Ethereum continues to wrestle under key resistance on the 4-hour chart as value compresses inside a narrowing vary. Sellers nonetheless information short-term construction, but weakening pattern energy suggests consolidation could dominate earlier than the following decisive transfer.

Worth Construction and Key Technical Ranges

$ETH trades under the Supertrend barrier close to $2,073, which limits rapid upside makes an attempt. The construction displays decrease highs and decrease lows after rejection close to the 0.786 Fibonacci area round $3,050. Consequently, short-term momentum stays fragile.

Fast assist rests between $1,975 and $1,960. A breakdown under this zone would probably enhance stress towards $1,746, which marks the main structural base. Therefore, bulls should defend $1,960 to keep away from deeper retracement danger.

$ETH Worth Dynamics (Supply: Buying and selling View)

On the upside, $2,073 serves as the primary pivot degree. A sustained transfer above that barrier might open a restoration towards $2,209, aligned with the 0.236 Fibonacci degree. Moreover, $2,380 and $2,576 signify stronger provide zones if consumers regain management.

Associated: XRP Worth Prediction: Can Permissioned DEX Catalyst Reverse Downtrend?

DMI indicators present sellers retain a slight benefit, with damaging directional stress exceeding constructive momentum. Nonetheless, ADX stays close to 14, which alerts weak total pattern energy. Due to this fact, Ethereum could proceed shifting sideways till volatility expands.

Open Curiosity and Spot Circulation Indicators

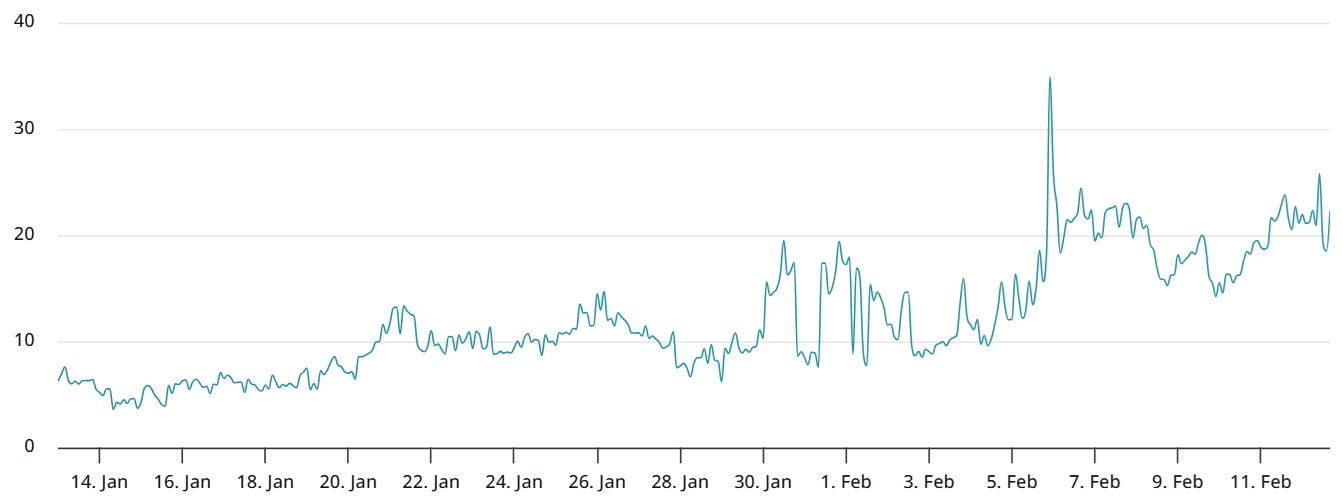

Ethereum’s open curiosity reveals a transparent shift from aggressive hypothesis towards lowered leverage. Throughout the prior rally, open curiosity surged above $50 billion as merchants elevated publicity. Nonetheless, declining value momentum triggered place unwinding and liquidations.

Present open curiosity stands close to $23.5 billion. That drop displays a cooling derivatives setting and lowered danger urge for food. Considerably, decrease leverage usually precedes sharper directional strikes as soon as new conviction emerges.

