Ethereum (ETH) has just lately seen a outstanding resurgence, inching nearer to its $4,878 all-time excessive (ATH) document after a chronic interval of consolidation. On Tuesday, ETH broke the $4,600 mark for the primary time in years, outperforming different cryptocurrencies, together with Bitcoin (BTC) and XRP.

Ethereum ETFs Entice $8.2 Billion YTD

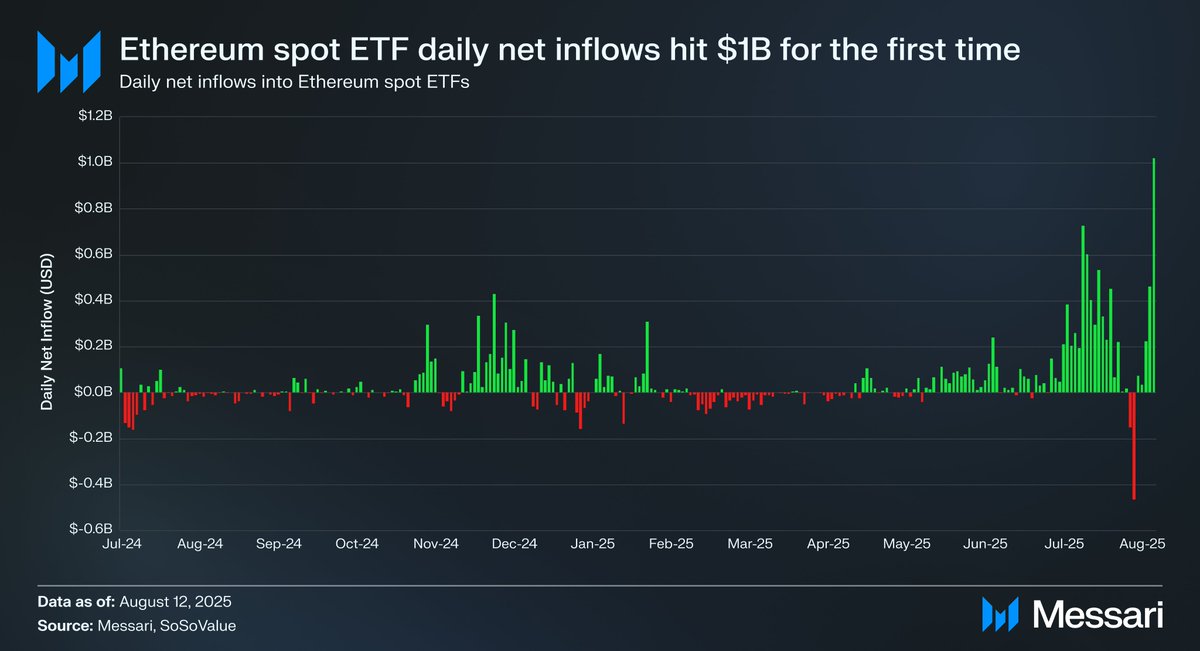

This worth efficiency is basically attributed to a major inflow of capital into Ethereum spot exchange-traded funds (ETFs), which recorded a staggering $1 billion in inflows in only a single day—the biggest day by day influx thus far.

In line with information from Messari, year-to-date inflows into Ethereum ETFs have reached $8.2 billion, accounting for roughly 1.5% of ETH’s market capitalization.

In distinction, Bitcoin spot ETFs noticed $178 million in inflows yesterday and $19.4 billion year-to-date, representing solely 0.8% of BTC’s market cap. Whereas BTC continues to steer in absolute flows, ETH is attracting almost double the capital relative to its measurement, signaling a shift in investor sentiment.

The current development in Ethereum’s worth can also be influenced by favorable regulatory developments. The signing of the GENIUS Act by President Donald Trump has established a brand new regulatory framework for stablecoins, which may improve their adoption and integration inside monetary techniques.

Main banks equivalent to Morgan Stanley, JP Morgan, Citigroup, and Financial institution of America are actively exploring the implementation of dollar-pegged cryptocurrencies, additional validating the potential of this market.

Public Firms Embrace ETH

Jake from Messari highlights that this regulatory improvement and key information factors have contributed to the reversal of the bearish outlook on Ethereum’s worth witnessed over the previous months on account of its poor efficiency.

Roughly $130 billion in stablecoins are presently secured, accounting for roughly 50% of the market share, alongside $7.2 billion in tokenized real-world property (RWAs) and a rising variety of enterprises constructing on the Ethereum blockchain.

Furthermore, 865,000 ETH is now being held by public corporations which can be adopting Technique’s (beforehand MicroStrategy) Bitcoin treasury method, reflecting a various vary of institutional patrons converging on Ethereum as a long-term funding.

SharpLink has appointed Ethereum co-founder Joseph Lubin as Chairman and holds over 360,000 ETH. BitMine has transitioned from Bitcoin mining to an Ethereum treasury mannequin, whereas Bit Digital has utterly shifted its focus to Ethereum, accumulating over 120,000 ETH.

Tangible Capital Flows

Institutional buyers have additionally been accumulating ETH at a formidable scale, with roughly 25 million ETH acquired since June. In line with the analyst, this accumulation just isn’t pushed by retail hypothesis however displays a strategic allocation by institutional corporations.

Finally, the convergence of stablecoins, tokenization, enterprise infrastructure, and treasury demand is leading to tangible capital flows, as evidenced by on-chain exercise and public firm disclosures. As Jake places it:

What was directional curiosity is turning into allocation. $ETH isn’t re-rating as a result of crypto desires it to. Wall Avenue stability sheets are forcing the transfer.

Featured picture from DALL-E, chart from TradingView.com