Ethereum (ETH) has recorded sturdy good points over the previous two weeks, rising from $2,111 on June 12 to $2,515 on June 25, reigniting hopes for a sustained bullish rally that might push the digital asset past the essential $3,000 stage.

Ethereum Rally Marked By Shift In Dynamics

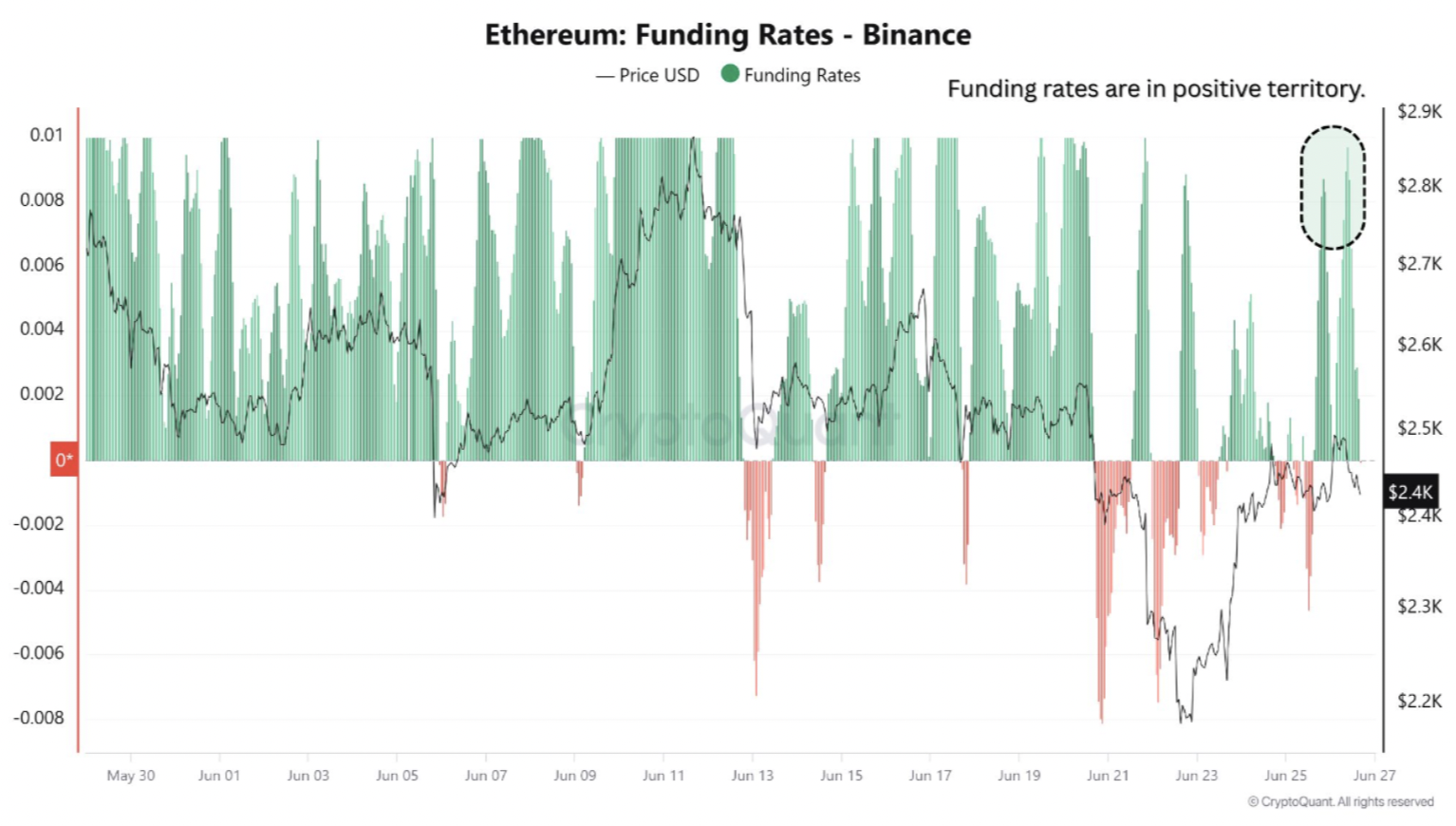

In line with a current CryptoQuant Quicktake put up by contributor Amr Taha, Ethereum’s newest rally has been accompanied by a notable shift in market dynamics – together with a flip to optimistic funding charges, a possible quick squeeze, and an increase in ETH inflows to Binance crypto trade.

Latest information from Binance reveals a major shift in ETH funding charges from adverse to optimistic. Optimistic funding charges sometimes point out that merchants are opening or holding leveraged lengthy positions, reflecting expectations of additional upside.

Nevertheless, rising funding charges can also elevate the danger of a short-term worth pullback if lengthy positions turn out to be overextended. Knowledge from CoinGlass exhibits that 68.15% of liquidations over the previous 24 hours have been lengthy positions – highlighting this threat.

Taha additionally emphasised the function of a brief squeeze in Ethereum’s current worth surge and the rise in funding charges. As ETH’s worth climbed, it retested the earlier short-squeeze zone round $2,500. He defined:

In that earlier occasion, quick positions have been forcibly closed by initiating aggressive market purchase orders to cowl their publicity, triggering a cascading impact generally known as a brief squeeze. This dynamic happens when merchants who had wager towards ETH (shorts) are compelled to shut their positions by aggressively shopping for again the asset to restrict losses.

In the meantime, ETH inflows to Binance have additionally spiked. On-chain trade information means that 177,000 ETH was deposited into Binance over a three-day interval – an unusually excessive quantity.

Such a surge sometimes alerts elevated promoting stress or large-scale repositioning by main holders. Giant transfers of ETH to exchanges usually precede both potential sell-offs or liquidity provisioning.

In conclusion, Taha famous that whereas a short-term correction could also be doubtless, ETH’s breakout above $2,500 underscores the aggressive speculative exercise driving its current worth motion. Merchants are suggested to carefully monitor funding charges and trade flows for indicators of an impending retracement.

ETH Bulls Take The Cost

Latest technical evaluation suggests ETH could also be gearing up for a breakout above the $2,800 resistance stage. The asset additionally not too long ago fashioned a golden cross on the day by day chart, fuelling hypothesis {that a} new all-time excessive (ATH) could possibly be inside attain.

That stated, ETH will not be totally within the clear. Technical analyst Crypto Wave not too long ago predicted that the cryptocurrency might revisit decrease ranges within the $1,700 to $1,950 vary. At press time, ETH trades at $2,429, down 0.4% over the previous 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com