Supply: Coinglass

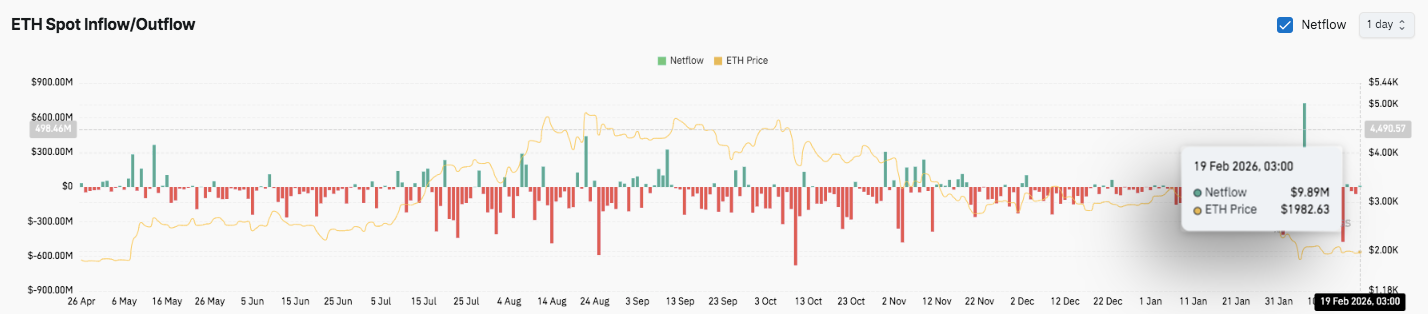

Spot circulation information additionally exhibits heavy distribution between mid-year and early winter. Outflows regularly exceeded $300 million and sometimes approached $800 million. Nonetheless, a latest influx spike above $600 million suggests renewed accumulation curiosity. Internet flows now hover close to impartial, indicating a possible transition part.

Institutional Accumulation Provides Lengthy-Time period Context

Evidently Tom Lee(@fundstrat)’s #Bitmine purchased one other 20,000 $ETH($39.8M) from BitGo 2 hours in the past.https://t.co/KR2SMP6Mrm pic.twitter.com/a59rFBukDb

— Lookonchain (@lookonchain) February 18, 2026

Moreover, Nasdaq-listed BitMine elevated its Ethereum publicity with a 20,000 $ETH buy valued close to $39.8 million. The agency now holds 45,759 $ETH after speedy accumulation over one week. Furthermore, administration goals to regulate 5% of Ethereum’s whole provide over time.

Associated: Terra (LUNA) Worth Prediction: Terra Struggles to Reverse Downtrend as Leverage Spikes

Technical Outlook For Ethereum ($ETH/USD)

Key ranges stay clearly outlined as Ethereum trades inside a tightening 4H construction heading into the following volatility window.

Upside ranges: $2,073 stays the rapid resistance and Supertrend pivot. A sustained break above this degree might open the trail towards $2,209 (0.236 Fib). Past that, $2,380 (0.382 Fib) stands as a stronger provide zone. If bullish momentum accelerates, value could lengthen towards $2,576 (0.5 Fib), which marks the mid-range retracement barrier.

Draw back ranges: $1,975–$1,960 acts as rapid intraday assist. A breakdown under this zone will increase stress towards $1,900 psychological assist. The most important structural ground sits at $1,746 (0 Fib base). Dropping this degree would expose Ethereum to deeper draw back and invalidate short-term restoration makes an attempt.

Resistance ceiling: $2,073 stays the important thing degree to flip for short-term bullish momentum. Till consumers reclaim this pivot, rallies could face provide absorption.

The technical construction exhibits Ethereum compressing inside a descending vary of decrease highs and regular assist assessments. In the meantime, DMI alerts sellers nonetheless lead, but ADX close to 14 displays weak pattern energy. Consequently, consolidation could proceed earlier than enlargement.

Will Ethereum Break Out?

Ethereum’s subsequent transfer relies on whether or not consumers can defend $1,960 lengthy sufficient to problem the $2,073–$2,209 cluster. Stabilizing open curiosity and neutralizing spot outflows recommend leverage has reset. Moreover, renewed accumulation exercise, together with institutional shopping for, helps longer-term conviction.

If inflows strengthen and value closes above $2,073, Ethereum might retest $2,209 and $2,380. Nonetheless, failure to carry $1,960 raises the likelihood of a retest of $1,746.

For now, $ETH stays in a decisive compression zone. Momentum affirmation and capital flows will decide the following directional leg.

Associated: Cardano Worth Prediction: ADA Drops To $0.2760 Regardless of Coinbase Mortgage Integration

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version isn’t answerable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.