A report degree of quick positions towards Ethereum on the Chicago Mercantile Trade (CME) has sparked dialogue of widespread bearish sentiment, however key market analysts are pushing again, arguing it is a misinterpretation of how refined establishments are partaking with ETH..

Regardless of a drop of three.67% prior to now 24 hours, Ethereum maintains a stable weekly acquire of three.48%, presently buying and selling at $2,488.16.

CME Shorts Are Structural, Not Speculative

CME information reveals Ethereum quick positions climbing steadily since mid-2023, peaking at a internet in need of -11,154 in mid-2025. At first look, such figures may recommend widespread bearish sentiment.

Nonetheless, this assumption misses the underlying technique. In response to van de Poppe, establishments are utilizing these shorts as hedges to steadiness spot ETH publicity via ETFs. These trades, sometimes called “foundation trades,” enable establishments to lock in arbitrage yields of 12% to 18% yearly.

Considerably, the quick curiosity seems to maneuver in near-perfect correlation with ETF inflows. This tight correlation helps the concept these positions are usually not speculative. Fairly, they’re strategic performs designed to seize risk-free returns. Therefore, report shorts on this context are usually not indicators of worry, however moderately confidence in Ethereum’s long-term viability.

The thesis surrounding the biggest quick place on $ETH is not actually legitimate.

These are simply shorts to cowl the spot longs via the ETF on establishments buying and selling the premise commerce to generate 12-18% APY on a yr.

It is nearly 1 to 1 correlated with the influx on the ETF. pic.twitter.com/gGuQsydvgx

— Michaël van de Poppe (@CryptoMichNL) July 3, 2025

On the Charts, Ethereum’s Bullish Construction Is Intact

On the technical facet, Ethereum has reclaimed assist at $2,403, a key degree in its ongoing bullish construction. The value is presently consolidating just under resistance at $2,630.

This zone has been examined a number of occasions, indicating potential for a robust breakout. Van de Poppe believes Ethereum is on monitor for a push towards $3,000, supplied the $2,630 resistance is flipped into assist.

A earlier liquidity sweep close to $2,233 bolstered shopping for power, additional supporting the bullish thesis. If momentum continues, the following value goal sits between $2,800 and $3,000, probably marking a brand new native excessive.

$ETH has began its upwards run in the direction of $3,000. pic.twitter.com/vFWBj8UPfl

— Michaël van de Poppe (@CryptoMichNL) July 4, 2025

Derivatives Exercise Alerts Wholesome Market Dynamics

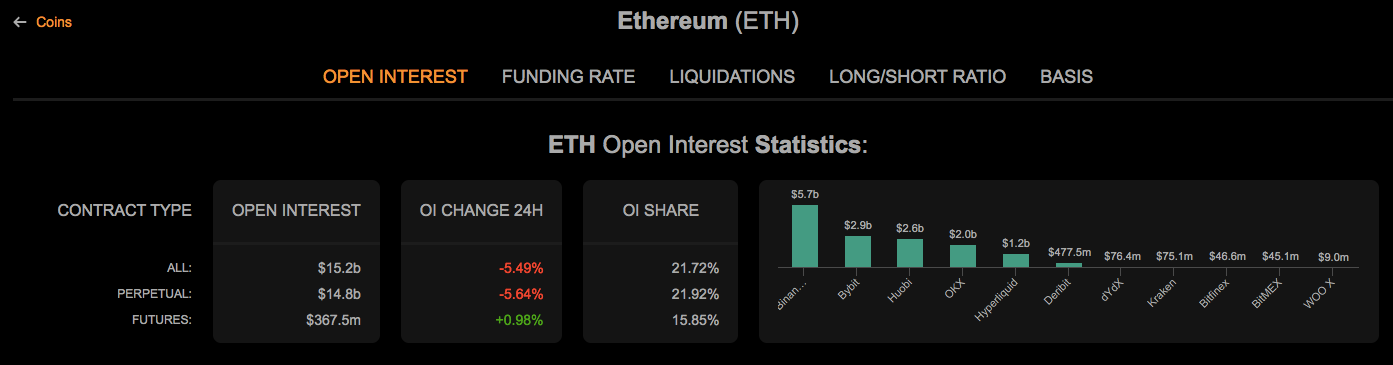

Supply: Coinanalyze

Ethereum’s open curiosity stays sturdy, totaling $15.2 billion. Most of this comes from perpetual contracts, accounting for $14.8 billion. Regardless of a current decline of 5.49% in complete open curiosity, futures exercise stays regular.

Main exchanges like Binance, Bybit, and Huobi proceed to dominate ETH derivatives buying and selling, indicating sustained market depth and institutional participation.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version shouldn’t be liable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.