Ethereum (ETH) has discovered a crucial worth stage and reclaimed the $2,200-$4,000 macro vary. This rise has created pleasure amongst traders, and analysts are projecting upward actions. Latest evaluation by crypto analyst Rekt Capital signifies that Ethereum’s restoration above the $2,200 mark might set off a rally throughout the newly reclaimed vary.

Ethereum Reclaims $2,200-$4,000 Vary

Ethereum’s worth has proven exceptional energy, bouncing again from a dip beneath $2,200 to safe the crucial vary. Based on Rekt Capital, this worth restoration signifies that Ethereum is more likely to expertise continued upward momentum, particularly because it settles throughout the $2,200-$4,000 macro zone.

$ETH

Key Ethereum Weekly Shut secured

Ethereum has reclaimed the $2200-$4000 Macro Vary

Historical past means that over time, Ethereum is more likely to elevate throughout the Vary

Any dips, if wanted in any respect, would solely solidify $2200 as Vary Low help#ETH #Crypto #Ethereum https://t.co/gtM5xcZnwp pic.twitter.com/fyGlz8qeFJ

— Rekt Capital (@rektcapital) Might 12, 2025

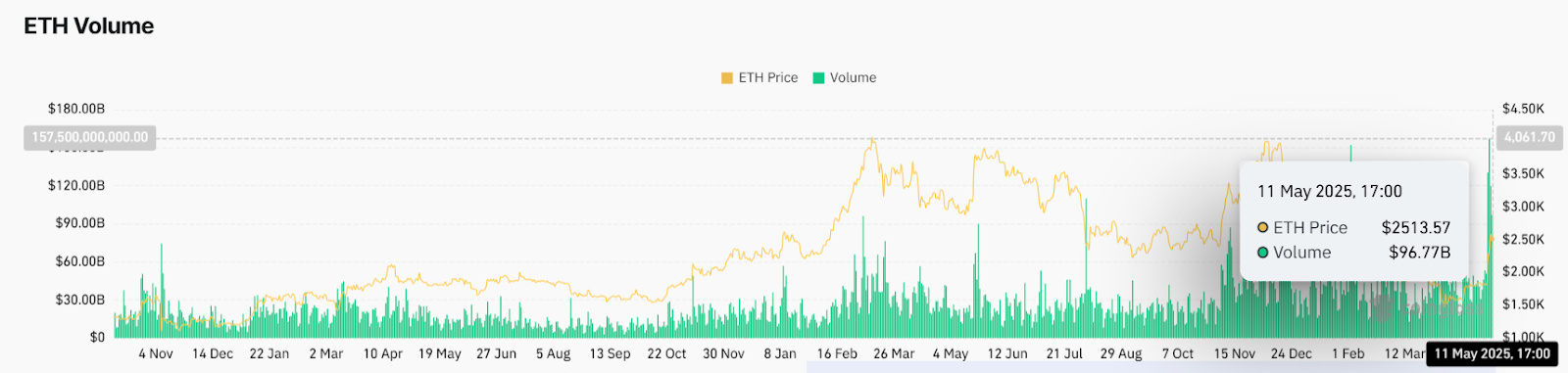

A excessive buying and selling quantity has fueled the current worth surge. Notably, on Might 11, ETH reached a buying and selling quantity of roughly $96.77 billion. This spike in quantity coincides with the worth rise to $2,513.57, indicating sturdy market participation. Notably, such quantity patterns point out that Ethereum’s restoration is firmly supported, thus lowering the possibilities of a short-term correction.

Supply: Coinglass

Based mostly on previous worth actions, after regaining this vary, Ethereum has proven upward momentum. Based on Rekt Capital, the restoration of the $2,200 help signifies that the asset stays resilient. If Ethereum continues above this help, the rising bullish view may drive the asset to check energy at $2,700 and ultimately $4,000.

Technical Indicators Sign Power

Key technical indicators help the optimistic sentiment for the worth of Ethereum. The Relative Power Index (RSI) is at 70.13, which signifies overbought circumstances. Though this determine sometimes signifies a possible pullback, it additionally reveals a excessive shopping for demand. Supplied the consumers are lively, the bullish momentum might proceed.

Supply: Tradingview

The Shifting Common Convergence Divergence (MACD) additionally alerts a possible bullish reversal. Though the MACD line stays beneath the sign line, the narrowing hole and fading purple histogram bars counsel weakening bearish momentum and the potential of an upcoming bullish crossover.

Merchants ought to look ahead to consolidation close to the $2,500-$2,600 stage earlier than one other breakout try. A plunge beneath $2,200 will probably be a powerful bearish signal, however the pattern will help additional progress.

Market Outlook: Additional Beneficial properties Potential

If Ethereum can keep its place above the $2,500 area, it may set the stage for increased good points. Analysts consider retaining this help would possibly open the door to a transfer towards the $3000 mark. If the amount continues to offer the mandatory help for the rally, the following resistance at $2700 could possibly be examined quickly.

Coinglass’s liquidation statistics present additional details about market sentiment. With whole liquidations reaching $37.17 million on Might 11, 2025, Ethereum’s shorts accounted for $27.63 million. The info means that many merchants had been positioned in opposition to the rally, resulting in a brief squeeze. The excessive liquidation quantity in main exchanges, reminiscent of Binance and OKX, highlights the depth of this squeeze, fueling Ethereum’s quick worth rise.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version just isn’t answerable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.