants amid its flat worth efficiency up to now few weeks.

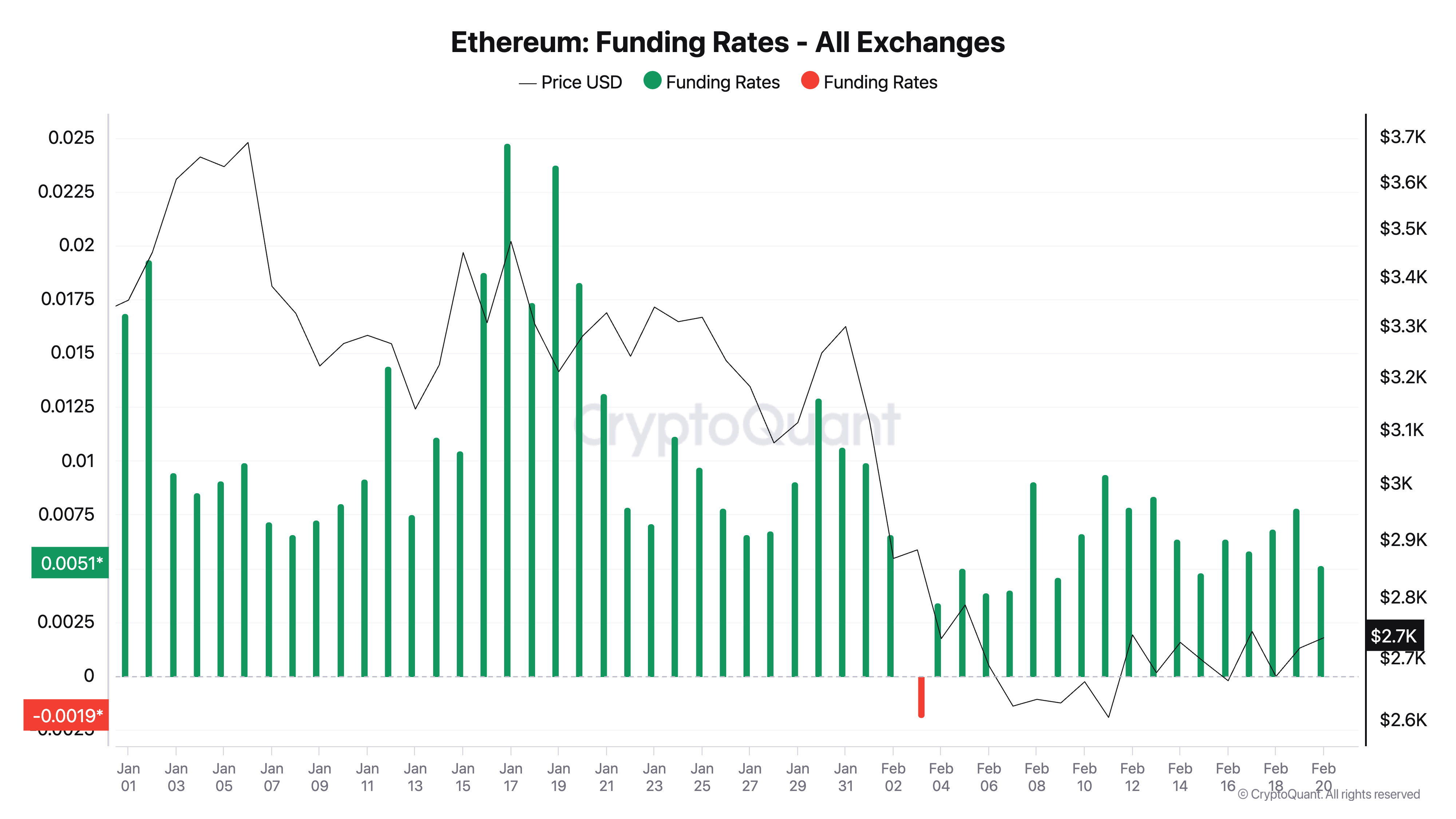

Moreover, ETH’s funding price has remained optimistic amid its worth consolidation. As of this writing, the metric is at 0.0051%.

Ethereum’s Funding Charge. Supply: CryptoQuant

The funding price is the periodic cost exchanged between lengthy and brief futures contract holders primarily based on the distinction between an asset’s spot worth and futures worth. When an asset’s funding price is optimistic, it signifies that lengthy place holders are paying brief, indicating a market bias towards bullish sentiment.

During times of worth consolidation like this, a optimistic funding price means that patrons are keen to pay a premium to carry lengthy positions, signaling confidence within the asset’s potential to interrupt out upward as soon as the consolidation section ends.

ETH Bulls Look to Break $2,758—A Path to $3,000?

A possible break above the resistance at $2,799 may propel its worth to $2,967. If ETH’s demand strengthens at this stage, it may rally above the crucial $3,000 worth level to commerce at $3,202.

ETH Value Evaluation. Supply: TradingView

Nevertheless, if the bears regain dominance and power a break under help at $2,585, ETH’s worth may plummet to $2,467. If the bulls are unable to defend this stage, the decline may proceed to $2,150.